Would you be interested in using a Payments Authorization API? Would you like to find out in cases to use it? Well don’t worry, we will solve all your doubts! And in addition, we will provide you with a product that will help you authorize all the payments you receive!

There are a number of crimes related to payment cards, ATMs and payment systems such as point-of-sale terminals. The prevalence of online payments has given criminals a huge boost by opening up a host of new possibilities. In addition to card theft, criminals use various methods to capture data, such as skimming (stealing data from ATMs or vending machines to clone cards) and phishing. People often only realize their card details have been stolen when it’s too late. This data can be used to manufacture false cards or later used to commit fraud without the physical presence of a card.

Fraudsters use the information to purchase property on behalf of victims or to obtain unauthorized funds from their accounts. Data from these cards can also be put up for sale on darknet marketplaces. In many cases, data stolen in one country is used elsewhere, making it difficult to trace. Therefore, it is necessary for companies to have card payment validators in order to reduce the number of victims. Thanks to this type of system, companies avoid being victims of scams.

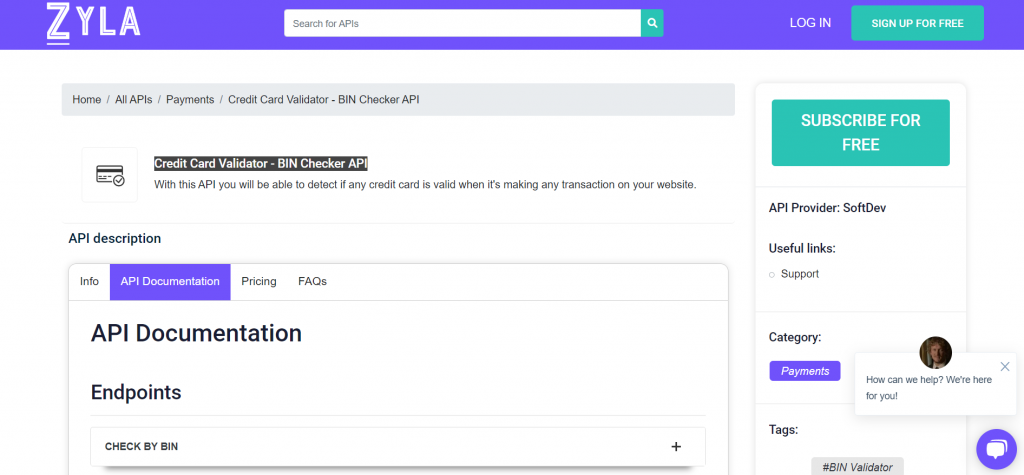

Among all the existing tools to validate online payments, without a doubt, the best possible option is to use a Payments Authorization API. It is a type of API, which provides digital security to payment platforms. We advise you to use Credit Card Validator – BIN Checker API, as it is the best system to authorize payments. If you want to know the most common use cases, we will provide them here.

Most common uses cases of Credit Card Validator – BIN Checker API

The main purpose of Credit Card Validator – BIN Checker API is for the security of payment platforms. Imagine that a customer wants to buy something with an invalid card. Without a good security system, the sale could be authorized with an invalid card! To prevent this from happening, this platform implements the latest cybersecurity technology to keep your sales safe. You can tell your developer to incorporate this API into your payment platform so that the process can be done automatically.

You will be able to find out information such as whether the card is Visa, Mastercard or American Express, what country the card comes from, what bank issued the card, whether it is a valid card or not, type of card and so on, you will avoid any security breach. The only thing you will need is to have the first 6 numbers on the card. These numbers are usually known as BIN (Bank Identification Number) or IIN (Issuer Identification Number). You just have to paste those 6 numbers and Credit Card Validator – BIN Checker API will take care of the rest!

But it does not mean that the only purpose of the system is for cybersecurity. It can also be used to authorize offers. Imagine that only Mastercard customers can pay in 3 installments without interest. With this platform, you can be sure that the card is Mastercard and thus authorize the offer safely. If the card were Visa, the offer would be void.