In today’s ever-changing economic landscape, understanding and analyzing macroeconomic factors is crucial for making informed decisions. One such vital factor is inflation, which has a profound impact on economies worldwide. To effectively study and comprehend inflation’s effects, utilizing an inflation data API is invaluable. So, in this article, we will explore how to leverage an Inflation Data API for in-depth macroeconomic impact exploration.

Understanding Inflation Data API Tech

An Inflation Data API provides access to comprehensive historical and real-time data on inflation rates. It allows users to retrieve inflation-related information based on specific time periods, geographical regions, and economic indicators. Thus, by utilizing this API, analysts, economists, and policymakers gain valuable insights into the dynamics of inflation and its potential implications.

Key Benefits Of An Inflation Data API

- Accurate and Timely Information: The API provides access to up-to-date and reliable inflation data. This ensures that users have access to the most accurate information for their analysis.

- Data Visualization: The API offers data in a structured format, allowing users to easily visualize and interpret inflation trends through visual representations.

Exploring Macroeconomic Impacts

Identifying Inflationary Pressures: By analyzing inflation data, researchers can identify periods of high or low inflation and assess the factors driving these fluctuations. Thus. this knowledge is crucial for understanding the health of an economy and formulating appropriate policy responses.

Assessing Monetary Policy Effects: Central banks and policymakers can leverage the API to evaluate the effectiveness of their monetary policies in controlling inflation. This insight helps them make informed decisions regarding interest rates, money supply, and other policy tools.

Investment Decision-Making: Investors can utilize inflation data to assess the potential impact of inflation on their investment portfolios. By understanding inflation trends, they can adjust their strategies accordingly to mitigate risks and identify investment opportunities.

Economic Forecasting: Besides, economists and analysts can incorporate inflation data into their models and forecasts to better predict future economic trends. This data-driven approach enhances the accuracy of economic projections and supports evidence-based decision-making.

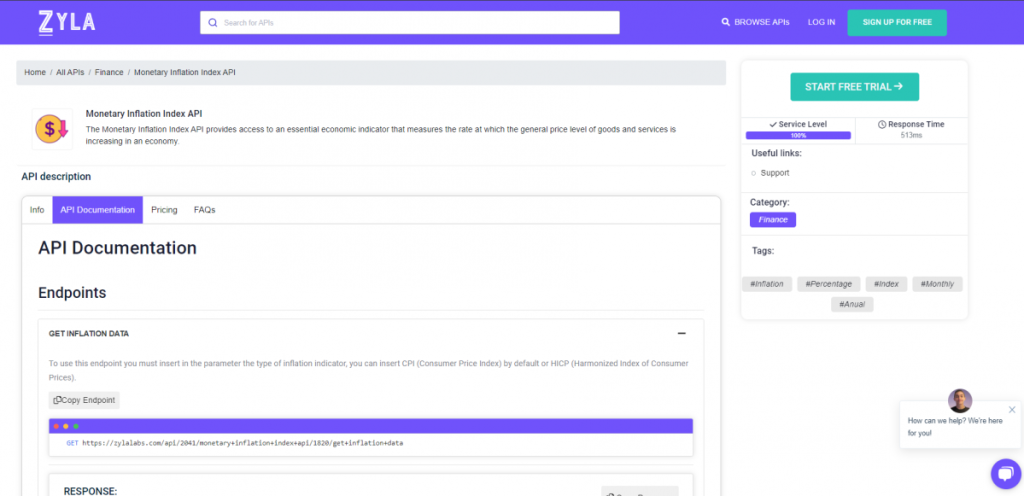

Take A Look At Monetary Inflation Index API

The Monetary Inflation Index API provides invaluable access to historical and real-time data on the Monetary Inflation Index. This comprehensive resource enables financial analysts, central banks, and investors to effectively track inflation trends and evaluate the impact of monetary policies on the economy.

By leveraging the API’s user-friendly documentation and support for popular programming languages, users can make informed decisions, manage risk, and optimize investment strategies. Whether you’re involved in financial analysis, monetary policy implementation, or investment management, the Monetary Inflation Index API offers powerful insights into inflation dynamics and facilitates evidence-based decision-making.

Besides, with its reliable data and comprehensive features, the Monetary Inflation Index API empowers users. Users can gain a deeper understanding of inflation trends and their implications for the economy. By leveraging the API’s extensive historical and real-time data, financial analysts can make informed investment decisions. Likewise, central banks can effectively manage monetary policies. Also, investors can adjust their strategies to mitigate risk. The API’s intuitive documentation and compatibility with popular programming languages make it accessible to a wide range of users. Stay ahead of inflation and harness the power of data-driven insights with the Monetary Inflation Index API.

Endpoint

For example, you can enter CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint. You will receive a response containing information similar to this:

[

{

"country": "Austria",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.023,

"yearly_rate_pct": 8.704

},

{

"country": "Europe",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.646,

"yearly_rate_pct": 6.976

},

{

"country": "Luxembourg",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.189,

"yearly_rate_pct": 1.95

}

]If you want to learn more, check How To Use A Monetary Inflation Index API To Forecast Market Volatility