In the realm of financial transactions, accuracy and reliability are paramount. Whether it’s international wire transfers or domestic electronic funds transfers, ensuring the validity of banking information is crucial. This is where the power of an Application Programming Interface (API) comes into play. An API that validates financial information, such as SWIFT codes and routing bank numbers, can be a game-changer for businesses and individuals alike. In this article, we will explore the significance of data accuracy when utilizing a banking information API.

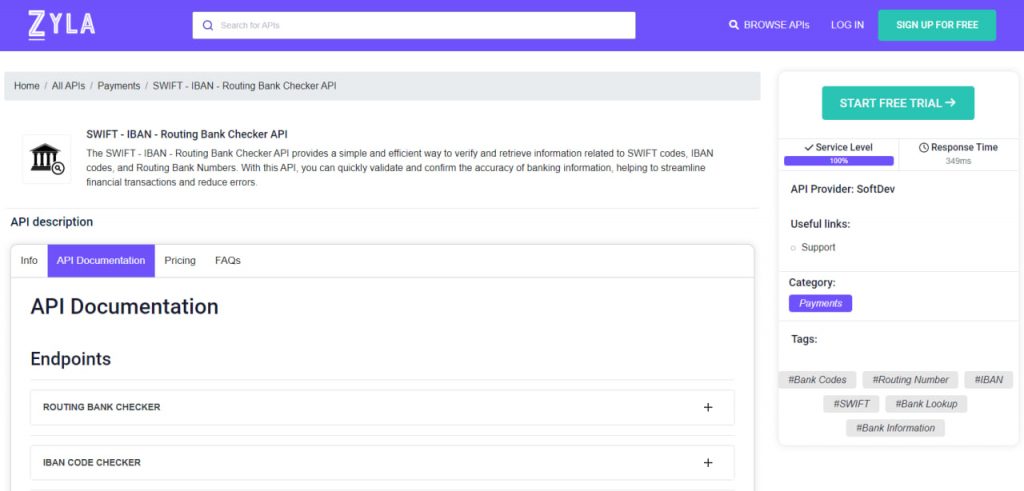

The use of a banking information API that validates crucial financial data, such as SWIFT codes and routing bank numbers, is pivotal in today’s interconnected financial landscape. The accuracy of such information ensures the success of transactions, prevents fraud, enables regulatory compliance, reduces costs, and enhances customer satisfaction. Investing in reliable APIs not only streamlines operations but also safeguards financial interests, allowing businesses and individuals to navigate the global financial ecosystem with confidence. This is why we recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API.

How This API Can Help With Data Accuracy

Data accuracy is of paramount importance when it comes to financial transactions. Any error in the provided banking information can lead to significant consequences, including delays, failed transactions, or even financial losses. Here’s why data accuracy matters when utilizing SWIFT – IBAN – Routing Bank Checker API:

- Transaction Success and Efficiency: When initiating a transfer, accurate banking information ensures that funds are routed correctly. A robust banking information API like SWIFT – IBAN – Routing Bank Checker API can validate the accuracy of SWIFT codes and routing bank numbers in real time, reducing the chances of errors and ensuring successful transactions. This leads to improved efficiency and customer satisfaction.

- Fraud Prevention: Accurate data validation plays a crucial role in preventing fraudulent activities. An API that cross-checks banking information against verified databases can flag suspicious or incorrect information, reducing the risk of fraudulent transactions. This helps safeguard the financial interests of businesses and individuals, bolstering security

- Cost Reduction: Error-free transactions lead to cost savings. Accurate banking information reduces the need for manual intervention and costly remediation processes. By leveraging SWIFT – IBAN – Routing Bank Checker API, businesses can streamline their operations, save time, and reduce administrative overheads associated with transaction errors.

- Enhanced Customer Experience: Data accuracy directly impacts the customer experience. A smooth and error-free transaction process instills confidence in customers, promoting trust and loyalty. With accurate information at their fingertips, businesses can provide a seamless user experience, bolstering their reputation and attracting new customers.

How Does This API Work?

The SWIFT – IBAN – Routing Bank Checker API offers effortless integration with current systems and applications. It provides the ability to enhance CRM systems, accounting software, mobile apps, and other financial tools. By leveraging its adaptable integration features, organizations can establish a cohesive overview of their customer’s financial situation, enabling a thorough examination of financial data.

The SWIFT – IBAN – Routing Bank Checker API has been designed for user-friendliness. By making straightforward API requests, you can swiftly obtain information pertaining to SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the “Swift Code Checker” option is utilized:

{

"status": 200,

"success": true,

"message": "SWIFT code ADTVBRDF is valid",

"data": {

"swift_code": "ADTVBRDF",

"bank": "ACLA BANK",

"city": "BRASILIA",

"branch": "",

"address": "Q SHCN CL QUADRA BLOCO E, 316,316",

"post_code": "70775-550",

"country": "Brazil",

"country_code": "BR",

"breakdown": {

"swift_code": "ADTVBRDF or ADTVBRDFXXX",

"bank_code": "ADTV - code assigned to ACLA BANK",

"country_code": "BR - code belongs to Brazil",

"location_code": "DF - represents location, second digit 'F' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}How Can I Get This API?

In an era where data accuracy is paramount, leveraging a banking information API such as SWIFT – IBAN – Routing Bank Checker API can be a differentiating factor for organizations seeking to optimize their financial processes. By placing accuracy at the forefront, businesses can achieve seamless transactions, mitigate risks, and foster trust among their customers, ultimately driving growth and success in the dynamic world of finance. You can try this versatile API by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.