With the rise in digital payments and e-commerce, businesses need to guarantee the validity of credit card information to prevent fraudulent activities and provide a seamless customer experience. One powerful tool that can aid in achieving this is the Credit Card Validator BIN Checker API. This API allows businesses to integrate a VBV (Verified by Visa) checker tool directly into their websites, enhancing security and trust for both the company and its customers.

Introduction to the Credit Card Validator BIN Checker API

The Credit Card Validator BIN Checker API is a robust solution that offers real-time validation of credit card information. BIN stands for Bank Identification Number, which is the first six digits of a credit card number. These digits carry crucial information about the card issuer, the type of card, and even the country of issuance. The API utilizes this information to validate and verify credit card transactions effectively.

By integrating this API into your website, you empower your business with the ability to perform a series of checks on credit card details, ensuring the authenticity of the card and the transaction. The highlight of the API is its VBV checker tool, which enables merchants to verify whether a card is registered for the Verified by Visa program. This program adds an extra layer of security, requiring cardholders to provide an additional authentication step during online transactions.

Why Integrate the Credit Card Validator BIN Checker API into Your Business Website

Enhanced Security: Integrating the Credit Card Validator BIN Checker API into your website significantly improves security. By validating credit card information and checking for VBV registration, you can prevent fraudulent transactions and unauthorized card usage. This not only safeguards your business from potential financial losses but also helps build trust with your customers.

Reduced Chargebacks: Chargebacks can be a nightmare for online businesses. They not only result in financial losses but also affect the company’s reputation. By using the API to verify card details before processing transactions, you can reduce the occurrence of chargebacks stemming from fraudulent activities.

Smooth Customer Experience: Customers expect a seamless and secure shopping experience. The VBV checker tool ensures that legitimate customers can complete their transactions without unnecessary hurdles. The added security can enhance their confidence in using your website, leading to higher conversion rates.

Compliance and Regulations: In the realm of online payments, businesses need to adhere to various regulations and security standards. Integrating the Credit Card Validator BIN Checker API can assist you in meeting these requirements by implementing an additional layer of cardholder authentication.

Real-Time Validation: The API offers real-time validation, which means customers receive instant feedback on their card details. This speeds up the checkout process and provides immediate assurance of successful payment processing.

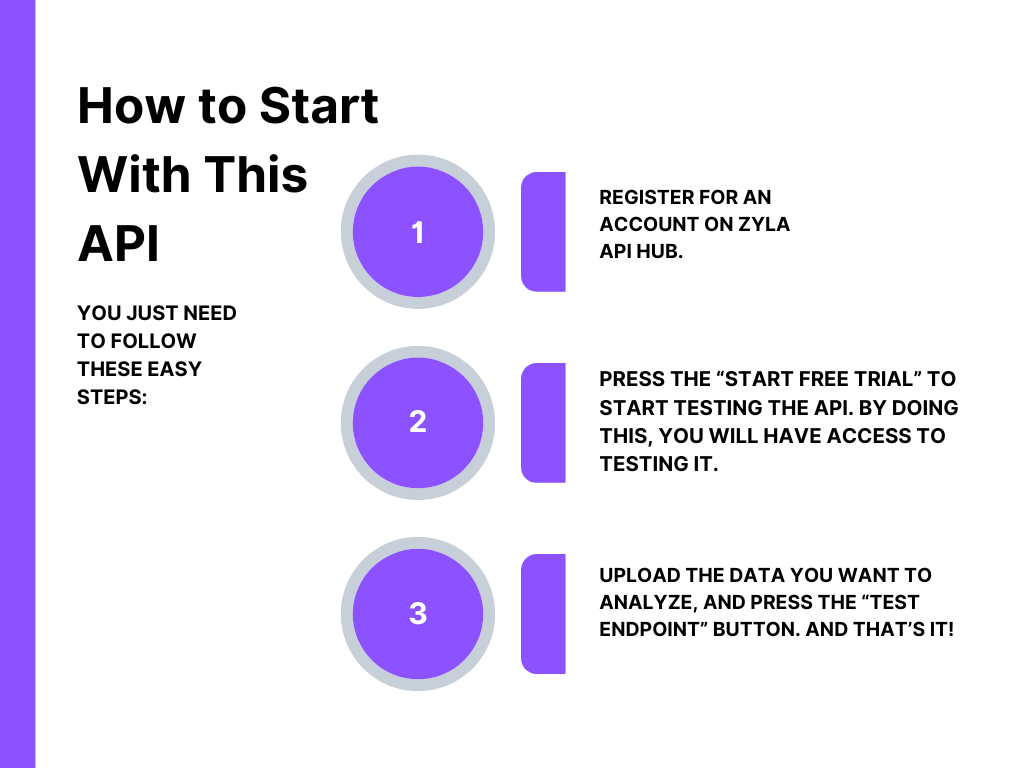

Follow These Steps To Start To Use This API

The country code, IP city, kind of card, and even category are displayed in the answer after entering the card’s BIN, which is 448590:

In a digital world where cyber threats are becoming increasingly sophisticated, businesses must prioritize security in all their online transactions. Integrating the Credit Card Validator BIN Checker API into your website offers a strategic solution to combat fraudulent activities and enhance customer trust. By leveraging the power of real-time validation and the VBV checker tool, you can create a safer environment for your customers to shop while also protecting your business from financial losses and reputation damage.