Businesses are continuously looking for ways to simplify operations and improve user experiences in the ever-changing environment of digital transformation, where technology is the cornerstone of innovation. One critical component of this journey is tax management and compliance, especially when dealing with the complex web of value-added tax (VAT) in the European Union (EU) and beyond. To meet this need, developers have resorted to VAT validator APIs, which provide a solution for validating VAT numbers and ensuring compliance. In this post, we’ll dig into the realm of VAT validator APIs, investigating how they manage taxation issues and shining a spotlight on the powerful VAT Validation APIs.

Uncovering The Taxation Problem

Consider the following scenario: an EU-based e-commerce platform has to validate the VAT numbers of its consumers, suppliers, and partners from several nations. This process, while necessary for compliance and smooth cross-border transactions, may be intimidating. Mistakes in VAT number validation might result in legal issues and financial setbacks, leading business operations to being disrupted. Manual validation is not only time-consuming but also error-prone, necessitating the use of an automated and dependable solution.

The VAT Validation API’s Strength

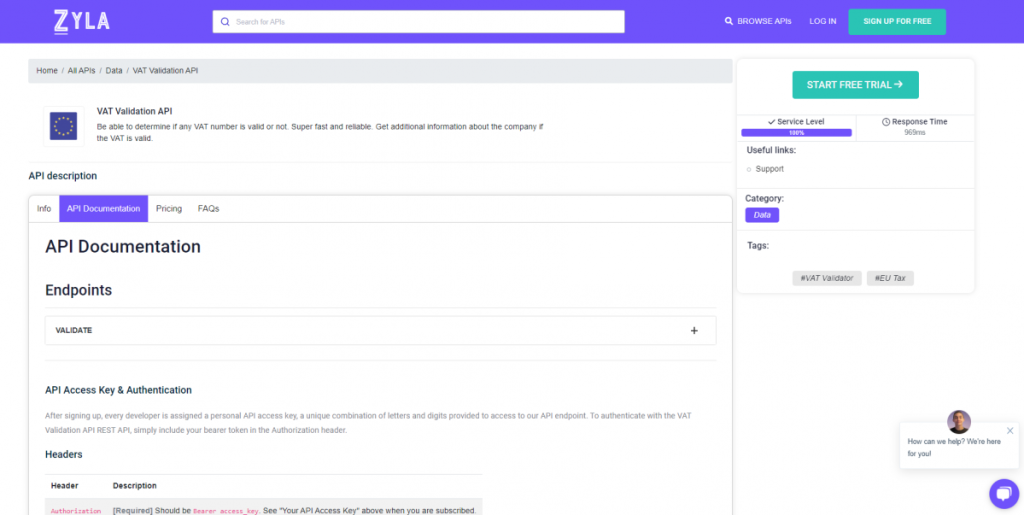

Enter the VAT Validation API, a game-changing technology that efficiently and precisely tackles these difficulties. This API, which is hosted at Zyla API Hub, enables organizations to quickly integrate VAT number validation into their apps, improving the correctness of tax-related procedures. Let’s have a look at the features and benefits that make the VAT Validation API a must-have for both developers and companies.

Investigating The Features

- Swift Validation: The VAT Validation API validates VAT numbers in real-time, guaranteeing that they are correct and active.

- Cross-Border Compatibility: The API supports a wide range of VAT numbers from EU member states, allowing for easy validation of foreign transactions.

- Error Reduction: By automating the validation process, the API decreases the risk of human mistakes that are frequently associated with manual data entry.

- Comprehensive data: Gain access to key data such as the VAT number’s validity status and relevant business facts.

Benefits In Brief

- Time and cost savings: Automating VAT validation saves organizations important time and money, allowing them to focus on core activities.

- Improved Compliance: Comply with EU tax legislation to avoid penalties and legal difficulties.

- Improved User Experience: The integration of the API results in speedier transactions, increasing consumer trust and happiness.

- Seamless Integration: The API’s user-friendly architecture allows for simple integration into a wide range of applications and platforms.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Using The VAT Validation API For The First Time

Follow these easy steps to leverage the power of the VAT Validation API:

- Sign up here: Begin by creating an account on the Zyla API Hub. You now have access to the VAT Validation API and related resources.

- The API documentation is as follows: Explore the whole Zyla API Hub API documentation. Find out more about endpoints, parameters, and integration rules.

- Create a unique API key that will serve as your authentication credential while making API requests.

- Follow the integration ideas to link the API to your systems. Use sample code snippets and tutorials to ensure a seamless integration process.

- Deployment and testing: Conduct comprehensive testing before installing in a production environment to guarantee smooth functionality.

Related Post: Try A VAT Validator API: Streamline Business Operations