In today’s fast-paced digital world, seamless and secure financial transactions are crucial for businesses and individuals alike. Whether it’s making international payments or conducting domestic transactions, accurate and reliable banking information is essential. To ensure the validity of crucial data such as SWIFT codes and routing bank numbers, financial institutions, and businesses can leverage the power of Banking Information APIs. These APIs not only streamline the validation process but also play a vital role in enhancing the overall customer experience.

Financial transactions involve the exchange of sensitive information, and any errors or inaccuracies can lead to delays, failed transactions, or even security breaches. To mitigate these risks, businesses and financial institutions traditionally rely on manual processes to verify banking information. However, this approach is time-consuming, prone to human error, and can be a frustrating experience for customers.

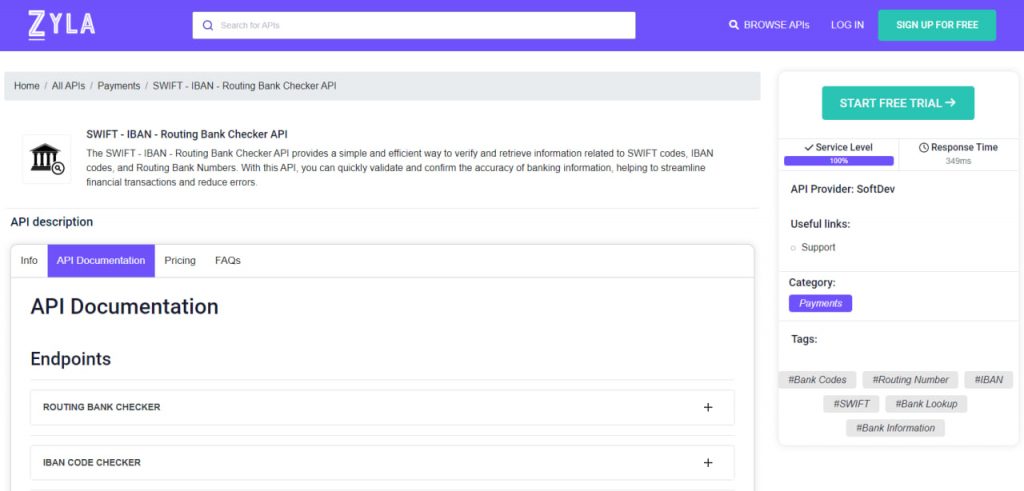

Introducing SWIFT – IBAN – Routing Bank Checker API

As the need for improving customer experience increases, it’s important to implement an API that lives up to the strict expectations of the world of finance. Luckily, SWIFT – IBAN – Routing Bank Checker API is a tool that can truly make a difference.

One of the key advantages of using SWIFT – IBAN – Routing Bank Checker API is the automation it provides. Instead of relying on manual data entry and verification, the API enables businesses to integrate their systems with real-time validation services. When a customer enters their banking information, the API makes a secure request to the validation service, ensuring that the provided data is accurate and up-to-date. This not only saves time but also reduces the likelihood of errors and failed transactions.

The use of a banking Information API such as SWIFT – IBAN – Routing Bank Checker API also ensures compliance with regulatory requirements. Financial institutions are often required to verify the accuracy of SWIFT codes and routing bank numbers to prevent money laundering, fraud, and other illegal activities. By integrating these APIs into their systems, organizations can maintain compliance with regulatory standards effortlessly.

Another benefit of using a SWIFT – IBAN – Routing Bank Checker API is the reduction in costs associated with failed transactions. Mistyped or outdated banking information can lead to payment rejections, causing unnecessary administrative work, customer dissatisfaction, and additional costs. By leveraging APIs, businesses can minimize these issues, decrease transaction failures, and improve operational efficiency. This not only saves time and resources but also fosters positive relationships with customers by avoiding inconveniences caused by failed transactions.

How Does This API Work?

This state-of-the-art API works by accessing reliable databases, and then cross-referencing the information, providing real-time validation results, giving businesses peace of mind that their operations adhere to legal requirements, and thus avoiding potential fraud and failed operations.

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9-digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

The use of banking information APIs has become indispensable for businesses and financial institutions aiming to streamline their processes and enhance the customer experience. By automating the validation of financial information such as SWIFT codes and routing bank numbers, these APIs reduce errors, improve compliance, and optimize operational efficiency. Customers benefit from faster and more accurate transactions, leading to increased satisfaction and loyalty. As technology continues to advance, embracing APIs like SWIFT – IBAN – Routing Bank Checker API is essential for organizations looking to stay competitive in the evolving landscape of financial services. You can try this API by following these steps:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.