The role of APIs has grown increasingly important in the ever-changing context of digital transformation, where smooth operations and accuracy are key. APIs, or Application Programming Interfaces, act as a link between different software programs, allowing them to communicate and work together. As we approach the year 2023, a new rival appears on the scene: VAT Number Validation APIs. In this article, we’ll look at how this type of API is changing the way organizations manage VAT number validation, why it’s important in the world of EU tax legislation.

Understanding The Problem: Navigating The VAT Environment

VAT compliance is not just a need for enterprises operating in the European Union, but it is also a legal requirement. The VAT (Value-Added Tax) number acts as a unique identification for authorities, allowing them to trace transactions, assure compliance, and enable cross-border trade. However, manually checking these VAT numbers may be a time-consuming and error-prone operation, especially as the volume of transactions grows. This is when the VAT Validation API comes into play.

VAT Validation API Is Unveiled

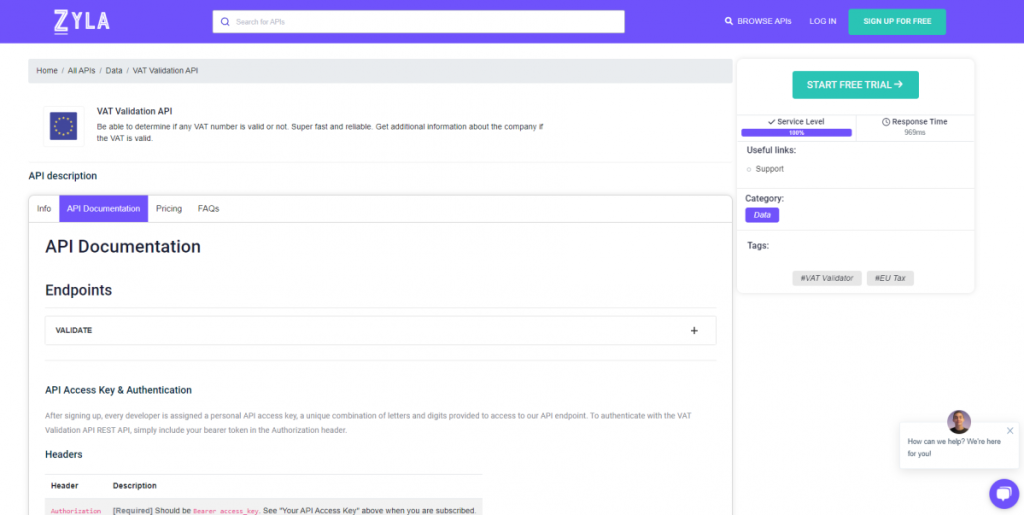

Enter the VAT Validation API, a powerful tool for automating and streamlining the validation of VAT numbers. Zyla API Hub, a platform that presents a variety of cutting-edge APIs, including the VAT Validation API, is at the forefront of technological innovation. Developers receive access to a dependable solution that smoothly integrates into their apps and provides real-time validation of VAT numbers via its user-friendly interface.

Investigating The Features And Advantages

The VAT Validation API is approachable and offers a variety of features and benefits. It assures accuracy first and foremost by cross-referencing VAT numbers with official databases, decreasing the possibility of mistakes and any compliance difficulties. Furthermore, the API provides a scalable solution that can handle massive amounts of queries without sacrificing speed or accuracy. This is critical, especially for organizations involved in cross-border commerce, where high quantities of transactions occur on a regular basis.

Similarly, the API’s adaptability shows through as it supports a variety of programming languages and frameworks, making integration a breeze for developers with varied technical backgrounds. Furthermore, the API includes descriptive response codes, allowing developers to understand the state of validation and take relevant actions inside their applications.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"vatNumber": "288305674",

"countryCode": "GB",

"companyName": "WEIO LTD",

"companyAddress": "142 CROMWELL ROAD",

"companyCity": "LONDON",

"companyPostCode": "SW7 4EF",

"serviceStatus": true

}Starting With The VAT Validation API

Getting started with the VAT Validation API is a simple procedure for individuals who are fascinated by its possibilities. Begin by registering with Zyla API Hub and reviewing the API documentation. The documentation provides detailed instructions for integrating the API into your application, as well as sample code snippets for several programming languages. Developers may easily integrate VAT number validation capabilities and improve the precision of their processes by following step-by-step instructions.

- Step 1: Create an account: Begin by obtaining an API key from the Zyla API Hub. This key will get you access to the VAT Validation API.

- Step 2: Put it into action: Refer to the API documentation to easily integrate the VAT Validation API into your chosen platform or application.

- Step 3: Implementation: Once the API has been integrated, start sending VAT numbers for validation and receiving real-time results.

- 4th Step: Transformation: Watch as precision becomes the bedrock of your relationships and transactions.

Related Post: Turbocharge Accuracy: The VAT Number Validation APIs Advantages