The security of online businesses is an ongoing worry for both business owners and consumers. Fraudsters are continuously seeking new methods to steal sensitive information and swindle organizations. Using a transaction validation API is an excellent strategy to secure your business.

In this post, we will look at the advantages of utilizing a transaction validation API to safeguard your organization. Learn how this tool can assist you in preventing fraud and improving the security of your online company.

What Is A Transaction Validation API, Exactly?

A Transaction Validation API is an application programming interface that allows developers to validate and authenticate credit card numbers. It is a method used by merchants, banks, and financial organizations to authenticate a credit card number and determine the kind of card and issuing bank.

The Transaction Validation API compares the supplied credit card number to a set of criteria and methods to verify whether it conforms to the anticipated format, has the right check digit, and was issued by a known issuer. The API will return data such as card type (such as Visa or Mastercard), issuing bank, and country of issue.

Online organizations and merchants commonly utilize Transaction Validation APIs to eliminate fraud and illegal purchases. Financial organizations employ them to verify cardholder identities, assess credit risk, and detect fraudulent activity. The usage of a credit card checker API reduces the chance of financial losses due to fraudulent transactions while also increasing overall security for both the cardholder and the business.

After reviewing various alternatives on the market, we can confidently state that we have found one that, owing to its functionality and ease of use, is one of the best current solutions.

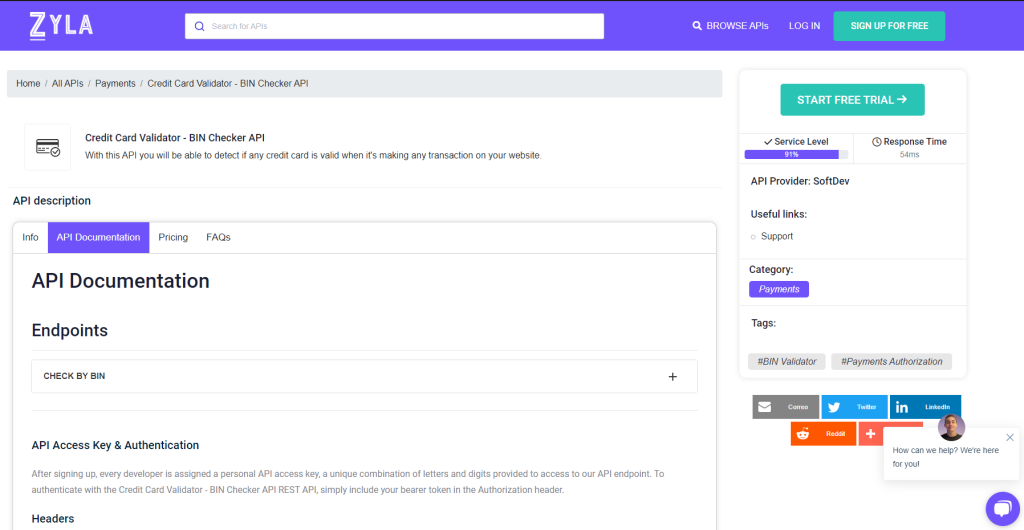

This option is the Credit Card Validator – BIN Checker API from Zylalabs since, as previously stated, it is an API that has worked incredibly well for us and is pretty straightforward to use even if you don’t know much about it.

How To Use Credit Card Validator API?

To obtain the entire data, the consumer will transmit the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number).

To access the whole data of this BIN in JSON format, you must enter a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card.

You will be notified of the card’s validity, whether it is a VISA or MASTERCARD, the issuing bank, and the card’s issuing location.

If we use this endpoint to enter the BIN number “448590,” for example, the API will return the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}How To Get This API?

1- Navigate to Credit Card Validator – BIN Checker API and click the “START FREE TRIAL” button to begin using the API.

2- You will be issued your unique API key after registering in Zyla API Hub.

3- Check the BIN number using the API endpoint.

4- When you’ve reached your endpoint, perform the API request by hitting the “run” button and viewing the results on your screen.

Related Post: Clear Any Suspicions With A Transaction Validation API