Securing bank transfers has always been a top priority for businesses and individuals alike. In an era where digital transactions are becoming increasingly prevalent, protecting sensitive financial information and ensuring the integrity of bank transfers is of paramount importance. However, achieving robust security measures can be a complex and daunting task. This article explores the challenges faced in securing bank transfers and presents a powerful solution in the form of a Bank Transfer API.

The Vulnerabilities Of Traditional Bank Transfers

Traditional bank transfers have inherent vulnerabilities that expose them to various risks. From potential data breaches to identity theft and fraudulent activities. The existing methods of conducting bank transfers leave room for exploitation. Hackers and cybercriminals constantly seek ways to intercept and manipulate sensitive information, jeopardizing the security and confidentiality of transactions.

Strengthening Bank Transfer Security With APIs

To address the vulnerabilities of traditional bank transfers, leveraging the capabilities of a Bank Transfer API can be a game-changer. This API acts as a secure and reliable intermediary between financial institutions. Streamlining the transfer process and significantly enhancing security measures. By integrating the Bank Transfer API into their applications or systems, developers can unlock a wide range of functionalities and robust security features.

Unleashing The Power Of Bank Transfer API

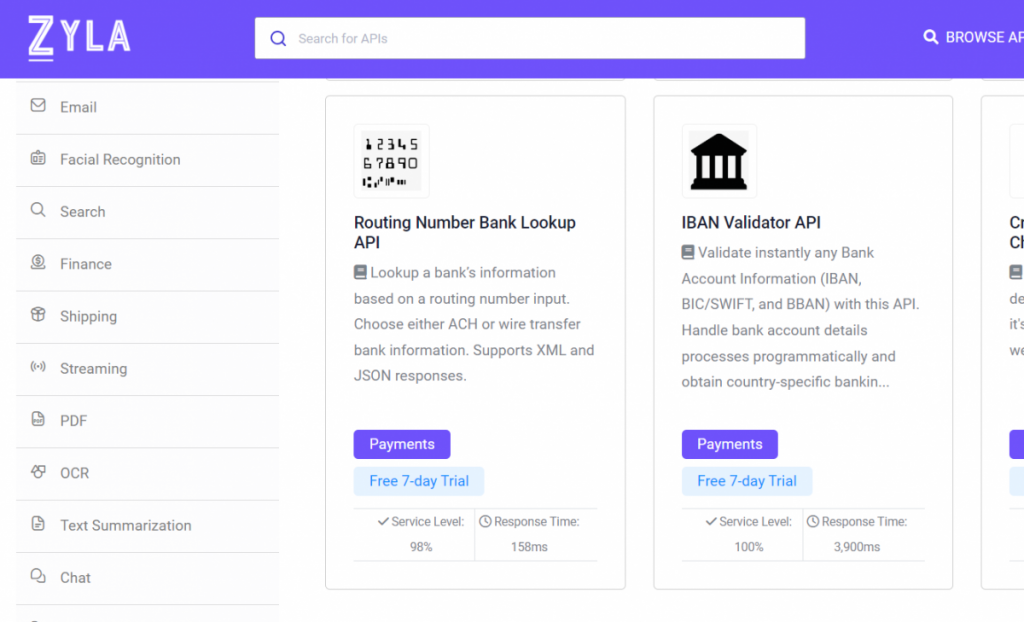

One powerful API that stands out in the realm of bank transfer security is the Routing Number Bank Lookup API. This API, available at the Zyla hub, offers a comprehensive solution to validate and verify bank account details, ensuring accurate and secure transactions. The Routing Number Bank Lookup API allows developers to programmatically retrieve routing numbers and other essential bank information, empowering them to conduct secure transfers and minimize the risk of errors.

Key Benefits Of The Routing Number Bank Lookup API

The Routing Number Bank Lookup API offers several key benefits that contribute to the security and efficiency of bank transfers. Firstly, it provides real-time validation of routing numbers, ensuring that funds are directed to the correct financial institution. This validation process helps prevent errors and minimizes the chances of transfers going astray.

Secondly, the API allows developers to validate account numbers, ensuring the accuracy of recipient information. This feature helps mitigate the risk of erroneous transfers and safeguards against potential fraud or unauthorized transactions.

Lastly, the Routing Number Bank Lookup API enables developers to retrieve additional bank details, such as bank names and addresses, further enhancing the security and reliability of bank transfers. These additional data points provide valuable insights and verification capabilities, enabling businesses and individuals to make informed decisions when conducting transactions.

How It Works: Registration And Free Trial At Zyla Hub

To harness the power of the Routing Number Bank Lookup API and take advantage of its robust security features, developers can easily register at the Zyla hub. The registration process is quick and straightforward, requiring basic information to create an account.

Once registered, developers can access the Routing Number Bank Lookup API documentation, which provides comprehensive guidance on integrating the API into their applications or systems. The documentation includes code snippets, sample requests, and detailed instructions, making the integration process seamless.

To encourage developers to experience the benefits firsthand, after registration, Zyla Hub offers a free trial option for the Routing Number Bank Lookup API. This trial period allows developers to explore the API’s capabilities. Furthermore, test its functionalities, and evaluate its impact on securing bank transfers. The free trial enables developers to assess the value the API brings to their projects before committing.

Example

Endpoint – GET BANK DETAILS

INPUT (Routing Number) – 121000248

OUTPUT (API Rerponse)

[

{

"status": "success",

"data": {

"routingNumber": "121000248",

"paymentType": "ACH",

"name": "Wells Fargo Bank, Na",

"addressFull": "255 2nd Ave South, Minneapolis, MN 55479",

"street": "255 2nd Ave South",

"city": "Minneapolis",

"state": "MN",

"zip": "55479",

"phone": "800-745-2426",

"active": "Active",

"lastUpdated": "Jan 5, 2023"

}

}

]