If you want to access antimony prices from Fastmarkets, keep reading. Here, we present the best API to acquire this data.

Antimony is a low-known metalloid that. Industries utilize it in lead-acid batteries and flame retardants, and deposits all over the world. The majority of people have never thought of antimony. It might have a beautiful silver color that shines and glistens. In recent years, the European Union and the United States have designated it as an essential raw resource.

What Is The Situation Of Antimony Worldwide Output?

In light of this, a new antimony roaster being built in Oman would help diversify the availability of the metal away from China, which controls mining and refining, especially if the US-Asian trade war escalates.

China presently accounts for more than 90% of antimony supplies. However, due to older mines approaching the end of their useful lives and a governmental drive to reduce pollution levels, which has resulted in plant closures, this has been dropping in recent years.

Rather than influencing the market, decreased supply has corresponded with a plateau in pricing. The value of antimony surged in 2011, but due to a general reduction in usage, the price fell significantly. Before rising again in 2016 to over $8,000 per ton. It has subsequently remained at or around this level.

A trend of replacing antimony with tin in new lead-acid batteries attributes to the drop, as well as changes in flame retardant legislation that have steered the industry away from antimony. Nonetheless, the metal is the most expensive and greatest fire retardant substance on the market.

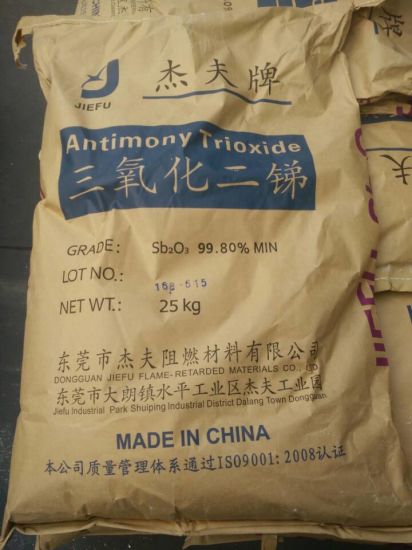

As a result, if there is a push to improve fire safety, there may be an increase in demand. In the form of metal ingots Antimony ore exists. It’s important to make antimony trioxide for flame retardants. The majority of this processing capacity is in China.

According to the corporation in charge of the project, Strategic and Precious Metal Processing (SPMP), the new roasting factory being built in Oman would have a potential of 20,000 tonnes of antimony and gold per year in mixed metallic materials. According to SPMP, this amounts to almost 12% of the estimated yearly global antimony output during the last five years.

TriStar owns 40% of the project, which is the first antimony roaster outside of China in the previous 30 years. While Backeberg believes the project will not ‘shock the antimony market’ because it is simply an intermediary stage, it does provide a major quantity of non-Chinese antimony goods.

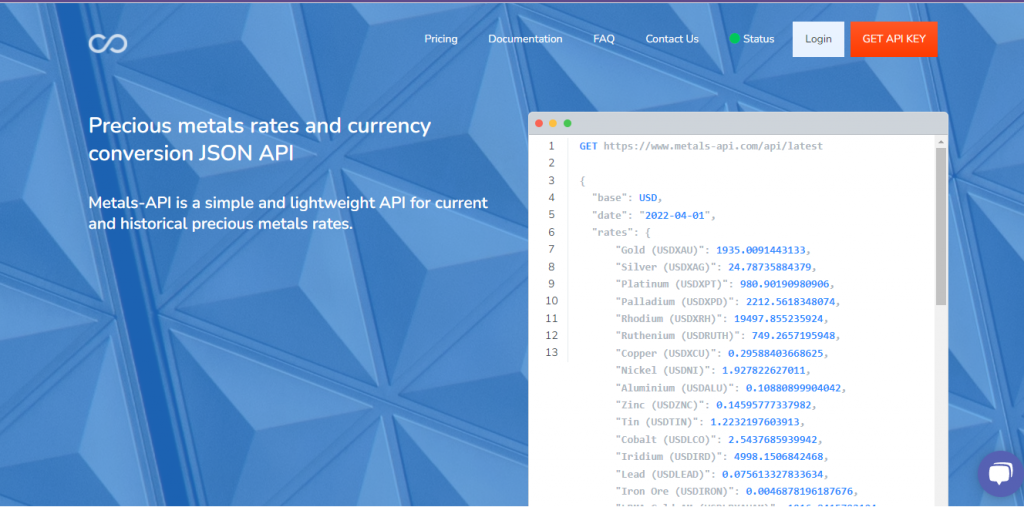

Having all of these factors in mind it is important to think about the best moment to invest in the Antimony prices. For this purpose, it’s important to keep in mind Fastmarkets prices because it’s one of the most trustworthy sources. If you’re looking for an API to get this data, you can try Metals-API.

Why Metals-API?

Metals-API.com is used by hundreds of programmers, small businesses, and large corporations. Metals-API, with its robust data sources and 6+ years of experience, is the top source for actual precious metals rates as antimony prices. Metals-API receives currency data from financial data providers and banks such as the European Central Bank.

The Metals-API interaction have an encryption with bank-grade 256-bit SSL. Metals-guiding API, on the other side, puts “developers first.” Because of extensive API documentation, intelligible code samples, and a simple API structure, you can develop the API in approximately 10 minutes. If you’re not sure how to use it, there’s an API Documentation with basic tips and sample code to get you began fast at any degree.