Do you want to get copper future prices from Nasdaq? This article try to explain how to get it with an API

In recent days, copper prices have reliably decreased. In this way, they registered the largest quarterly decrease, an issue that has not happened since 2011. This is related to the Covid confinements that took place in China. Lately, one of the major importers of this metal is used for the manufacturing production of technology and electronic products. However, in June the Chinese industry was reactivated.

This situation is consistent with that of other precious metals in general, since several suffered declines of between 20% and 40%. A fairly sharp drop in prices as a result of the war and the saturation and cut-off of the global supply chain.

For this reason, many analysts fear further declines in precious metal values in the short term. This occurs at the same time that the Central Banks of the nations with strategic economies are raising interest rates, which is generating a disorder of the currencies as well.

Specifically, copper fell by approximately 1.5% to $8,200 a ton. In this sense, it experienced a decrease of 20% since April. This compares it to the first quarter of the first year of Covid, 2020 when copper fell 19.8%.

This was when everything was closed due to the confinements, with which the new drop demonstrates an unparalleled collapse of this metal. Some professionals expect copper to continue to decline next quarter to $7,000 or $7,500 a ton. However, estimates for the end of the year are still unclear.

Use An API

If you wish to work in the copper sector, you must have an API. It is a sort of system that gives up-to-the-minute information. You may use this information on your website or app to engage with other buyers or providers and offer detailed information to them.

In this instance, you should utilize an API that has pricing for the most important metals. This will allow you to examine the influence of macroeconomic forces on the copper market more accurately. You require an API that has reliable data about the largest and best copper deals. Furthermore, they are affiliated with most major sources, such as Nasdaq.

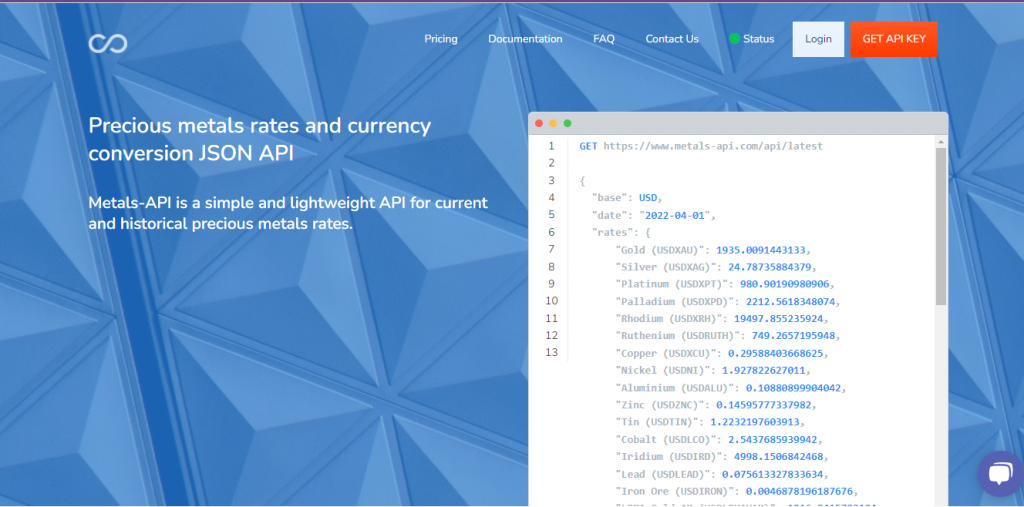

It might be tough to find an API with such trustworthy data. As a consequence, we recommend that you use Metals-API, which will give you a comprehensive set of productive resources. Professionals adore it because it supports a broad number of languages. The API will provide you with Nasdaq copper spot and futures data.

Why Metals-API?

Metals-API is a good choice if you want to engage in the electronic and electrical business and need copper or another important metal like aluminum, lithium, or tungsten. This may be quite useful when comparing it to your currency and other major international currencies.

Furthermore, the API includes not only current pricing information but also historical rates and variation statistics. You will have a greater knowledge of metal price movements and the factors that influence them. This is significant because it will provide you with more tools to decide the best moment to purchase or sell copper contracts or Nasdaq futures.