Are you seeking an API for daily metal prices? In this post, we recommend the best one that there is on the internet.

Today, the US dollar is practically the only genuinely important determinant for precious metals. Although the USD is in full swing, it cannot last. The USD will eventually encounter too much opposition.

The exact reverse is anticipated to occur in 2023 given that the USD was the cross-market factor that pushed precious metals lower in 2022. The answer to the issue of which precious metal to buy for 2023 is based on these cross-market trends.

Precious metals and monetary policies have a negative relationship. A highly strict monetary policy was implemented by policymakers in 2022. Precious metals were under a lot of strain as a result. Governments tightened their purse strings more quickly in March 2022, just as gold and silver were set to begin a spectacular breakout. The effect on the price of precious metals is over.

Precious metals are largely influenced by inflation forecasts. As long as monetary policy is restrictive, its effect is that it lowers inflation expectations. However, the door will open for greater inflation expectations as soon as the tightening stabilizes.

Metals Situation As Of 2023

In the past, gold has helped silver transition from a bear market to a bull market. Although silver tends to lag, once it starts trending, it has tremendous strength. Palladium is an anomaly, with platinum primarily tied to gold.

Early 2023 is probably the time when the US dollar reaches its peak. Expectations of greater inflation will rise as a result. In addition, it is anticipated that the physical market would be tight. Without a discernible rise in the actual supply, there have been the longest-lasting retail premiums in silver history as well as rising wholesale physical demand in China and India.

The biggest difference between increasing physical demand and a rapid and incredibly counterintuitive historical price fall has been present over the past six months, to a degree never before witnessed. This situation is likely to occur since many individuals desire to invest in metal bullion as assets to save money in the face of the global economic crisis.

Use An API For Daily Metal’s Prices

As you can see, this year will be very dynamic in terms of rising or lower prices in the metal market. This is the reason why you may watch the metal’s prices daily, to understand the factors that influence this industry. Every person who wants to participate in this economy, whether as an asset or as an investment for any industry, must watch this.

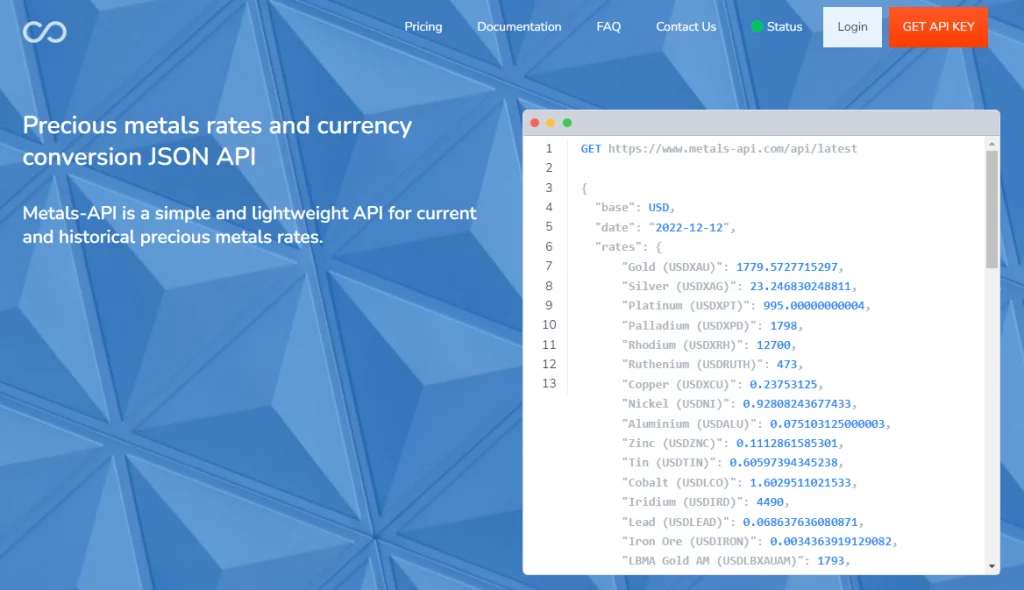

This is not everyone’s problem. Many companies seek to advise thousands of investors around the world. So they have to look to update the prices of metals every day. This is an important task, but it can take a lot of time and effort. Here we want you to use the Metals-API to see all the metal values daily.

About Metals-API

Metals-API will show you the prices of metals daily, as well as their historical prices. In this way, you can organize articles, research, and analysis of market dynamics. In this way, you will be able to better advise investors, governments, and different sectors of the economy that participate directly or indirectly in this market.

You can share this information with them incorporating the documentation that you think is pertinent. You will do it without problems since you can use the API responses in the programming language you want.