Conversion rates are the compass pointing businesses in the right directions for success in today’s dynamic business environment. The true test of success is the capacity to convert prospective clients into devoted supporters.

Trust is the cornerstone of any successful business relationship. Accurate credit card validation instills confidence in customers, making them more likely to complete transactions and become repeat buyers. The inner workings of an API are a marvel of technology. It swiftly and accurately verifies card information, minimizing errors and ensuring smoother transactions.

Meet the Bank API, an unsung hero in the world of e-commerce and transactions. This innovative tool is more than just a technical solution; it’s a strategic asset that can significantly enhance conversion rates and propel businesses toward greater prosperity.

What Is An API?

An application programming interface (API) is a set of instructions that tells one program how to communicate with another program. This communication allows two programs to exchange data or commands; thus, allowing one program to take action based on information from another program.

This information can be very helpful for your business, as it can help you identify invalid cards before accepting them for payment. It can also help you identify stolen cards, which can help you prevent fraud on your website or app.

With this tool you will be able to easily determine whether or not any of the cards in your database are real or fake. You will also be able to see which cards are from local businesses and which ones are international. This way you will be able to offer better services to your clients and increase your conversion rates.

Credit Card Validator – BIN Checker API

You can identify unauthorized credit card transactions by using this API. Utilizing BIN numbers, begin searching for each piece of information on credit and debit cards. To view all the information, the user must enter the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card.

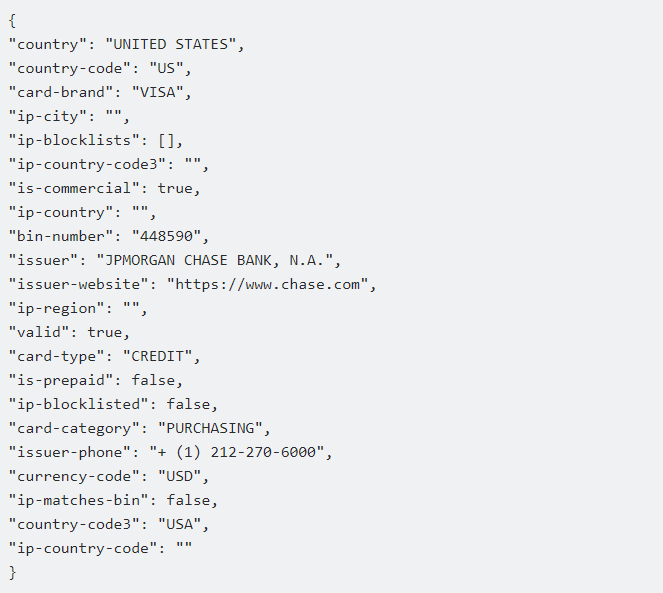

To access all of this BIN/IIN information in JSON format, you must enter a BIN (Bank Identification Number), which is the first six numbers of a credit or debit card. You will be informed of the card’s type (Visa or MasterCard), expiration date, bank, and issue location.

The customer’s credit card information will be available to you, including the issuing bank, the issuing institution (AMEX, VISA, MC), the location of the card, and whether or not it is a valid credit card.

Credit card data can be protected using the BIN’s first six digits. As a result, there won’t be any security gaps. To determine whether to approve the payment or run a promotion, this API just considers the credit card’s authenticity combined with the bank and business information. This endpoint will provide the following message in response to your query after your API call:

To learn how to utilize the API, view the video below:

It is simpler to determine the issuing bank or institution thanks to this CC Checker API. Therefore, depending on whether you have specific agreements with a particular bank, you may or may not be able to approve the transaction.