In a landscape of shifting compliance standards, a Credit Card Checker stands as a beacon of adaptability. Staying compliant becomes a seamless endeavor as businesses align with industry evolution, all the while leveraging the API’s prowess to ensure adherence.

In the realm of e-commerce, businesses can use an API as a weapon against fraud. It’s a testament to how this API transforms into a strategic asset, enabling businesses to combat fraud and ensure secure transactions. Moreover, it’s a cornerstone in the realm of subscription services, where seamless recurring billing becomes a testament to operational prowess.

As the future unfurls, a Bank API continues its journey of evolution. The realm of credit card validation holds promise in the embrace of AI-powered security, where accuracy is heightened through the infusion of artificial intelligence. Furthermore, the integration of biometric authentication emerges as the pinnacle of security measures, where the very essence of a user becomes the key to unlocking transactions.

Securing Transactions, Fostering Trust:

In the tapestry of business growth, this kind of API assumes the role of a guardian, nurturing secure transactions and fostering trust. Its potential as a catalyst for expansion is undeniable, a testament to its ability to secure the present and shape a brighter future. Embracing the API is not just a choice; it’s an investment in growth, a commitment to customer confidence, and a step towards a more secure and prosperous business horizon.

There is a bank identification number (BIN) on every credit card. The first six to eight numbers on a credit or debit card, known as the BIN, collectively indicate the financial institution that issued the card. The number is used to locate the bank or other financial organization that issued the card. A card issuer’s BIN number links all of the cards it issues and all of the transactions made with those cards.

Credit Card Validator – BIN Checker API

Using this API, you can spot fraudulent credit card transactions. Start examining every bit of data on credit and debit cards using BIN numbers. The user needs to input the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card in order to view all the information.

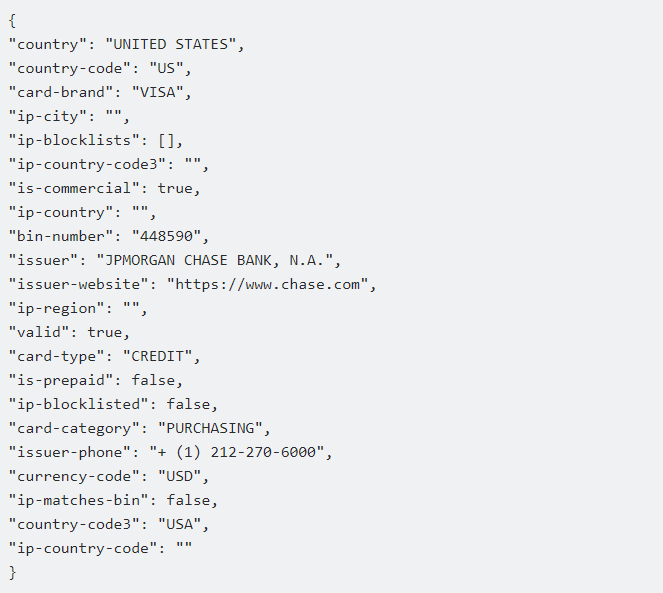

You must input a BIN (Bank Identification Number), which is the first six digits of a credit or debit card, in order to access all of this BIN/IIN’s information in JSON format. The card’s type (Visa or MasterCard), expiration date, bank, and issue location will all be disclosed to you.

You will have access to the customer’s credit card details, including the issuing bank, the issuing institution (AMEX, VISA, MC), the card’s location, and whether or not it is a legitimate credit card.

The first six digits of the BIN can be used to protect the confidentiality of credit card information. There won’t be any security holes as a result. This API only uses the credit card’s validity and bank and business information to decide whether to authorize the payment or run a promotion. This endpoint will respond to your query with the following kind of message after making the API call:

Watch The Following Video To Learn How To Use The API:

This CC Checker API makes it easier to identify the issuing bank or organization. You will therefore be able to approve the transaction or not depending on whether you have special deals with a particular bank.