In the fast-paced world of banking and financial transactions, ensuring a seamless customer experience is crucial. To achieve this, businesses can leverage the power of Bank Verification APIs. These APIs, such as the Bank Verification API, provide access to essential banking information. Including Bank Codes, Routing Numbers, IBANs, and SWIFT codes. Here, we will explore the significance of Bank Verification APIs in optimizing the customer experience, enhancing accuracy, authenticity, and streamlining transactions.

Enhancing Accuracy And Authenticity With Bank Verification API:

One of the primary advantages of integrating a Bank Verification API is the ability to access accurate and up-to-date banking details. APIs provide real-time access to crucial identifiers, such as Bank Codes, Routing Numbers, IBANs, and SWIFT codes. By leveraging this information, businesses can verify the authenticity of recipient accounts. Reducing the risk of erroneous transactions and potential fraud. The Bank Verification API acts as a reliable checker, ensuring the accuracy and integrity of the provided banking information. Furthermore, optimizing the customer experience.

Streamlining Transactions With Bank Information API:

Manual verification of banking information can be time-consuming and prone to errors. However, with a Bank Verification API, businesses can automate the validation process, streamlining transactions and improving efficiency. By integrating the API into their systems, organizations can seamlessly incorporate the validation checks within their payment workflows, reducing manual intervention and minimizing potential mistakes. This not only saves time but also contributes to a smoother and more efficient customer experience.

Access To Comprehensive Bank Data:

A Bank Verification API provides access to a vast database of bank information, offering a comprehensive overview of banks worldwide. Businesses can validate the accuracy of bank details, including account numbers, branch information, and addresses, by leveraging the API’s extensive data. This comprehensive information enables organizations to verify recipient accounts more effectively, ensuring successful cross-border transactions and further optimizing the customer experience.

Enhanced Security And Regulatory Compliance:

Bank Verification APIs play a crucial role in ensuring security and regulatory compliance in financial transactions. By leveraging the API’s capabilities, businesses can validate recipient accounts before initiating transfers, reducing the likelihood of rejected or delayed payments. This not only enhances security but also helps organizations comply with banking regulations and requirements, fostering trust and confidence in the customer experience.

Empowering the Customer Experience with Bank Lookup API: Unlocking the Potential

In an increasingly digital and customer-centric banking landscape, optimizing the customer experience is essential for businesses. Bank information APIs, such as the Bank lookup API, provide the tools to enhance accuracy, and authenticity, and streamline transactions. By leveraging these APIs and their features, organizations can access real-time banking information, automate validation processes, and ensure regulatory compliance. This ultimately leads to an optimized customer experience, minimizing errors, and fostering trust in financial transactions.

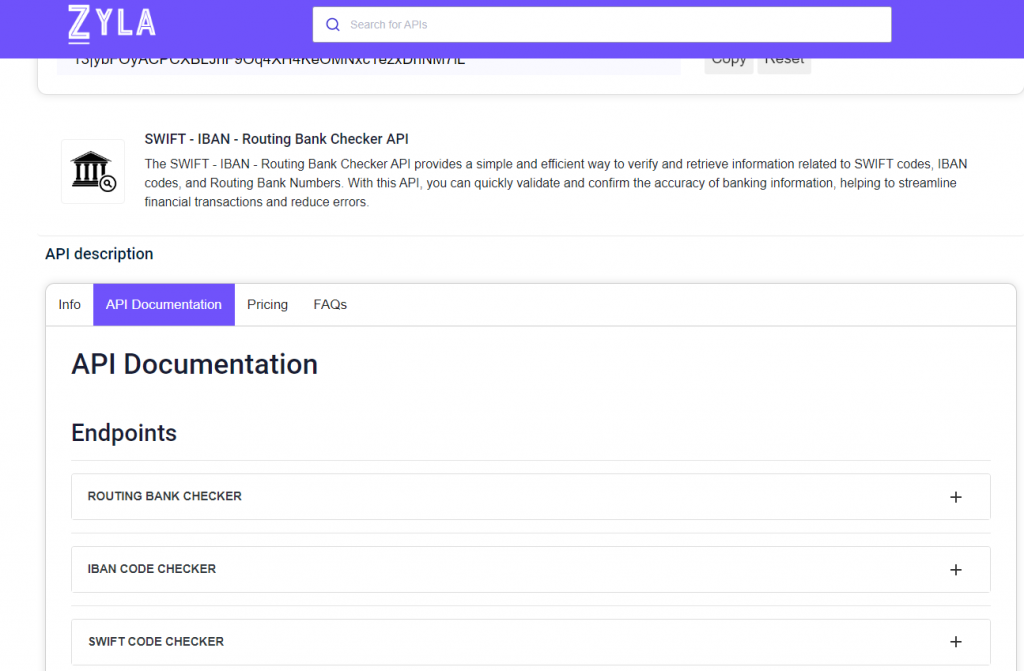

To streamline this process, developers can harness the power of the SWIFT – IBAN – Routing Bank Checker API provided by Zyla API Hub. This API provides businesses with a powerful tool to streamline and optimize financial transactions. By leveraging this API’s features, organizations can validate SWIFT codes, verify IBAN codes, and confirm Routing Bank Numbers, thereby minimizing errors and ensuring secure transactions. With real-time access to accurate banking information, businesses can enhance the efficiency, accuracy, and authenticity of their financial processes. By incorporating the SWIFT – IBAN – Routing Bank Checker API into their systems, organizations can navigate the complexities of financial transactions with ease and confidence.

To explore the API, visit www.zylalabs.com and navigate to the Categories menu, select the Payments option. This will take you to the page featuring the Best Payment APIs, where this API is located. By clicking on the API, you will be directed to the API’s dedicated page. Here you can access detailed information and documentation. This documentation provides a list of available endpoints.

To get started, and take advantage of the free 7-day trial, you are required to register after selecting a suitable plan for your application monthly calls needs.

Getting Started

To start using The API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you need to register after selecting the plan, then you can start your 7-day free trial. You can send API requests using different endpoints based on your interest. Once yoselected your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

Routing Number (INPUT) – 121000248

Below ithe s API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}