APIs for Visa payments are among the most important tools for businesses in 2024. In this article, we explore a visa API that checks visa payments processing.

Visa is the world’s largest payment network. It’s estimated that more than 20 billion transactions are completed each year using Visa cards, mobile devices, and other payment technologies. Visa has more than 20,000 employees around the world, including more than 2,000 engineers and scientists who work to develop new technologies and improve existing ones.

Visa’s network also allows consumers to use their debit cards to withdraw cash from ATMs or make online purchases. In addition to its payment services, Visa also provides fraud prevention technologies and digital identity verification services. So, if you’re running an e-commerce site or managing a large enterprise, the Credit Card Validator – BIN Checker API is an indispensable tool for maintaining the integrity of your business. Don’t take chances with your financial transactions.

Also, the company offers two types of prepaid Visa cards: a general-purpose card that can be used anywhere that Visa is accepted and a payroll card that is used only at specific merchants. The payroll card can be used to pay employees who do not have bank accounts or who do not want to use their bank accounts for payroll purposes.

Use An API

If you are part of a company that works with Visa transactions, you understand the importance of being able to process them quickly and effectively. However, there are many transactions that can take time to process and need to be checked thoroughly.

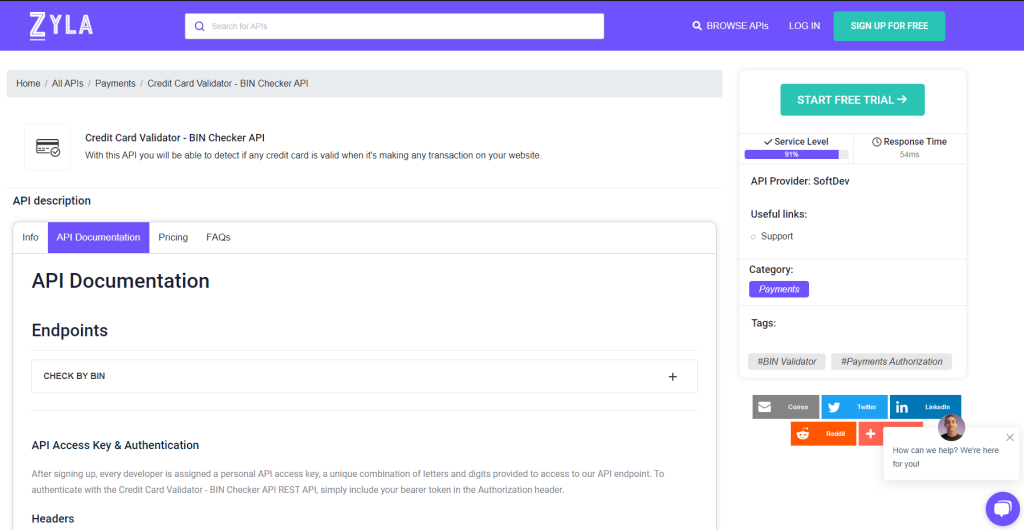

That is why we recommend an API like Credit Card Validator- BIN Checker API which can help you automate many of these tasks. This API will allow you to verify transactions quickly and easily so you can focus on other aspects of your business.

About VISA Checkout Payment API

Credit Card Validator- BIN Checker API is an excellent tool for companies that work with Visa transactions. This API will allow you to process transactions quickly and easily. You will be able to accept payments from all over the world using this API.

This API will help you automate many tasks so you can focus on other aspects of your business. It also works with AI technology so it is constantly improving its performance. Try this API today!

How To Use It

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- With your API key, you can already integrate the API in the language you need. In the mentioned URL, you can find a lot of Code Snippets, that can facilitate your integration.

Endpoint

- CHECK BY BIN

If you choose CHECK BY BIN endpoint you can get the following response:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}Credit Card Validator – BIN Checker API works in JSON format and it is easy to integrate into your website or application. It also supports multiple languages so you can easily translate the information into the language of your choice. You can also customize the design of your payment page so it matches your brand image. Let’s try it!