Are you looking for a VAT Checker API with a free trial? In this article, we’ll tell you which is the best one

The value-added tax is a consumption tax that is charged on most goods and services, including those that are exempt from sales tax or other taxes. The VAT is paid by the final consumer at the point of sale and is then passed on to the government. This is why it is also known as a “tax on consumption.”

So, the value-added tax rate varies from country to country and can range from 0% to 27%. In some countries, certain products are exempt from VAT (for example, food in most European countries). The VAT is generally included in the price of goods and services and cannot be charged separately. The final consumer pays the VAT at the time of purchase, but businesses can claim it back when they make purchases.

This system allows businesses to recover the VAT they have paid on their purchases. This means that they can offer their products at a lower price than they would if they had to pay sales tax on everything.

In order for your business to be successful and profitable, you must be aware of all taxes that apply to your business activity. This will allow you to report your income accurately and avoid any penalties or fines.

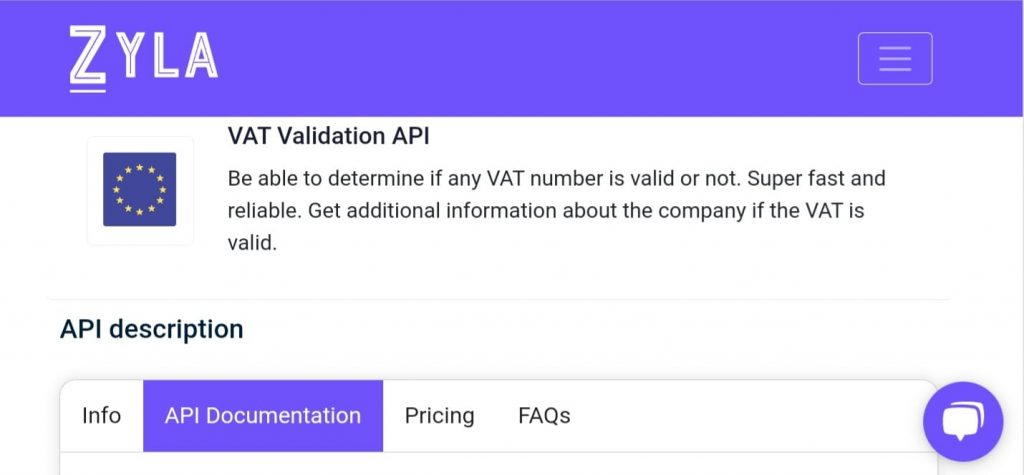

If you are looking for an API with a free trial, you should try out an API called VAT Validator API.

Why Use Vat Validation API?

With Vat Validation API, you can verify that your clients’ VAT numbers are always complete, correct, and, most importantly, up to date. The automatic check detects missing or inaccurate VAT numbers and, if necessary, removes them from your system. You improve the accuracy of your customers’ VAT numbers and always have a complete picture.

VAT Validation API is a good solution for anyone who need information on VAT rates. You will be able to use this API to request information about any country in Europe and obtain complete information about VAT rates, including which goods are VAT free.

How To Use This API?

1- Go to VAT Validation API and simply click on the button “Try Free for 7- Days” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- With your API key, you can already integrate the API in the language you need. In the mentioned URL, you can find a lot of Code Snippets, that can facilitate your integration.

You have to choose the “VALIDATE” endpoint type, and you may examine the following responses:

API Responses:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}So, why not try Vat Validation API right now? You’ll be glad you did!