Optical Character Recognition (OCR) technology is widely used by companies to extract text and data from various documents, including credit cards. OCR can be particularly useful in industries such as finance, e-commerce, and retail, where credit card information needs to be quickly and accurately processed. Here’s how companies can use Credit Card OCR API for payment processing.

It’s important to note that when implementing OCR for credit card processing, security and privacy are paramount. Companies must take appropriate measures to safeguard customer data and comply with relevant data protection laws, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS).

Additionally, OCR technology should be chosen carefully to ensure accuracy, especially when dealing with financial transactions and sensitive information. Regular testing and validation of OCR systems are essential to maintain data accuracy and integrity. There´s nothing an application, customized by developers to meet the company´s needs, cannot do, and Credit Card OCR API is the most robust basis for their developments.

Most Common Use Cases Of The Application

OCR software allows to extract essential information from credit cards, such as the cardholder’s name, card number, expiration date, and sometimes even the CVV (Card Verification Value) code. This extracted data applies to various purposes, including payment processing and customer identification.

Basically, e-commerce companies often use OCR to streamline the payment process. When customers upload images of their credit cards during checkout, OCR can quickly read and verify the card details, reducing the need for manual data entry. This enhances the user experience and reduces the risk of errors.

At the same time, OCR technology can scan and digitize physical credit cards and related documents. This can be useful for businesses that want to maintain digital records of credit card transactions for compliance, auditing, or customer service purposes.

Additionally OCR guarantees the company´s reputation, as it can assist in fraud prevention by rapidly validating credit card information against known patterns and databases. Suspicious transactions or discrepancies ring a bell for further review, helping to protect both businesses and customers from fraudulent activities.

Financial institutions and credit card companies can use OCR to simplify the onboarding process. Customers can scan their credit cards and supporting documents, and the OCR system can extract relevant information to facilitate account setup.

In addition to credit card processing, OCR technology can automate data entry for various other documents, such as invoices, receipts, and ID cards. This reduces manual labor and minimizes errors in data entry processes.

OCR Technology Ensures Security

When handling sensitive credit card information, companies must adhere to data security and compliance regulations, such as PCI DSS. Using OCR to process credit card data can help ensure compliance by automating data capture and reducing the likelihood of data breaches due to human error.

Mobile applications can integrate OCR to allow users to scan their credit cards using smartphone cameras, making it convenient for customers to make payments or input card information.

Benefits Of Using Credit Card OCR API

When implementing a Credit Card OCR API, it’s crucial to prioritize security and data privacy to protect sensitive financial information. Additionally, developers should choose a reliable OCR API provider that offers high accuracy and robust support for various card formats and languages.

The integration of Credit Card OCR API in a company´s system, website and applications brings about many benefits, which make the most of its efficiency, functionality, versatility and affordability.

To begin with, integration with an OCR API allows e-commerce websites and apps to enable users to make payments by scanning their credit cards. This can simplify the checkout process and reduce the risk of manual data entry errors. Likewise, mobile wallet applications can utilize OCR to capture credit card details when users want to add their cards to the app. This enhances the user experience and makes it easier for customers to use mobile payment options.

Also OCR can be used in expense tracking apps to automatically extract credit card information from receipts and categorize expenses. This streamlines expense reporting for individuals and businesses.

Financial institutions and fintech companies can use OCR APIs to facilitate the onboarding of new customers. Customers can scan their credit cards and other identification documents, and the OCR API can extract the necessary information for account setup.

Furthermore OCR can support the process to digitize physical credit cards and related documents. It also allows organizations to maintain digital records of credit card transactions and customer profiles for compliance, auditing, and archiving purposes.

Why Companies Need A Credit Card OCR API

For short, credit card issuers and payment processors can use OCR to quickly verify and authenticate credit card details, helping to detect and prevent fraudulent transactions. Also, it allows data entry automation, control of compliance and reporting with regulations. Moreover, the application ensures customer support and authentication, data enrichment, inventory and stock management and subscription and billing management.

OCR technology eases down payment processes and helps companies keep a clean cashflow, with constant upkeeping of records, apart from the other benefits above listed. Try out a no-cost plan, and you´ll surely subscribe to one of the paid versions to optimize solutions.

To learn more read https://www.thestartupfounder.com/best-credit-card-recognition-api-available-online-in-2024/

How To Start Using Credit Card OCR API

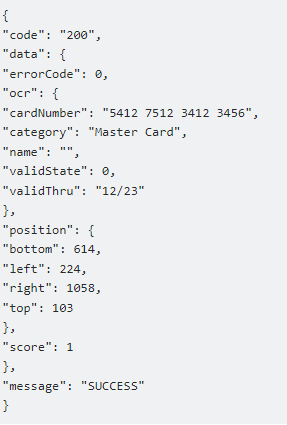

Counting on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.mastercard.co.nz/content/dam/public/mastercardcom/nz/en/consumers/find-a-card/images/world-mastercard-card_1280x720.jpg” in the endpoint, the response will look like this: