Are you looking to discover the uncovering hidden opportunities in the metal markets? Then you must discover it with an API! In this article, we’ll suggest the best one!

In 2022, a lot of things changed for us. like when Russia invaded Ukraine. The US Federal Reserve’s fastest round of interest income rises in a decade is on the other side. In 2023, world growth is projected to straddle the precipice between rich countries headed for recession and emerging market economies working to bolster their recoveries.

Numerous people who engage in metals wonder if there are any other investment options outside gold. They do this since a lot of individuals depend on these assets to keep their money intact. Currently, they recommend buying less well-known commodities like platinum.

The hydrogen industry is expanding, especially thanks to technologies that generate green hydrogen using renewable energy. It may be able to supply up to 25% of the planet’s energy needs and grow to be a $10 trillion business by 2050. The long-term impact of green hydrogen programs on the worldwide demand for platinum is so evident.

How Was This Year

Many significant investment banks have released their projection for 2023 as 2022 comes to a close. There, they examine the metals that will climb or decline during the coming year. 2023 is anticipated to be a turning point for metals because of mounting recessionary concerns in industrialized economies and the expectation of a Chinese economic recovery after the Covid closings.

The US Federal Reserve have all the looks as well as other significant central banks throughout the coming year. To combat inflation, these institutions will modify and raise interest rates.

This will have a substantial influence on precious metals like silver and gold, which have considerable industrial and jewelry connections to the country. According to this report, China spent 675 metric tons of gold jewelry or approximately 56% of the world’s total.

This study also found that China consumed over 3,400 metric tons of silver. Professionals utilize this metal in the production of solar panels as well as in industries including jewelry, photography, and electronics.

Due to China’s bleak economic forecast, the view for gold and silver may be a little more pessimistic in 2019. Given that China’s real estate sector hasn’t fully recovered, even basic metal prices, such as copper and iron ore, are expected to decline. The Australian dollar (AUD) will have influence in this. Australia is a major source of copper and iron ore imports for China.

Apply An API

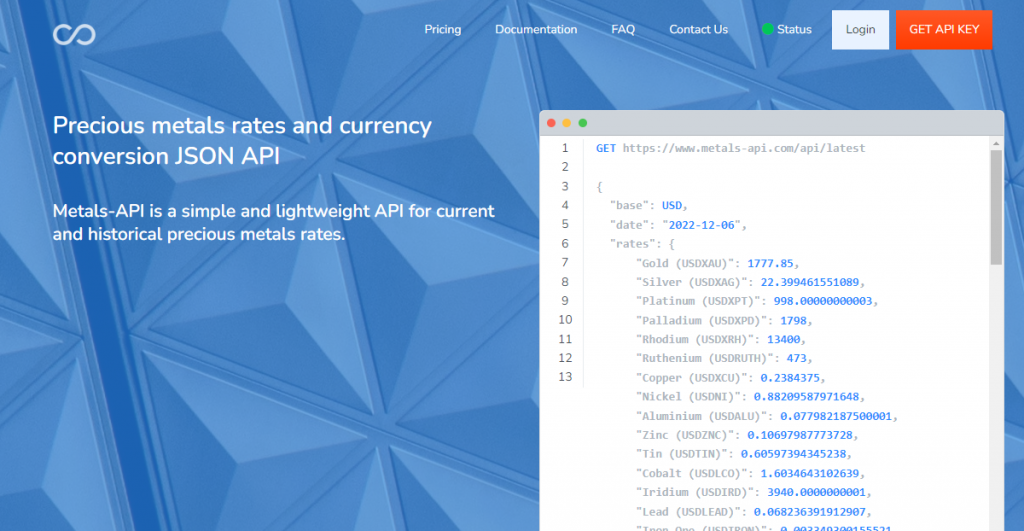

You should have the greatest tools to engage in the precious metals market in light of all of this. Therefore, we wish to provide an application programming interface (API) that will enable you to instantly refresh all the information relative to this sector.

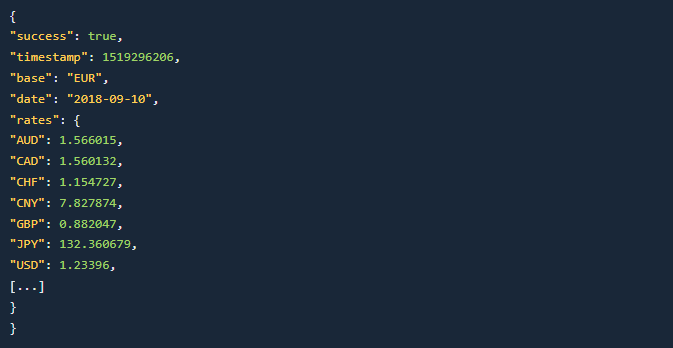

Particularly, Metals-API contains up-to-date pricing data in your preferred currency for hundreds of metals worldwide. To judge the market’s overall behavior, you may also draw other analogies. The API could respond in one of the following ways:

Why Metals-API?

Amongst the most significant internet APIs is Metals-API. It’s because it offers investment firms and developers a large variety of facilities. One advantage is that it functions in several programming languages. You can integrate in your website or app the API without problems!

On the other side, clients will have a lot of faith in your web material because you will offer a ton of information and crucial elements that affect how the mining operation behaves.