In the rapidly evolving world of online commerce, ensuring the security and authenticity of credit card transactions is of paramount importance. With the rise of digital payments, businesses face the constant threat of fraudulent activities that can wreak havoc on their operations and reputation. Enter the Credit Card Validation API, specifically the BIN Checker API, a powerful tool that stands as a guardian against fraudulent credit card transactions. In this article, we explore the key benefits of utilizing this Bank API and how it safeguards your business while enhancing the developer experience.

Understanding the Credit Card Validator – BIN Checker API

At the core of this robust solution lies the BIN (Bank Identification Number) Checker API, a technological marvel designed to validate credit card transactions with precision and efficiency. The BIN Checker API analyzes the initial digits of a credit card, known as the BIN, to extract crucial information such as the card issuer, card type, and geographical location. Armed with this data, the API swiftly verifies the legitimacy of credit card transactions, providing an added layer of security for businesses.

Fraudulent credit card transactions can result in financial losses, tarnished reputation, and legal troubles for businesses. This Bank API acts as a shield, detecting suspicious activities and preventing unauthorized transactions from taking place. By cross-referencing the provided BIN against a comprehensive database of legitimate BINs, the API effectively identifies potential risks and safeguards your business from falling victim to fraudulent schemes.

Explore The Benefits Of Using This Bank API For Developers

Developers, the architects behind digital platforms, stand to gain significantly from the incorporation of the Credit Card Validator – BIN Checker API. Here are some key benefits that make this API a must-have in their toolkit:

-The Credit Card Validator – BIN Checker API offers a developer-friendly interface, complete with well-documented integration guidelines. This ensures that developers can seamlessly integrate the API into their payment gateways and systems without unnecessary roadblocks.

-Typos and errors in credit card information can lead to declined transactions and frustrated customers. The API’s real-time validation capability helps developers catch these errors before they impact users, ensuring a smooth and seamless payment process. This translates into positive user experiences and increased customer satisfaction.

-Developers play a pivotal role in fortifying the security of a business’s digital ecosystem. By integrating the Credit Card Validator – BIN Checker API, they contribute to enhanced security measures, minimizing the risk of fraudulent transactions and unauthorized access. This proactive approach to security helps maintain customer trust and safeguard sensitive financial data.

-Developers can harness its capabilities to gain valuable insights into customer behavior and preferences. By analyzing patterns in card issuer distribution and types, developers can inform business strategies and personalize offerings, thereby enhancing customer engagement.

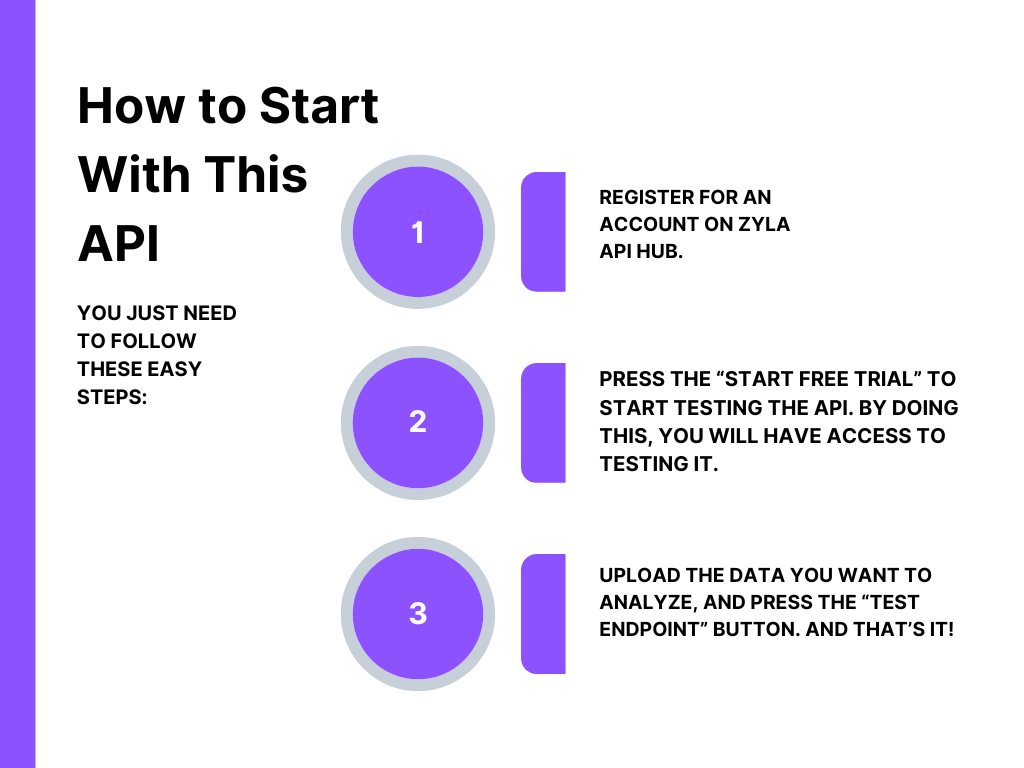

Follow These Steps To Start To Test This API

After entering the card’s BIN, which is 448590, in the test endpoint, you can see the country code, IP city, type of card, and even category in the response:

The Credit Card Validation API BIN Checker API, stands as a guardian of business security and reputation. By leveraging the power of this API, businesses can protect themselves from the looming threat of fraudulent credit card transactions. With benefits ranging from streamlined integration and error prevention to enhanced security measures and strategic insights, the API empowers developers to create secure, seamless, and trustworthy payment experiences.

Incorporating the Credit Card Validator – BIN Checker API is not just a technological upgrade; it’s a strategic move to uphold the values of security, accuracy, and customer satisfaction. As businesses continue to navigate the complexities of online commerce, the Credit Card Validation API emerges as a steadfast companion, ensuring that each transaction is legitimate, every customer interaction is positive, and the digital ecosystem remains fortified against fraud.