Because inflation affects the purchasing power of money, it is critical for individuals to understand how it impacts their own finances. Individuals may acquire a better grasp of inflation patterns by using the Monetary Inflation Index API. Allowing them to plan and budget more efficiently. Furthermore, organizations may use this API to forecast price trends, adjust pricing strategies, and limit inflation risks, assuring long-term growth and profitability.

Individuals, investors, and corporations may all gain a competitive advantage in the ever-changing economic landscape by using the potential of a Monetary Inflation Index API. Inflation data that is up to date provides them with the knowledge they need to handle inflationary pressures. Optimize financial strategies, and make educated decisions that protect their financial well-being. “Knowledge is power,” as the adage goes, and when it comes to financial intelligence, having access to solid inflation statistics is a game changer.

How To Use An API For Monetary Inflation Index To Improve Financial Intelligence

- Understanding the Impact of Inflation: The API gives users access to monthly and annual inflation rates, allowing them to see how inflation impacts their money’s buying power. People can make better judgments about saving, investing, and spending if they track inflation patterns.

- Individuals might utilize inflation statistics in their own financial planning. They may adapt their budgeting, savings, and investment strategies to ensure their finances stay up with growing costs over time by taking the predicted inflation rate into account. This helps them secure their wealth and achieve their financial objectives.

- Investment Decision Making: Investors can use the API’s inflation statistics to examine the impact of inflation. They can make better investing selections if they evaluate the implications of inflation on returns. They may, for example, opt to invest in assets that have traditionally outperformed during inflationary periods, such as real estate or commodities.

- Evaluating Investment Options: The API allows users to compare inflation rates across nations or areas. This data can assist investors in determining the relative attractiveness of investment possibilities in various markets. By taking inflation differentials into account, they may make more informed judgments about overseas investments and efficiently diversify their portfolios.

- Individuals can examine the inflation-related risks connected with various financial products, such as bonds or fixed-income investments, through risk management. By taking the inflation rate into account, they may assess the possible impact on the real value of their investments and alter their risk management measures appropriately.

In conclusion, by giving access to reliable and timely inflation data, a Monetary Inflation Index API enables users to make better-educated financial decisions. It improves financial intelligence by allowing people to grasp the effects of inflation, properly plan their finances, make educated investment decisions, and reduce inflation-related risks.

What Is The Best Monetary Inflation Index API Available?

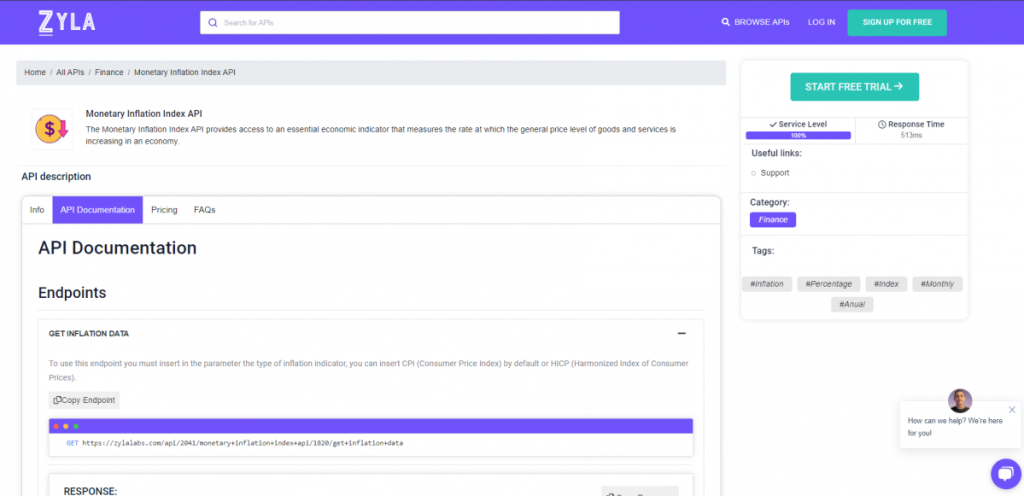

After experimenting with many choices, we can confidently state that the easiest-to-use API with the greatest results is the one provided by Zylalabs: API for the Monetary Inflation Index

Not only that but the results are returned in JSON format!

For example, if you enter CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint, you will receive the following response:

[

{

"country": "Austria",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.023,

"yearly_rate_pct": 8.704

},

{

"country": "Belgium",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.217,

"yearly_rate_pct": 2.722

},

{

"country": "Czech Republic",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": -0.135,

"yearly_rate_pct": 14.253

},

{

"country": "Denmark",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.255,

"yearly_rate_pct": 5.635

},

{

"country": "Estonia",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.04,

"yearly_rate_pct": 11.169

},

{

"country": "Europe",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.646,

"yearly_rate_pct": 6.976

},

{

"country": "Finland",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.227,

"yearly_rate_pct": 5.193

},

{

"country": "France",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.116,

"yearly_rate_pct": 5.967

},

{

"country": "Germany",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.56,

"yearly_rate_pct": 7.613

},

{

"country": "Great Britain",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 1.164,

"yearly_rate_pct": 8.667

},

{

"country": "Greece",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.554,

"yearly_rate_pct": 4.122

},

{

"country": "Hungary",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.734,

"yearly_rate_pct": 24.459

},

{

"country": "Iceland",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.718,

"yearly_rate_pct": 8.343

},

{

"country": "Ireland",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.256,

"yearly_rate_pct": 5.381

},

{

"country": "Italy",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.329,

"yearly_rate_pct": 8.075

},

{

"country": "Luxembourg",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.189,

"yearly_rate_pct": 1.95

}

]Where Can I Find The API For The Monetary Inflation Index?

To begin, go to the Monetary Inflation Index API and press the “START FREE TRIAL” button.

After joining Zyla API Hub, you will be able to utilize the API!

Make use of the API endpoint.

Then, by clicking the “test endpoint” button, you can perform an API call and view the results on the screen.

Related Post: How To Use A Monetary Inflation Index API To Forecast Market Volatility