In today’s ever-changing financial world, data-driven insights and analytics play a critical role in strategic decision-making. A Banking Information API is a powerful tool that may access vital financial knowledge.

APIs for financial data may provide significant benefits to organizations and individuals looking to access and use financial data. Developers may use these APIs to create apps and services that link to financial systems and provide users with real-time data and expanded functionality.

Financial information APIs may also assist organizations in improving their operations by providing access to data that can assist them in making better decisions and managing their finances. Banks, for example, may utilize APIs to give real-time information about their client’s accounts and transactions, increasing transparency and customer service.

This meticulous publication delves into how organizations may use a Banking Information API to drive financial analytics, obtain actionable insights, and make educated decisions that fuel their financial success.

Steps To Use A Banking Information API For Financial Analytics

- Understanding the Financial Information API: A Banking Information API allows you to have access to a multitude of financial data, such as transaction information, account balances, historical data, and more. It enables enterprises to obtain and analyze detailed financial data from a variety of sources, giving them comprehensive insights into their financial environment.

- Data Integration and Aggregation: The first step toward realizing the analytical potential of a Banking Information API is to integrate it with your existing financial systems and data infrastructure. Businesses may acquire a full perspective of their financial environment by combining data from numerous sources such as bank accounts, credit cards, and payment gateways. This integration serves as the foundation for accurate and comprehensive financial analysis.

- Financial Performance Analysis: A Banking Information API allows firms to do in-depth financial performance analysis. Businesses may examine revenue patterns, spending trends, and cash flow dynamics by extracting transaction data and integrating it with other relevant variables. This study identifies areas of financial strength and weakness, allowing for more informed decisions to improve financial performance.

- Risk Assessment and Management: Financial analytics enabled by a Banking Information API assists in efficiently analyzing and managing risk. Businesses can detect possible hazards and adopt risk mitigation techniques by monitoring transaction patterns, credit history, and account balances. These insights enable proactive decision-making and help to reduce overall risk and financial stability.

- Customer Segmentation and Personalization: A Banking Information API delivers useful financial data about customers that may be used for customer segmentation and customized services. Businesses may design targeted marketing campaigns and customized financial solutions that appeal to certain client categories by monitoring customer transactional activity, spending habits, and financial preferences. This personalization increases consumer engagement and satisfaction.

- Fraud Identification and Prevention: Financial analytics is critical in the identification and prevention of fraud. Businesses may detect suspicious transactions, uncover trends suggestive of fraudulent conduct, and implement sophisticated fraud protection measures by employing the data analytic capabilities of a Banking Information API. This proactive strategy protects financial assets, consumer information, and the company’s image.

- Compliance and Regulatory Reporting: Financial regulatory compliance is a key part of every firm. A Banking Information API can help with compliance and regulatory reporting requirements. Businesses may provide accurate reports, verify compliance, and reduce the risk of penalties or legal issues by evaluating financial data and incorporating regulatory requirements into the analytics framework.

- Predictive Analytics and Forecasting: Financial forecasting and predictive analytics are critical for strategic planning and decision-making. Businesses may foresee future trends, anticipate market dynamics, and make educated forecasts by studying historical financial data and employing predictive modeling tools. These insights give organizations a competitive advantage, allowing them to modify their strategy and remain ahead of the competition in a continually changing financial market.

We can confidently declare that, after extensively investigating many market alternatives, we have chosen one that, due to its functionality and ease of use, is among the best current options.

Which Banking Information API Is The Most Reliable?

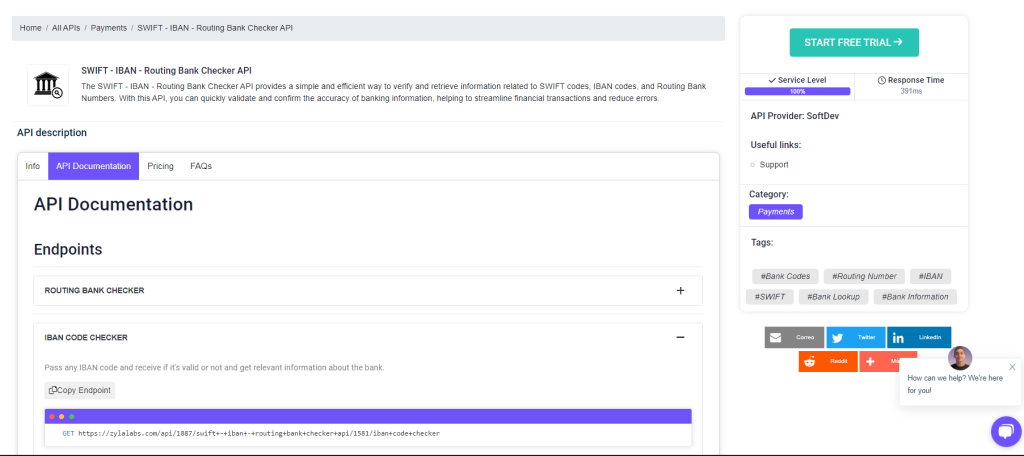

We chose the Zylalabs SWIFT – IBAN – Routing Bank Checker API since it has served us well and is simple to use even if you are unfamiliar with it.

Look for a bank’s details using a routing number, IBAN code, or SWIFT code. Select if you want to use ACH or wire transfer banking information. It accepts either XML or JSON replies.

If you input the SWIFT code “ADTVBRDF” into the endpoint “SWIFT CODE CHECKER,” for example, you will get the following response:

{

"status": 200,

"success": true,

"message": "SWIFT code ADTVBRDF is valid",

"data": {

"swift_code": "ADTVBRDF",

"bank": "ACLA BANK",

"city": "BRASILIA",

"branch": "",

"address": "Q SHCN CL QUADRA BLOCO E, 316,316",

"post_code": "70775-550",

"country": "Brazil",

"country_code": "BR",

"breakdown": {

"swift_code": "ADTVBRDF or ADTVBRDFXXX",

"bank_code": "ADTV - code assigned to ACLA BANK",

"country_code": "BR - code belongs to Brazil",

"location_code": "DF - represents location, second digit 'F' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}

What Is The Location Of The SWIFT-IBAN-Routing Bank Checker API?

- Begin by navigating to SWIFT-IBAN-Routing Bank Checker API and selecting the “START FREE TRIAL” button.

- You will be able to use the API after joining Zyla API Hub!

- Use the selected API endpoint.

- When you’ve arrived at your destination, make an API request by selecting the “test endpoint” button and viewing the results on your screen.

Related Post: The Benefits Of Using A Banking Information API For Your Business