Are you an officer of the administrative department of your country? Does it belong to the European Union? If it is your case, you must read this article! We are going to tell you how you can verify any VAT number using a single platform.

A value-added tax number is, as you must know, a kind of indirect tax that is required by the Government in every monetary transaction. This occurs in the different stages of the production and supply chain, so it’s a sum of percentages. As a consequence, if your country is part of the EU each company that sells goods or services has to comply with the normative. This means that they have to increase the final price of their product to collect the money and pay the tax.

It’s a good thing to know that VAT has no impact on the manufacturing or service provisioning industries because they can charge it to their customers. So, it doesn’t affect the offer and demand of products and doesn’t have a significant impact on the domestic economy. The problem appears when some businesses try to fake that information to avoid taxes. If it happens, their CEOs will have to pay all of their own money.

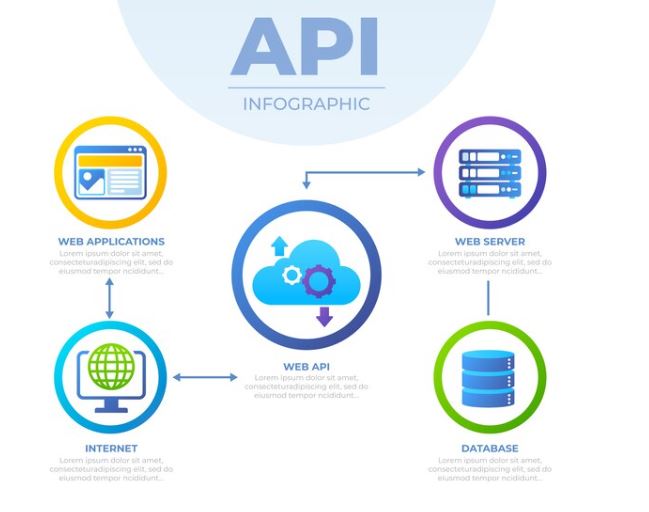

And as a taxes control department, your job is to validate these codes to check companies’ financial states. In this line, centralizing VAT number validation in a single repository will ensure that the results are constantly updated. Agents will identify violations faster and apply the correspondent sanctions immediately. But is there a way to verify VAT numbers without using several online sites? Yes, there is! It’s called API.

An Application Programming Interface is a server that compiles all the information you need to manage in the same platform. By providing the code, you will know if it’s legal or not. Also, you can have, for example, the name of the companies related to their VAT Numbers and their money movements in real time. You will ensure that your department will always have complete, correct, and up-to-date information.

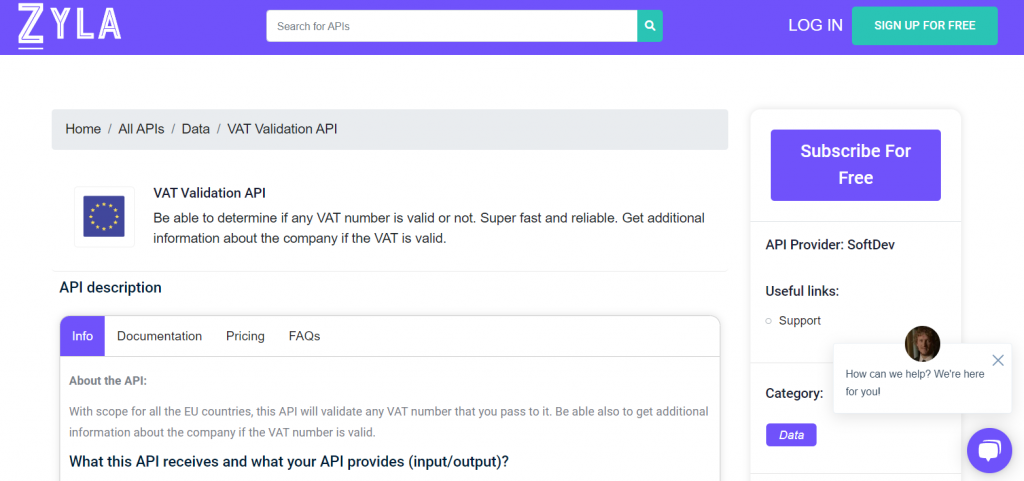

The best VAT validator we can suggest to you is the VAT Validation API. It will automatically check VAT numbers if you sign up. Its instant verification AI detects missing or incorrect numbers at a glance and, if necessary, removes them from your system. It’s extremely quick and simple to use!

VAT number check API covers the entire EU and it will provide you with additional information about the company if the value-added tax is valid. Among them, we can mention the name of the business, its city and location, and its code and postal code. With this data, you could make useful files and search more easily.

What do you have to do to begin to use it? Firstly, you must sign up for ZylaAPIHub (it’s a popular software marketplace) and subscribe to the VAT Validation API. Then, in the provided box, enter the VAT number along with the country code. If it is correct, you will receive a “true” response as well as a series of data like we listed before. If it is invalid, the platform will respond with “false”. With this API you will recognize fake VAT numbers faster and better!