Staying ahead of the curve in today’s marketplace is critical and companies are constantly looking to do so. Taxation is an area that has undergone significant change, with the introduction of APIs aimed at facilitating the process of obtaining and validating VAT numbers. Let’s look at the benefits of using a VAT number API and highlight one of the APIs available.

The Issue

For businesses operating within the European Union, complying with VAT regulations may be a challenging and time-consuming process. It is vital to keep VAT numbers updated and active in order to avoid fines and ensure seamless cross-border transactions. Manually checking and confirming VAT numbers, on the other hand, can be time-intensive and mistake-prone.

Zyla API Hub’s VAT Validation API Is The Solution

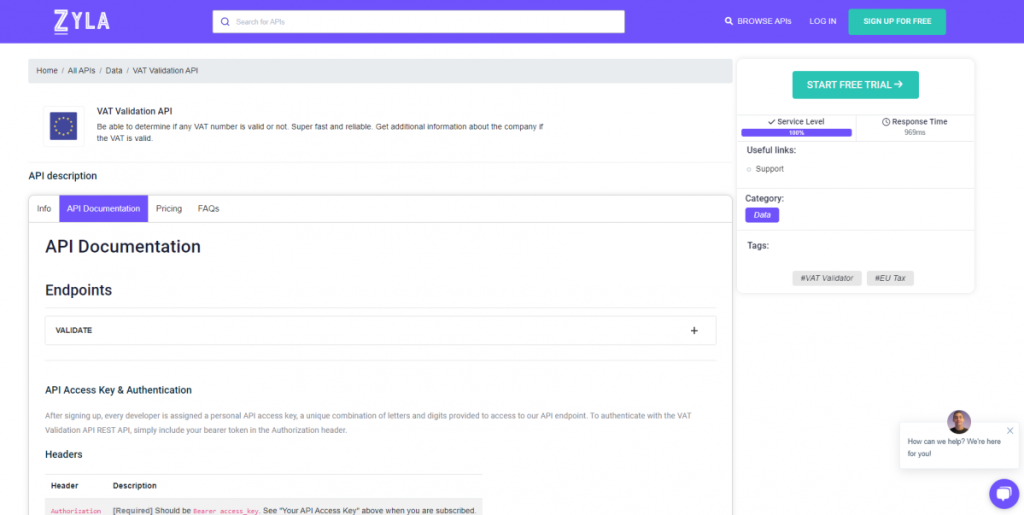

The Zyla API Hub is a developer-friendly public hub where API providers may publish APIs for use by developers and partners. The VAT Validation API, one of the numerous APIs available on the Zyla API Hub, is a sophisticate solution design to help organizations optimize their VAT compliance procedures.

Businesses may use the VAT Validation API to quickly and accurately confirm the legitimacy of their customers’ VAT numbers, ensuring compliance with local regulations. The VAT Validation API provides a trustworthy and secure solution for enterprises looking to enhance their taxing processes, with features like real-time data updates and bank-level security.

Advantages And Characteristics

- Real-time data updates: The VAT Validation API changes VAT numbers in real-time, ensuring that companies always have access to up-to-date information.

- Bank-level security: All queries made via the VAT Validation API are encrypted with 256-bit SSL, ensuring that sensitive data is always kept secure.

- Simple integration: The VAT Validation API is designed to be easy to integrate with existing systems, allowing businesses to quickly integrate it into their operations.

- Developer-friendly: Because of rich documentation and assistance, developers can quickly get started with the VAT Validation API.

In this section, we’ll walk through an example to show how it works. The API endpoint “VALIDATE” will be called. Enter the VAT number and the country code to obtain VAT-related information. It’s that simple! The following is how it works:

{

"valid": true,

"vatNumber": "288305674",

"countryCode": "GB",

"companyName": "WEIO LTD",

"companyAddress": "142 CROMWELL ROAD",

"companyCity": "LONDON",

"companyPostCode": "SW7 4EF",

"serviceStatus": true

}Starting From Scratch With VAT Validation API

It’s simple to get started using the Zyla API Hub’s VAT Validation API. Simply establish an account on the Zyla API Hub, obtain your API key, and begin querying. The VAT Validation API, with its vast features and ease of use, is a critical tool for any firm attempting to streamline its tax processes.

- Sign up here: Begin by creating an account on the Zyla API Hub. The VAT Validation API and associated resources are now live.

- Create a unique API key that will be used as your authentication credential while doing API queries.

- Take advantage of the free trial to test the API and remember that you can cancel at any time.

Finally, when it comes to VAT compliance, using a VAT number API, such as the one available on the Zyla API Hub, may help businesses save time and reduce errors. By automating the process of validating VAT numbers, businesses can focus on what they do best: serving their customers and expanding their operations.

Related Post: Tax Made Simple: Explore A VAT Number API