Are you a shop website owner and want to be sure about the veracity of the companies that post their products there? In this article, we will cover what VAT numbers are, how they work, and the most accurate validators. With these VAT Validation tools, you will save time and dedicate more effort and resources to relevant obligations.

Digital technology is allowing companies to extend outside conventional borders to reach more clients and new sales possibilities. Some industries, however, are still creating the financial infrastructure required. So if you have one marketplace domain, you should validate that the companies you deal with are legal. With this term, we mean that they comply with the EU requirements for selling products or services among its countries. VAT numbers are an indicator of that.

A VAT number is a unique identifying number provided to each value-added tax registered firm. It’s used only for tax purposes but it can increase your company’s reputation and lead to cross-border sales. It opens a lot of doors inside the commercial processes.

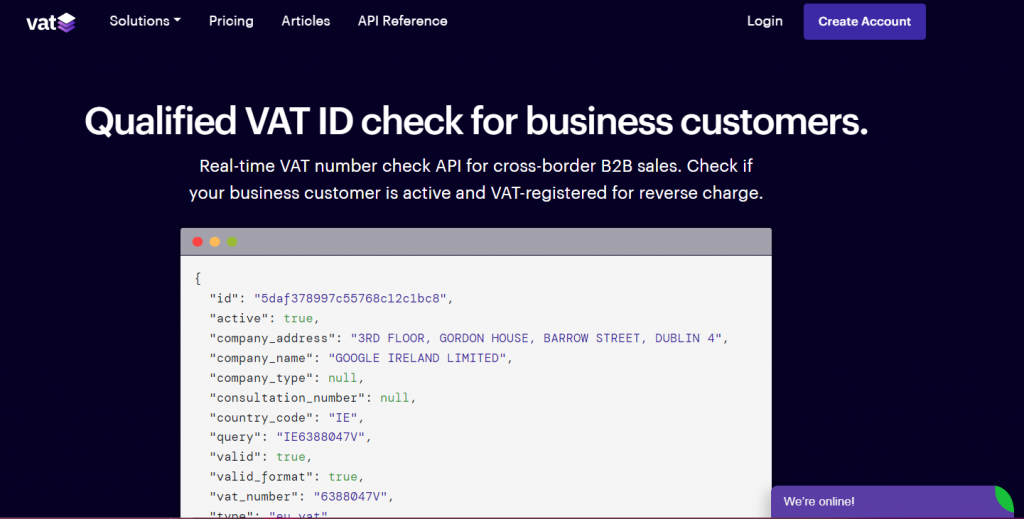

So, every time you expend a bill, you should include your customer’s legitimate VAT number. Vatstack is a popular example of a VAT Number Validation API. It allows you to verify if your consumer’s VAT number is registered in the applicable national database. The information comes from authoritative government databases, such as the European Commission’s VAT Information Exchange System (VIES).

This application programming interface has sophisticated features that will help you focus on the primary objective of your organization. But it’s so used that it’s down most of the time and this can’t be a solution for your business! In the next section, you will find the best alternatives for all your financial requirements.

Other Options For Your VAT Validation

VAT Validation API

VATValidationAPI is the best solution for determining whether or not a VAT number is legitimate. It’s incredibly quick and simple to use! If the value-added tax is genuine, you can also acquire extra information about the firm. It collects all the codes of the countries that are part of the EU. You will need an account, a subscription, and the VAT number you want to check. If it is authentic, you will receive a “true” answer but if it is invalid, the platform will respond with “false”. Start verifying your VAT numbers using this API!

VatLayer

VatLayer provides essential services such as calculating EU VAT rates, validating IDs instantly, and calculating VAT-compliant prices. If you believe you need to grow your operations and send more API queries than 100, you may purchase a premium membership. They also include 256-bit HTTPS encryption to keep your company’s data safe from attackers.

VATAPI

VATAPI services such as VAT number validation, VAT rate computation, and VAT invoicing can help you with all the payment issues. You can provide an IP address, geolocation, or ISO country codes, to determine the exact VAT rate for your consumer. Look for VAT IDs in the EU’s VIES or HMRC’s VAT database to instantly determine if clients are companies or consumers.