It’s no secret that the e-commerce industry is booming. With the increase in online shopping, it’s now easier than ever for consumers to browse and purchase goods from the comfort of their homes. However, with this convenience comes a new set of challenges for merchants: how to safeguard customer payment data and protect them against fraud.

The payment process determines whether or not the client will return to one´s business in the future. Additionally, it has a significant impact on the company’s bottom line.

A payment gateway also stores your customer’s payment information securely, it protects your online store from fraud, and provides reports on your sales and expenses. Business owners need automated tools that can validate, process and store a transaction process, and at the same time safeguard the cardholder´s confidentiality. Developers respond by devising software that can perform this process efficiently and accurately, and they choose Credit Card OCR API as a robust starting point for their developments.

Developers must be certain that their customized applications guarantee security, ease of use and functionality. Security of information will favor the business reputation, and you don’t have to worry about your data being compromised or stolen; the software must be seamlessly integrated in any system or website; users don´t need to be experts to operate it. Likewise, it must be cost-effective: there are many affordable options available, but you must choose the plan that best meets your needs without sacrificing effectiveness.

This API is ideal for those who have a lot of validations to do, because it’s very fast and simple to use; it only needs the image of the card in a URL in order to retrieve all the information you need about it. This API has no limits on how many times you can use it. It’s very simple to use and doesn’t have any extra steps or requirements.

How Can This API Protect You From Fraud?

This information can be used to determine whether or not the card is legitimate. This will help prevent fraud and protect both you and the merchant when making purchases online or in-store. In addition, accepting payments via an API can help streamline the checkout process for customers. This can lead to higher conversion rates and more sales for your business. Overall, using a payment API can help you improve your sales funnel and increase your revenue.

Additionally, this information can be used to collect payments from customers who have not yet paid their invoices. This can be helpful if you are trying to collect payments from customers who have forgotten or neglected to pay their invoices. Besides, you can use this information to create reports that show how much money is owed by specific customers.

With Credit Card Validation API, you can also retrieve information such as BIN, issuer bank name (which can be used to look up the bank balance online), and more.

Additionally; this API also supports all major programming languages (such as JSON and PHP) and is very easy to use.

With this API you will be able to check if there are any problems with any of the cards in your database. Also, you will be able to check if any of the cards in your database are valid. The best part about using an API is that this API is ideal for those payment platforms that receive a credit card image. Use this API to access the data and make your own validations, like credit card expiration date, for example.

How To Get Started With Credit Card OCR API

Once you already count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

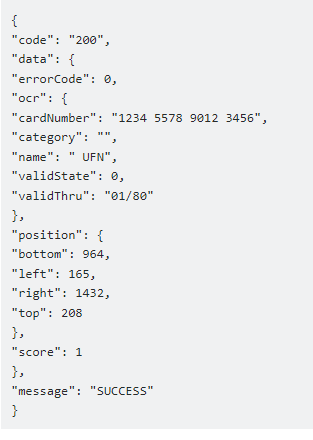

“https://assets.materialup.com/uploads/103ef1d5-4d2e-4d0a-8c48-1aab4656ca35/preview.png ” in the endpoint, the response will look like this: