Businesses in today’s fast-paced digital world are continuously looking for methods to simplify their operations and boost their bottom line. The use of APIs to automate and improve different business processes is one area that has witnessed substantial development and transformation. In this article, we’ll look at the advantages of employing a VAT Number Validation API and how it may help organizations achieve success.

The Obstacle: Ensuring VAT Compliance

VAT is a consumption tax that is levied on products and services in several nations throughout the world. VAT must be collected from customers and remitted to the government by businesses. However, guaranteeing VAT compliance may be a complicated and time-consuming task. A VAT Number Validation API can help with this.

Using The Power Of A VAT Number Validation API As A Solution

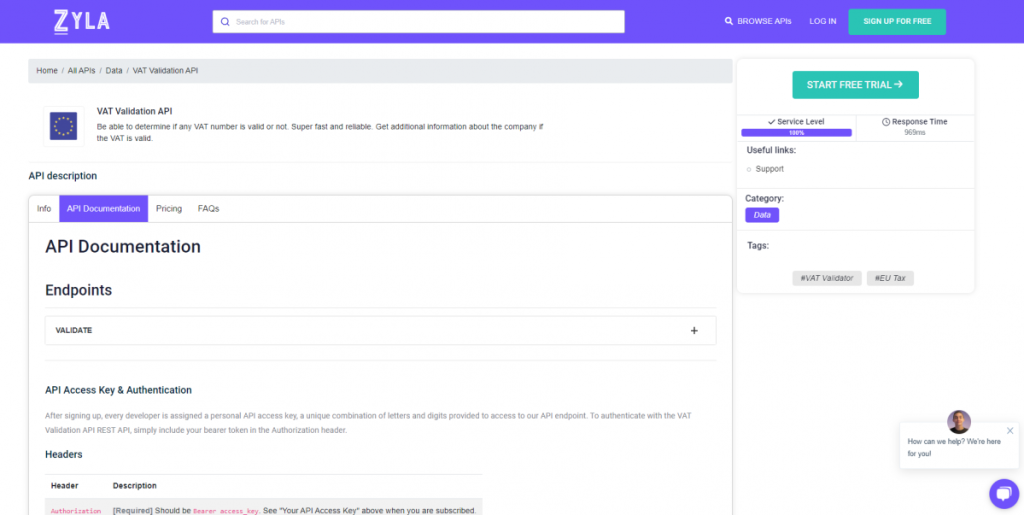

A VAT Number Validation API is a technology that allows businesses to automatically validate the VAT numbers of their customers. This can help to assure tax compliance and limit the risk of fraud. The VAT Validation API, which is available at Zyla API Hub, is one such API.

VAT Validation API Features And Benefits

Businesses may make use of various capabilities and benefits provided by the VAT Validation API. These are some examples:

- Real-time validation: The API validates VAT numbers in real-time, ensuring that companies have access to correct and up-to-date information.

- All EU member states are covered: The API includes all EU member states, allowing companies to quickly check VAT numbers for clients throughout the EU.

- Simple integration: The API is simple to connect to current systems, allowing businesses to automate their VAT validation procedures quickly and efficiently.

- Reduced risk of fraud: Businesses may reduce the risk of fraud and assure compliance with tax legislation by automatically validating the authenticity of VAT numbers.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Using The VAT Validation API For The First Time

It’s easy to get started with the VAT Validation API. Businesses may create an account at Zyla API Hub and then follow the instructions to connect the API to their existing systems. The VAT Validation API, with its rich features and advantages, is a great tool for organizations aiming to unlock success by leveraging the power of APIs.

- Sign up here: Begin by creating an account on the Zyla API Hub. The VAT Validation API and associated resources are now live.

- The API documentation is as follows: Examine the Zyla API Hub API docs in its entirety. More details about integration rules, endpoints, and parameters may be found here.

- Create a unique API key that will be used as your authentication credential while doing API queries.

- Use the integration principles to link the API to your systems. Use sample code snippets and tutorials to ensure a seamless integration process.

- Testing and implementation: Extensive testing should be performed prior to installation in a production situation to guarantee optimal performance.

Finally, a VAT Number Validation API may help organizations streamline their processes, assure tax compliance, and limit the risk of fraud. Businesses may unlock success and remain ahead in today’s fast-paced digital environment by leveraging the potential of this unique technology.

Related Post: Embrace The Power Of A VAT Number API: Data Precision Redefined