Optical character recognition (OCR) has evolved and gained popularity as a way of processing images and converting them into structured information.

Credit cards are constantly at risk of fraudsters and tricky transactions. To make sure that your and your customers´ payments are secure you need an automated tool.

An optical character recognition (OCR) API is a tool that allows developers to integrate optical character recognition into their applications. This means that they can automatically process images and documents by extracting text data and converting it into structured information. To help protect your customers from fraud, you can use an OCR API to automatically detect and block fraudulent transactions. Developers devise tools for their clients to help ensure that their customers’ payments are secure and not used fraudulently. Credit Card OCR API is the strongest software on the market on which to make their developments.

An OCR API can be extremely useful for businesses that deal with a lot of images or documents, such as banks and payment processors. An OCR API can be used to detect and extract text from images, which can then be converted into text. This text can then be used for a variety of purposes, such as creating documents or performing analysis. OCR APIs are becoming more popular as they become more accurate and easier to use. They are a great way to automate tasks that would otherwise require a lot of manual work.

How Can An OCR API Help Your Business?

There are many ways an OCR API can help your business. First and topmost, to reduce costs by automating manual tasks. Then, to improve customer service by allowing employees to respond faster to customer requests. Furthermore, to improve productivity by allowing employees to spend less time on non-value-added tasks. Moreover, to improve accuracy by automating tasks that are prone to human error. Likewise, to improve customer experience by making customer service processes more efficient. Also, to reduce errors by automating manual processes, and finally to improve compliance by automating processes that are subject to regulations.

Protect Your Customers With An OCR API

If you’re looking for a way to protect your customers from fraud, an OCR API is a great option. With this technology, you can quickly identify fraudulent transactions and take action to prevent them from happening in the future.

The first step is to make sure that the API you choose is reliable and secure. After that, you will need to sign up for it and get started! There are many APIs available so make sure you do some research and find one that fits your needs.

The Optical Character Recognition API also processes information quickly, so you won’t have to wait around for results. The API also has a high accuracy rate, so you can be sure that any transactions processed through it are accurate. This technology is very useful for fraud detection because it can recognize patterns in transactions that are indicative of fraud. For example, if someone tries to make several purchases in one day from different devices or locations, this could be a sign that something is not right. So, by integrating an OCR API into your payment system, you can protect your customers and also save time and money by preventing fraud before it happens.

This API works with AI so it can easily identify patterns and anomalies in transactions. This means that it will be able to detect any attempts of fraud automatically and notify you so you can take the necessary measures and precautions. You’ll be able to see if any transactions were made without your approval or if any data was falsified.

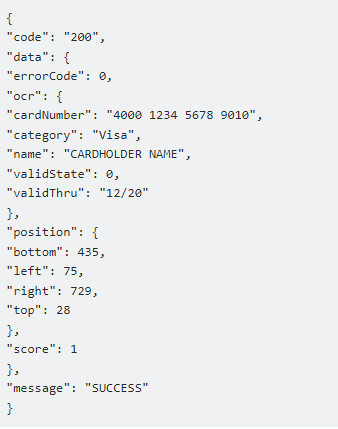

Besides API call limitations per month, there are no other limitations. You must just pass the publicly accessible image URL and receive the credit card data in a structured JSON. Efficiency, reliability, functionality, affordability and ease-of-use…these features guarantee the best solution for the purpose.

How To Get Started With Credit Card OCR API

Counting on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

https://africa.visa.com/dam/VCOM/regional/cemea/genericafrica/global-elements/cards/classic.jpg

the response will look like this: