In the era of digital transformation, businesses are increasingly relying on data-driven insights to make informed decisions. Financial data analysis plays a crucial role in understanding customer behavior, improving risk management, and enhancing operational efficiency.

One valuable resource for acquiring accurate and up-to-date financial information is banking information APIs. These powerful tools enable businesses to validate and confirm banking information, thereby empowering them to perform customizable financial data analysis. Banking information APIs are software interfaces that provide developers with programmatic access to banking systems and databases. These APIs offer a standardized method to retrieve, validate, and confirm various banking-related data points, such as account details, transaction history, and customer information. By leveraging these APIs, businesses can access real-time financial data securely and reliably.

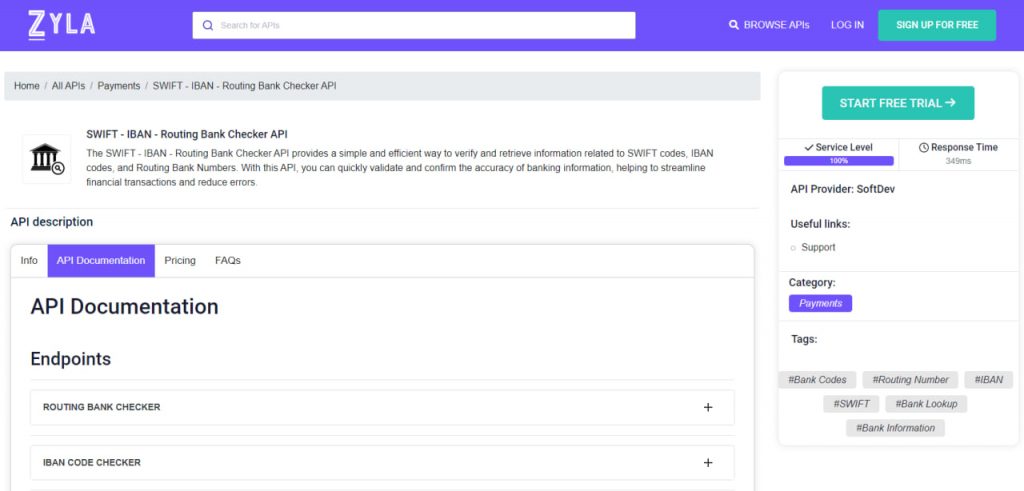

As the need for validation increases, many businesses are turning towards APIs. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s a very flexible tool and it’s very easy to integrate into either an app or a website.

This kind of API is very important because validated banking information allows organizations to provide accurate financial planning tools and budgeting solutions. By accessing real-time transaction data, businesses can help customers visualize their spending, track expenses, and optimize their financial well-being.

Another field where this kind of banking information APIs plays a vital role in detecting and preventing fraud. By continuously monitoring transactional data and cross-referencing it with known fraudulent patterns, organizations can identify suspicious activities promptly and take appropriate action to safeguard their customers’ assets.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API can be seamlessly integrated into existing systems and applications. It can be used to enrich CRM systems, accounting software, mobile applications, and other financial tools. With its flexible integration capabilities, businesses can create a unified view of their customers’ financial landscape, allowing for a more comprehensive analysis of financial data.

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9-digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

Banking information APIs have emerged as indispensable tools for customizable financial data analysis. By leveraging these APIs, businesses can validate and confirm banking information, opening up new avenues for customer behavior analysis, risk assessment, financial planning, and fraud prevention. The ability to access real-time, accurate financial data empowers organizations to make data-driven decisions, improve operational efficiency, and deliver personalized financial services.

As the digital landscape continues to evolve, embracing banking information APIs will become increasingly vital for businesses seeking to unlock the full potential of their financial data. You can be a part of that future by trying SWIFT – IBAN – Routing Bank Checker API, following these instructions:

- 1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

- 2- Employ the different API endpoints depending on what you are looking for.

- 3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.