International transactions have become an integral part of the global economy, facilitating seamless cross-border transfers and payments. However, ensuring the accuracy and authenticity of banking information is crucial for the success of these transactions. The International Transaction API offers a cutting-edge solution to streamline and validate critical financial data. Furthermore providing a reliable tool for efficient international transactions.

Authenticating SWIFT Codes: Ensuring Secure Fund Transfers

SWIFT codes serve as unique identifiers used to facilitate international transactions, guaranteeing that funds are directed to the intended recipient. The International Transaction API’s standout feature is its ability to authenticate SWIFT codes, enabling users to swiftly verify their validity. By leveraging the Bank Codes Lookup API, financial institutions, businesses, and individuals can ensure that funds are securely transferred to the correct destination every time.

Validating IBAN Codes: Minimizing Errors In International Transfers

IBAN codes are essential for identifying bank accounts in Europe and various parts of the world, facilitating international transfers. The International Transaction API provides access to IBAN codes and enables users to verify their accuracy promptly. This validation process reduces the risk of errors in financial transactions. Furthermore, ensuring seamless fund transfers and promoting confidence in international transfers.

Confirming Routing Bank Numbers: Ensuring Accurate Transaction Processing

Routing Bank Numbers are vital components in financial transactions, particularly within the United States. As they identify financial institutions and facilitate transaction processing. The International Transaction API plays a crucial role in confirming the accuracy of Routing Bank Numbers, minimizing errors, and ensuring prompt and precise transaction processing. Furthermore, by utilizing this API, businesses and individuals can reduce the likelihood of errors and enhance the efficiency of their international transactions.

User-friendly Design And Seamless Integration

The Bank lookup API is designed with user convenience in mind. With simple API requests, users can effortlessly retrieve critical information about SWIFT codes, IBAN codes, and Routing Bank Numbers. This user-friendly design ensures that even non-technical users can leverage the API effectively. Furthermore, the API’s seamless integration capabilities allow for easy implementation into existing financial systems, benefiting both large financial institutions and small businesses.

Most Common Applications

This Banking Information API revolutionizes the landscape of international transactions by providing access to critical information about SWIFT codes, IBAN codes, and Routing Bank Numbers. By minimizing errors, streamlining processes, and enhancing the accuracy of financial data, this API empowers businesses, financial institutions, and individuals to achieve their financial goals with ease and confidence.

Banking And Financial Institutions

Financial institutions can utilize the Bank Codes Lookup API to verify and validate SWIFT codes, IBAN codes, and Routing Bank Numbers provided by their clients. This ensures transaction accuracy, reduces the risk of errors, and improves overall system efficiency.

E-commerce And Online Payment Processing

E-commerce companies and payment processors can incorporate the Bank Codes Lookup API to validate customer banking information during the payment process. By verifying bank codes, these businesses can reduce the risk of failed transactions and enhance customer satisfaction.

Accounting And Tax Services

Accounting and tax service providers can leverage the Bank Codes Lookup API to validate banking information provided by their clients. This ensures accurate financial reports that comply with relevant regulations, mitigating the risk of penalties and legal complications.

Travel And Tourism Industry

The travel and tourism industry can benefit from the Bank Codes Lookup API by validating international payments from customers. This reduces the risk of errors and delays in the booking process, improving customer satisfaction and ensuring accurate and timely transaction processing.

Government Agencies

Government agencies can use the Bank Codes Lookup API to verify banking information provided by individuals and businesses. By ensuring accurate tax payments, social security benefits, and other financial transactions, the API reduces the risk of fraud and errors.

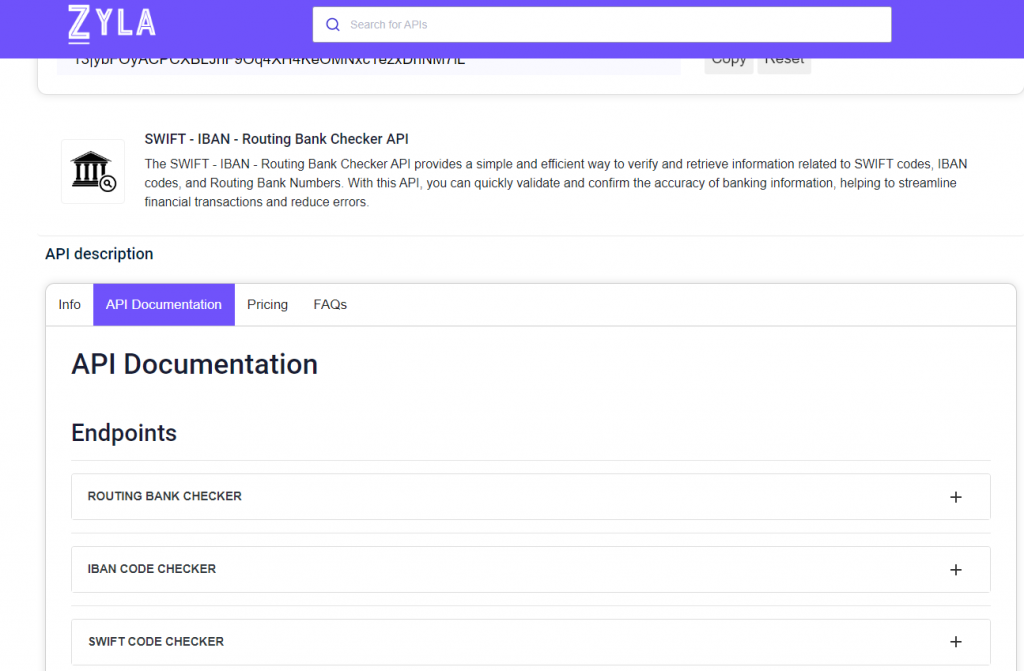

Cutting-edge Validation: The SWIFT – IBAN – Routing Bank Checker API

The SWIFT – IBAN – Routing Bank Checker API is a cutting-edge validation tool that revolutionizes international transactions. By leveraging this API, users can quickly and efficiently validate SWIFT codes, IBAN codes, and Routing Bank Numbers, ensuring accurate and secure financial transactions. With its powerful features and seamless integration capabilities, this API simplifies the validation process and streamlines international transactions like never before.

To explore the API, visit www.zylalabs.com and by navigating through the Categories menu, select the Payments option. This will take you to the page featuring the Best Payment APIs, from here you can select the featured API. On the API’s dedicated page, you can access detailed information and documentation. This documentation provides a list of available endpoints.

To get started, you can take advantage of the free 7-day trial, allowing you to experience the API’s functionality. Furthermore, you can choose a suitable plan based on your monthly call requirements from the available options.

Getting Started

To start using SWIFT – IBAN – Routing Bank Checker API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you need to register after selecting the plan, then you can start your 7-day free trial. You can send API requests using different endpoints based on your interest. Once you select your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

Routing Number (INPUT) – 121000248

Below is the API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}