Bank verification is a crucial process for financial institutions to ensure accurate and secure transactions. The advent of technology has led to the development of bank verification APIs, such as the Bank Verification API, which simplifies and streamlines this essential task. By leveraging the capabilities of this API, financial institutions can seamlessly integrate bank verification processes into their existing systems, leading to improved efficiency, enhanced accuracy, and strengthened data integrity. Here, we will explore the benefits of using a bank verification API and how it facilitates seamless integration for streamlined operations.

Efficient Bank Verification With API

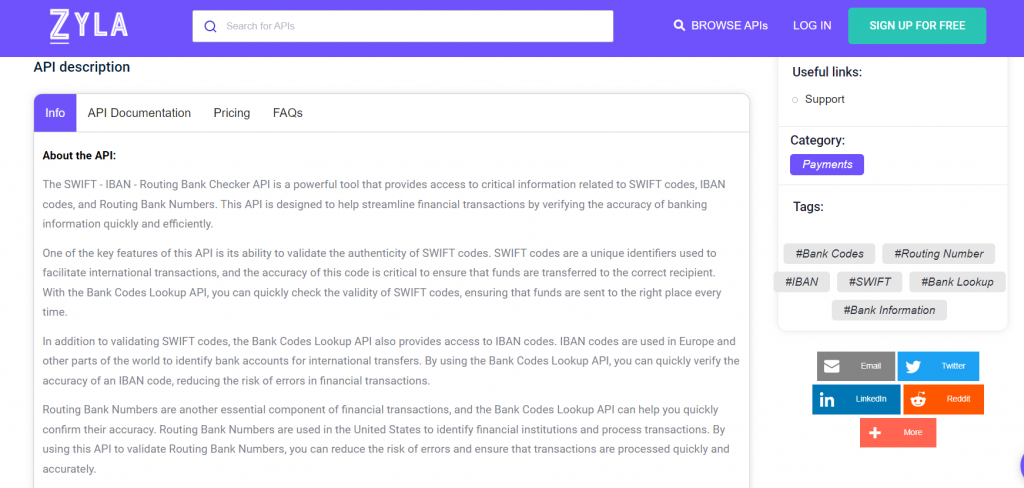

The Bank Information API offers a comprehensive solution for verifying bank codes, routing numbers, IBANs, and SWIFT codes. Its advanced features provide the ability to access and authenticate bank information accurately and efficiently. By utilizing this API, financial institutions can streamline their bank verification processes, reducing manual efforts and potential errors. The API’s seamless integration capabilities enable institutions to seamlessly incorporate it into their existing systems, ensuring a hassle-free implementation process.

Seamless Integration For Streamlined Operations

The key advantage of a Bank Lookup API lies in its ability to seamlessly integrate with existing banking systems. It offers a user-friendly interface and straightforward API requests, allowing financial institutions to integrate the API effortlessly. Whether it’s integrating the API into online banking platforms, payment gateways, or customer relationship management (CRM) systems, the Bank Checker API ensures a smooth and efficient integration process. This seamless integration translates into time and cost savings, as well as improved operational efficiency for financial institutions.

Enhanced Accuracy And Data Integrity

Accuracy and data integrity are crucial factors in bank verification processes. Manual entry of bank codes and other identifiers is prone to human error, leading to potential discrepancies and transaction failures. The Bank Lookup API mitigates this risk by automating the verification process and accessing real-time data from reliable sources. By eliminating manual data entry and relying on the API’s accuracy, financial institutions can ensure the authenticity and correctness of bank information, reducing errors and enhancing data integrity.

Real-Time Verification For Faster Transactions

Timeliness is vital in the banking industry, especially in processing transactions. The bank verification API facilitates real-time verification of bank codes, routing numbers, and other essential identifiers. This enables financial institutions to expedite transaction processing by swiftly confirming the accuracy of recipient bank information. With faster verification, financial institutions can offer efficient services, reduce processing delays, and enhance customer satisfaction.

Improved Compliance And Risk Mitigation

Compliance with regulatory standards and risk mitigation are critical aspects of banking operations. The Bank Information API helps financial institutions meet compliance requirements by accessing accurate and up-to-date bank information. By leveraging the API’s authentication capabilities, institutions can ensure adherence to regulatory guidelines, reducing the risk of non-compliance penalties and legal issues. This proactive risk mitigation approach enhances overall operational security and regulatory compliance.

Streamline Bank Verification with Bank Checker API

The SWIFT – IBAN – Routing Bank Checker API is the top choice for financial institutions. Its real-time validation of SWIFT codes, IBAN codes, and routing bank numbers ensures accuracy and authenticity. The API streamlines bank verification processes reduces errors, and enhances financial security, fostering trust between institutions and customers.

This Bank Checker API offers seamless integration and a user-friendly interface. Financial institutions can easily incorporate it into existing systems without disruption. Real-time verification capabilities expedite transaction processing, improving customer satisfaction. The API also ensures compliance, reduces risks, and maintains data integrity, making it the ideal choice for streamlining bank verification processes.

To explore the capabilities of the Bank Checker API, visit www.zylalabs.com and go to the Payments section in the Categories menu. There, you will find the Best Payment APIs page, featuring this exceptional API. Access its dedicated page to obtain detailed information and comprehensive documentation, including a list of available endpoints.

Getting started is easy. Simply register with your preferred plan and enjoy a free 7-day trial. This trial period allows you to experience the API’s functionality firsthand, assess its effectiveness, and determine its suitability for your specific needs. Take this opportunity to explore its features, ensure seamless integration with your systems, and make an informed decision about incorporating it into your operations.

Example

Routing Number (INPUT) – 121000248

Below is API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}