Using a digital tool offers several benefits for businesses and applications. Credit Card Recognition API allows to extract and process credit card information from images, scanned documents, or user inputs.

As developers do their job in customizing applications to make processes easier and more accurate, ordinary users don´t need any expertise, nor do they need to hire a team of experts. Keep on reading to find out why we need this software.

Here are some of the key advantages of adopting a credit card recognition API for various purposes.

In the first place, the software integrates with a suite of applications and is powered by AI and ML algorithms that add efficiency. Credit card recognition APIs automate the process of capturing and processing credit card information, making data entry faster and more efficient. This reduces manual data entry errors and saves time for users and employees.

Benefits Of Using The Credit Card Recognition API

As a matter of fact, accuracy is an outstanding feature. OCR technology used in credit card recognition APIs is highly accurate in extracting text from images, ensuring that credit card details are correctly transcribed. This reduces the risk of errors in payment processing.

For business owners, customer experience is crucial. Credit card recognition improves the user experience by simplifying the input of payment information. Users can scan their cards rather than typing in the details, leading to a smoother and more convenient checkout process.

Likewise, this technology if useful for e-commerce websites and mobile apps. Credit card recognition streamlines the payment process. This can lead to increased conversion rates as users find it easier to complete transactions.

Moreover, in business security is a must. Reputable credit card recognition APIs prioritize data security. They often use encryption and comply with security standards like PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive credit card data.

Thus this API has the capability of reducing fraud. Some credit card recognition APIs include built-in validation checks to detect invalid or potentially fraudulent credit card numbers. This helps prevent fraudulent transactions and protects businesses from chargebacks.

More Reasons To Opt For The Application

By reducing data entry errors and speeding up payment processing, credit card recognition APIs can lead to cost savings for businesses, particularly in terms of time and labor. Equally important, credit card recognition API is designed to integrate into various applications and systems, making it easy to add this functionality to existing processes.

Furthermore, credit card recognition API can be applied to a wide range of industries and use cases beyond payment processing, such as identity verification, document management, and expense tracking. In truth businesses that handle credit card data must comply with payment industry regulations. Using a reputable credit card recognition API can help ensure compliance with these standards.

Above all credit card recognition APIs can provide valuable data insights by analyzing payment data. This information can inform business strategies, customer behavior analysis, and marketing efforts.

Indeed this credit card recognition API supports credit cards issued by various financial institutions worldwide, making them suitable for businesses with a global customer base.

Following, credit card recognition can also apply to document management systems, automating the extraction of credit card data from scanned documents, invoices, and receipts. For subscription-based services, credit card recognition can speed up the onboarding process, making it easier for customers to sign up and start using the service.

On top of that, credit card recognition API can work across different platforms, including web applications, mobile apps, and point-of-sale systems.

In summary, Credit Card Recognition API offers numerous advantages, including improved efficiency, accuracy, security, and user experience. Businesses across various industries can benefit from integrating these APIs into their applications and processes.

How Does The API Work

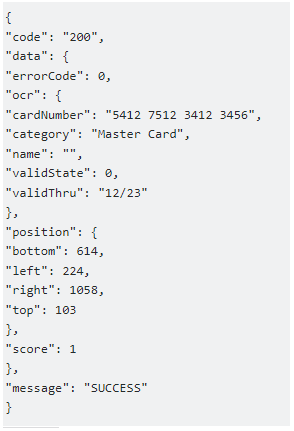

Once you count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.mastercard.co.nz/content/dam/public/mastercardcom/nz/en/consumers/find-a-card/images/world-mastercard-card_1280x720.jpg” in the endpoint, the response will look like this: