Businesses and governments are rushing to adapt and innovate in a quickly changing digital ecosystem where every click, tap, and swipe creates data. As our world grows more linked, the demand for precise and efficient solutions to expedite operations has never been greater. Tax compliance is one such subject that has seen tremendous development. With the increase in cross-border transactions and the complexity of tax legislation, the demand for solutions such as VAT Lookup APIs has increased.

Navigating Tax Compliance Difficulties: The Role Of VAT Lookup APIs

Consider a corporation that operates in numerous countries and must manage Value Added Tax (VAT) computations for each transaction. With varied tax rates, laws, and regulations between jurisdictions, guaranteeing precise compliance becomes a maze. Manual computation is not only time-consuming and error-prone, but it also consumes resources that may be better used for essential company tasks.

VAT Lookup APIs Hold The Key To Improving Efficiency

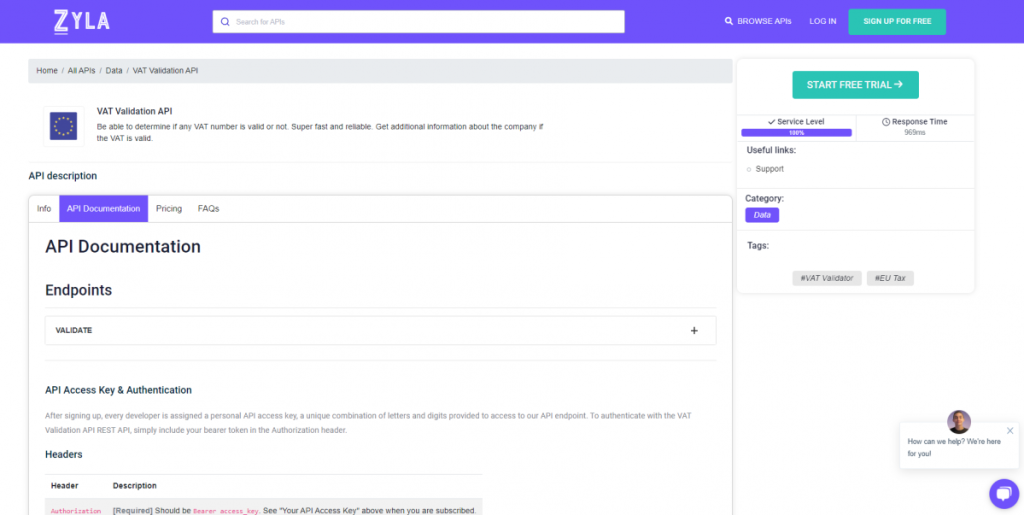

Enter the VAT Validation API, a remarkable tool that has transformed tax compliance. Among them, Zyla API Hub’s VAT Validation API stands out for its broad features and developer-friendly architecture. Zyla’s API Hub serves as a showcase for the VAT Validation API, providing developers with a platform to capitalize on its capabilities.

Investigating The Features And Advantages

The VAT Validation API has a number of capabilities that allow organizations to easily include correct VAT validation into their systems. Developers may quickly include VAT lookup functions with its user-friendly documentation and simple APIs, removing the complications of cross-border tax computations. This API supports a number of programming languages, ensuring flexibility and interoperability with multiple technology stacks.

Furthermore, the VAT Lookup API’s real-time validation capabilities enable organizations to validate VAT numbers on the fly during client interactions. This rapid validation not only reduces mistakes but also improves the user experience. Furthermore, the API gives insight into EU tax legislation, ensuring that firms are up to speed on the most recent compliance needs.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To gain access to VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}How To Use The VAT Validation API

Starting your adventure with the VAT Validation API is a simple procedure. Here’s how you can begin:

- Register here: Begin by signing up for an account on the Zyla API Hub. VAT Validation API and related resources are now available for use.

- The following is the API documentation: Examine the Zyla API Hub API docs in their entirety. Here is further information about integration rules, endpoints, and parameters.

- Make a one-of-a-kind API key that will serve as your authentication credential while conducting API queries.

- To connect the API to your systems, apply the integration principles. To guarantee a smooth integration process, use example code snippets and tutorials.

- Testing and deployment: To ensure seamless operation, do extensive testing before installation in a production situation.

Related Post: Streamline Tax Checks: Dive Into A VAT Lookup API