Online financial transactions are becoming increasingly popular, which has raised the requirement to secure transaction security. One technique to ensure this security is the validation of the credit cards used in these transactions.

This is where the Credit Card Validation API, a service that enables developers to incorporate credit card validation into their applications and websites, comes in.

In this post, we’ll look at the advantages and reasons why organizations should think about integrating a credit card validation API into their systems. This API may assist businesses in a variety of sectors, from fraud prevention to user experience enhancement. In addition, some popular use cases for this API will be explored, as will some of the accessible market possibilities. But First…

What Exactly Is A CC Checker API?

A CC checker API is an application programming interface that allows developers to validate and authenticate credit card numbers. It is a technology used by retailers, banks, and financial organizations to verify the validity of a particular credit card number and to identify the kind of card and its issuing bank.

The CC checker API compares the supplied credit card number to a set of criteria and algorithms to verify whether it follows the anticipated format, contains the right check digit, and belongs to a known issuer. The API will return data such as card type (e.g., Visa, Mastercard), issuing bank, and country of issue.

Online businesses and retailers frequently utilize CC checker APIs to avoid fraud and illegal transactions. Financial organizations employ them to verify cardholder identities, assess credit risk, and detect fraudulent activity. The usage of a credit card checker API reduces the risk of financial losses due to fraudulent transactions and improves overall security for both the cardholder and the merchant.

How Does A Credit Card Validator API Work?

Before taking payments, Credit Card Validator APIs are used to validate credit card numbers. You may utilize a CC checker API by following these steps:

Choose a respectable Credit Card checker API provider: There are several CC API providers available online; choose one that is reputable, secure, and has a fair price plan.

Acquire an API key: Once you’ve decided on a provider, create an account and acquire an API key. You will be able to access the API and authenticate using this key.

Integrate the API into your website or application: Follow the provider’s guidelines to integrate the API into your website or application. Sending a request to the API with the credit card number you want to check is typical.

Handle the API response: After sending the request, the API will respond with credit card information, such as if it is valid, the card type, and the issuer. In your code, you must handle this answer and take necessary action based on the results.

Test the API: Before going live, extensively test the API to ensure it is operating as planned. Use test credit card numbers to ensure that the API successfully distinguishes between valid and invalid cards.

To secure your clients’ sensitive data, you must guarantee that the API you use complies with the Payment Card Industry Data Security Standard (PCI DSS). To keep your client’s data safe, use best practices for managing credit card information, such as encrypting it in transit and at rest.

Which Is The Best CC Validator API In The Market?

After reviewing various alternatives on the market, we can confidently state that we have found one that, owing to its functionality and ease of use, is one of the best current solutions.

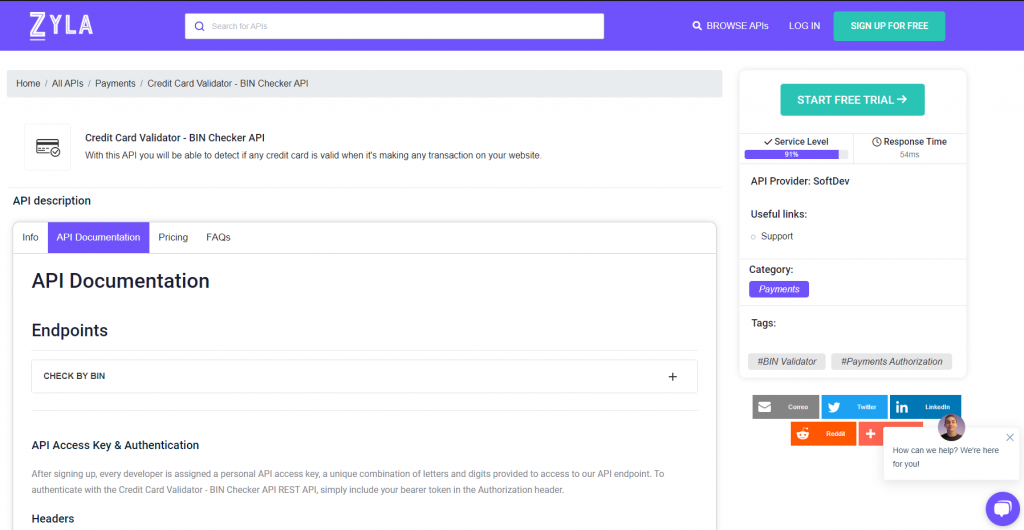

This option is the Credit Card Validator – BIN Checker API from Zylalabs since, as previously stated, it is an API that has worked incredibly well for us and is pretty straightforward to use even if you don’t know much about it.

To obtain the entire data, the consumer will transmit the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number).

To access the whole data of this BIN/IIN in JSON format, you must enter a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card.

You will be notified of the card’s validity, whether it is a VISA or MASTERCARD, the issuing bank, and the card’s issuing location.

If we use this endpoint to enter the BIN number “448590,” for example, the API will return the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}How To Get This API?

1- Navigate to Credit Card Validator – BIN Checker API and click the “START FREE TRIAL” button to begin using the API.

2- You will be issued your unique API key after registering in Zyla API Hub.

3- Check the BIN number using the API endpoint.

4- When you’ve reached your endpoint, perform the API request by hitting the “run” button and viewing the results on your screen.

Related Post: CC Checker APIs: Which One Is The Best?