In the realm of finance, accurate and up-to-date information is vital for effective decision-making and streamlined operations. When it comes to financial reporting, validating banking information such as SWIFT codes and routing bank numbers is crucial.

Financial reporting relies heavily on accurate and reliable data. Businesses, financial institutions, and regulatory bodies need to have confidence in the integrity of the information they use for financial analysis, audits, and compliance purposes. SWIFT codes and routing bank numbers play a significant role in financial transactions, ensuring that funds are routed correctly and securely. Incorrect or outdated information can lead to errors, delays, and even regulatory non-compliance.

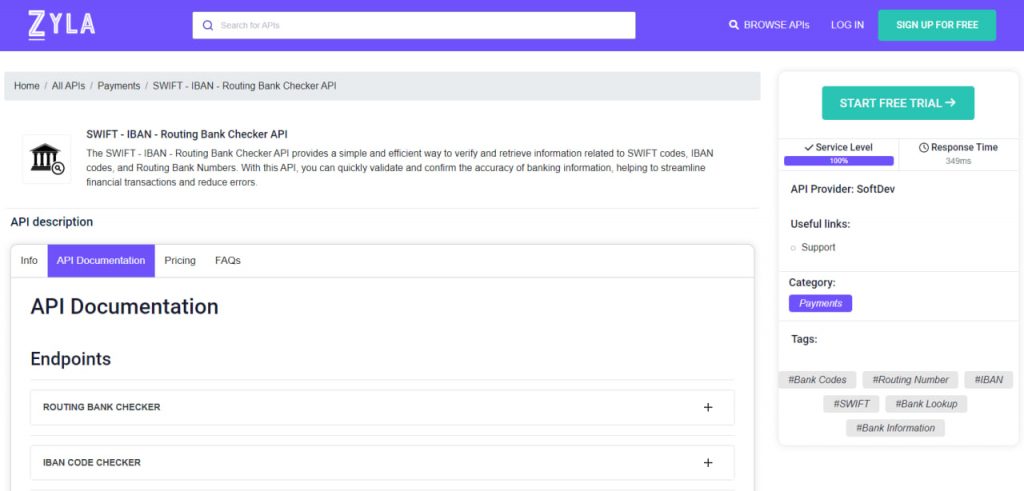

Banking Information APIs offer a powerful solution to streamline financial reporting processes by providing real-time validation and verification of crucial financial data. By implementing banking information APIs, organizations can enhance their financial reporting processes, reduce the risk of errors, and ensure regulatory compliance. These APIs provide a reliable and automated solution for validating banking information, enabling seamless integration with existing systems and workflows. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API, which is a very solid and versatile option in the market today.

Streamlining Financial Reporting

SWIFT – IBAN – Routing Bank Checker API is a banking information API that offers a powerful solution to streamline financial reporting processes by providing real-time validation and verification of crucial financial data. Here are some key benefits of using this API:

- Data Accuracy and Integrity: APIs that validate banking information help ensure data accuracy and integrity in financial reporting. By leveraging these APIs, businesses can cross-reference and validate SWIFT codes and routing bank numbers against authoritative databases, reducing the risk of errors and providing confidence in the accuracy of financial data.

- Time and Cost Savings: Manual verification of banking information can be a laborious and time-consuming task. APIs automate the validation process, allowing businesses to retrieve accurate data swiftly and efficiently. This saves valuable time and reduces costs associated with manual data entry and verification, freeing up resources for other critical tasks.

- Enhanced Compliance: Regulatory compliance is a top priority in the financial industry. Banking Information APIs can help organizations comply with regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. By validating banking information against trusted sources, businesses can strengthen their compliance efforts, mitigate risks, and avoid potential penalties or reputational damage.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9-digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

In the era of digital transformation, leveraging banking information APIs for validating financial information such as SWIFT codes and routing bank numbers is a game-changer for streamlined financial reporting. The accuracy, efficiency, and compliance benefits offered by these APIs empower businesses to make informed decisions, save time and costs, and maintain data integrity. As the financial landscape continues to evolve, embracing technological advancements like SWIFT – IBAN – Routing Bank Checker API becomes crucial for organizations seeking to stay competitive and efficient. You can try this powerful tool by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.