Are you looking for the best option for API in 2022 to get zinc prices from reliable sources? Here, we make a recommendation with Shanghai Futures Exchange data.

Zinc prices are projected to fall after seasonal increases owing to anticipated excessive production. Between December 2021 and January 2022, the average price for high-grade zinc with a purity of 99.95 percent increased by 6% to $3,599 per tonne, a 14-year high. This year, the cost is expected to drop by 4% to around $2880 per tonne.

Global zinc mine output increased by 8% y/y to 13K tonnes of contained metal in 2021. This year’s mining intensity is expected to continue high, resulting in a production-to-consumption surplus and lower prices. Although a few zinc factories in the EU have been forced to close owing to rising energy prices, China’s increased output will help to compensate for the decline in Europe.

You must keep up with the market advances to avoid missing out on opportunities to gain from selecting the best answer for you. If you’re thinking about investing in zinc or if the price of the metal affects a company, the easiest way to find out is to look at pricing data throughout time and see how it’s changed. You should only use data from the most reliable sources, such as the Shanghai Futures Exchanges in this case.

What Is Shanghai Futures Exchange?

China’s principal trading arena for industrial derivatives is the Shanghai Futures Exchange (SHFE). Shanghai Metals, Construction Materials, Cereals and Oils, Zinc, Petroleum, Chemicals, nickel, Coal, and Agricultural Materials merged and reorganized to form it.

The Interim Provisions of the State Council Concerning the Administration of Futures Trading and The Measures of the CSRC and the Administration of Futures Exchanges were used to develop SHFE’s trading activity and needed to effectively manage laws and regulations. It operates more than 250 remote monitoring stations around the region. You’ll need to utilize an API to get data from this trading market.

About APIs

API stands for Application Programming Interface. So, what does it mean? It’s a program of software that allows two or more devices to communicate and exchange data. It’s a typical occurrence in internet transactions and social networking sites.

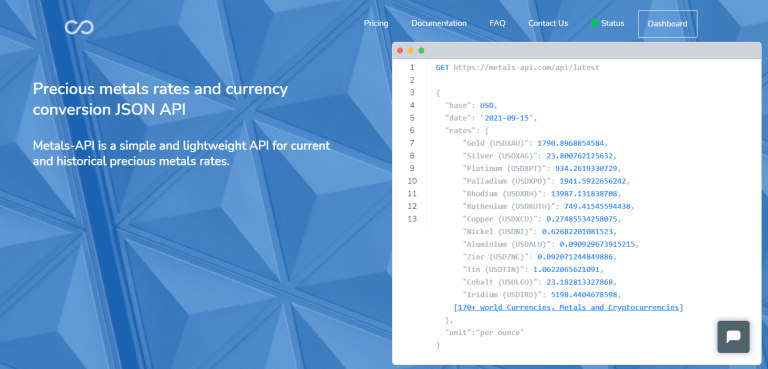

There are various APIs that provide metal data on the internet, but not all of them are the best option to help you to invest. Unfortunately, not all of them use the Shanghai market to transmit rates. Zinc rates may be found at Metals-API.

Why Metals-API?

Metals-API contains information on zinc, gold, palladium, and HRC steel, among other metals. You may also track the values of these metals in over 170 other currencies, such as USD, EUR, and BTC. It gathers information from well-known financial institutions. COMEX/NYMEX rates are also available. It is also used by businesses of various sizes, such as Barrick Gold, a global mining firm.

This API provides real-time precious metals data with a 2 decimal point precision and a 1-minute frequency. Utilizing current and historical prices, you may examine indicators and identify the optimum time to invest. Metals-API can also be used to identify data fluctuations for this purpose.