Do you work in the sales department of a B2B company that is planning to export? In this article, you will find all the information you have to know to successfully get through the customs office. We will talk about VAT numbers and recommend you the best VAT validator alternatives to Vatlayer -you will see why!

What Is A VAT Number?

Value-added tax (VAT) is a tax that the Government charges you on sales of goods or services inside the territory of the EU’s member states. In all circumstances, the tax is eventually paid by the final consumer of the commodity -that means, European citizens. Each stakeholder in the supply chain -maker, wholesaler, and retailer- serves as a VAT collector.

So, at the end of the path, these several VAT percentages are summed and added to the final price. Companies collect it from customers and put it in their return to Revenue. They can reclaim VAT that has been levied on them by their suppliers by returning the VAT collected.

To put all these ideas together: you must have a VAT number correctly established to make cross-border sales. Bureaucracy aside, this information will appear in your bills verifying that you are doing things in a legal way. And the most efficient and probed AI tools to check VAT numbers are APIs (application, programming, software interfaces).

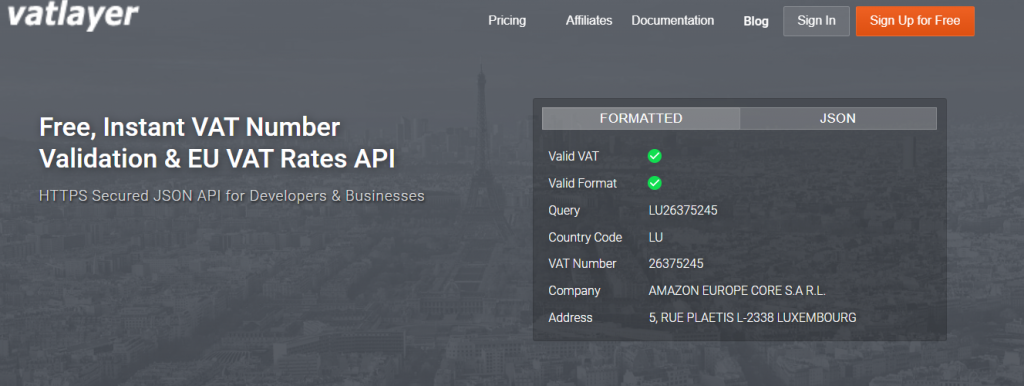

Vatlayer: A VAT Validator Example

Vatlayer VAT Number checker API is a JSON-based example that operates with HTTPS security. By using it you will figure out value-added tax data rates, number validation, and company information obtained straight from the European Commission’s databases. It’s simple and all that you must provide is the VAT number. As a result of the processing, you will have verification, rates by country code or IP address, and calculate VAT-compliant prices. But it isn’t the best option if you need data encryption, currency conversion, or tech support. Let’s see what alternatives we can find online.

Best VAT Number Checker Alternatives

VAT Validation API

VATValidationAPI is effectively capable of detecting whether or not a VAT number is genuine for all EU nations. It’s super fast, and legitimate and you can totally trust its strong system. If the VAT is legitimate, you would obtain more information about the firm. If it is incorrect because it’s no longer valid or due to falsification, you will instantly know.

With this software, you can verify that your clients’ VAT numbers are always complete, correct, and, most importantly, up to date. The automated check detects missing or inaccurate VAT numbers and, if required, removes them from your system. You will have an accurate account system and will always see the complete picture.

VATComply

VATComply allows you to enter the VAT number in the form to be confirmed. You can also try the API for automation. You may check its authenticity issued by any EU Member State or in Northern Ireland. In addition, you could get the geolocation of the company you are checking. This VAT validator can give you extra information as currency exchange rates from The European Central Bank.

Quaderno.io

Quaderno is a VAT number check API that can optimize your business’s international taxes compliance with a single click. It will save you valuable time by improving your procedures to increase business growth. You will sell globally on all of your favorite platforms and services, without extra worries. You can add this tax automation software to your systems to automate the sales tax process from start to finish.