In the ever-evolving landscape of e-commerce and digital transactions, credit card fraud has emerged as a lurking threat. This is where the power of a BIN Checker API comes into play, orchestrating a formidable defense for businesses. This type of API acts as a virtual guardian, meticulously scrutinizing each digit and code of a credit card transaction.

By leveraging intricate algorithms like the Luhn Algorithm, a BIN Checker API not only validates the legitimacy of card numbers but also detects the tiniest anomalies that might elude human detection. It’s like having an electronic magnifying glass that scrutinizes every pixel of a painting. Moreover, the API extends its vigilance to ensure that expiration dates and CVVs are accurately aligned, thwarting any potential exploits. Businesses embracing this technology fortify their walls against the deluge of fraudulent attempts. Think of it as a cybersecurity fortress equipped with biometric locks. This proactive approach doesn’t just prevent monetary losses but also safeguards the trust of customers who entrust their sensitive data.

The Advantages of Using BIN Checker APIs

In the realm of online transactions, where speed and security dance a delicate tango, a BIN Checker API emerges as a silent guardian of financial gateways. This unassuming tool holds the power to transform the way businesses conduct transactions and safeguard against potential fraud.

Beyond its sleuthing capabilities, a BIN Checker API introduces a symphony of advantages. Businesses revel in the swiftness of real-time validation, reducing friction in customer experiences. They’re shielded from the financial repercussions of fraudulent transactions, donning a cloak of security that reassures both clientele and bottom lines.

In the grand mosaic of modern commerce, a BIN Checker API isn’t just a tool; it’s a sentinel that stands tall, allowing businesses to embrace the digital era without compromising security or speed.

However, if you want to work with the best tool in the market, you should pick Credit Card Validator – BIN Checker API.

What is the Credit Card Validator – BIN Checker API and Why is it Important?

In the fast-paced world of digital transactions, where security and accuracy are the pillars that uphold financial interactions, the Credit Card Validator – BIN Checker API emerges as an unsung hero. It’s the virtual equivalent of a skilled detective, piecing together clues to determine the authenticity and origin of a credit card.

BIN, or Bank Identification Number, is the DNA of a credit card, revealing its issuing bank, card type, and more. The Credit Card Validator – BIN Checker API harnesses this data, swiftly scrutinizing each digit to ensure the card’s legitimacy before transactions unfold. This seamless yet intricate process is akin to a digital bouncer allowing only the right guests into the party.

The importance of the Credit Card Validator – BIN Checker API reverberates across the financial landscape. It’s a barrier against fraudulent transactions, shielding businesses from monetary losses and customers from data breaches. Its role is not just crucial but transformative, ensuring that the digital economy flourishes securely and confidently.

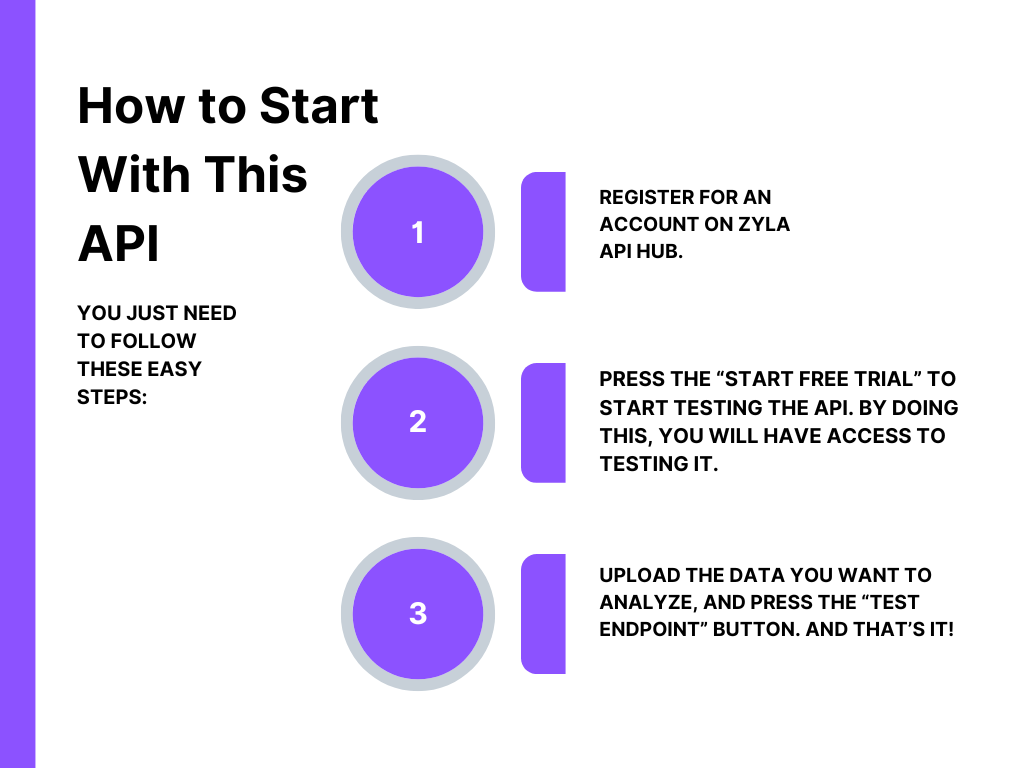

Follow These Steps To Start To Use This API

The country code, IP city, card type, and even category are displayed in the response after inputting the card’s BIN, which is 448590, in the test endpoint:

In an era where transactions transcend physical borders, the Credit Card Validator and BIN Checker API stand as digital shields. These technological sentinels ensure that your business navigates the digital landscape with resilience and security, shielding against the ever-evolving threats of fraud and data breaches. With the power of these tools, your enterprise strides confidently into the future, fortifying its foundations in the face of modern challenges.