APIs have emerged as unsung heroes in the ever-changing environment of digital transformation, silently altering the way we engage with technology. These code snippets serve as bridges, linking various software systems and allowing them to communicate easily. APIs have evolved into the backbone of modern apps, allowing organizations to simplify operations, improve user experiences, and discover new opportunities.

APIs Are Promoting Efficiency

It’s not just about comfort in this age of fast technology innovation; it’s about staying ahead of the competition. APIs are the building elements that allow for this progress. They give developers the ability to include specific functionality in their apps without having to reinvent the wheel. The VAT Lookup API is one such specific service that is making waves.

Uncovering The Obstacle: Navigating The VAT Maze

Consider this: A worldwide market with various tax laws and countries. Compliance with VAT (Value Added Tax) standards becomes a maze for enterprises operating across borders, particularly in the European Union. It is critical to ensure correct VAT computation and validation in order to prevent legal difficulties and financial setbacks. This is when the VAT Validation API comes into play.

VAT Validation API At Zyla API Hub Provides A Solution

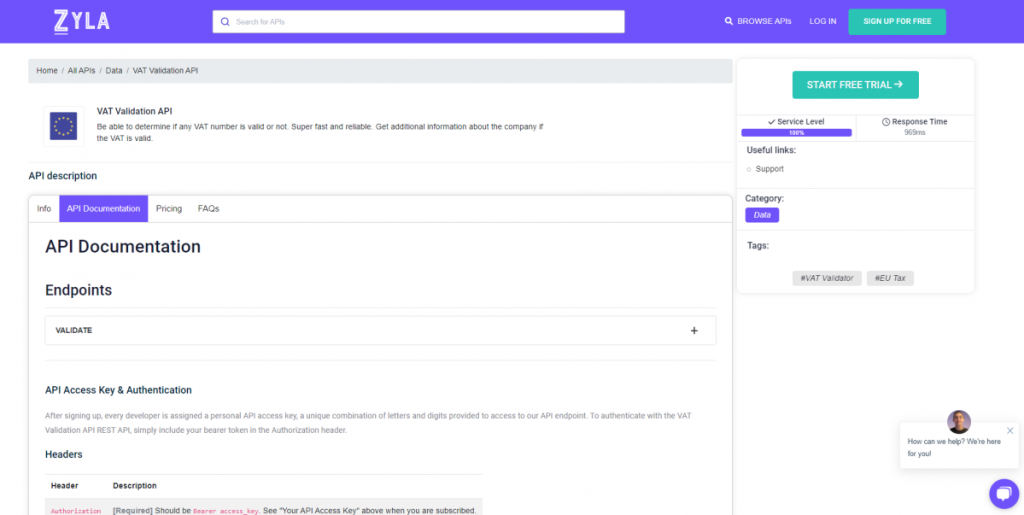

The VAT Validation API is the key to unlocking the complicated riddle of VAT compliance. One could question what distinguishes this API. Let’s look at Zyla API Hub, the portal that showcases this disruptive technology, to find out more. The Zyla API Hub is a marketplace for creative APIs that answer contemporary business concerns.

The Neutrality Balancing Act’s Features And Benefits

The trick is that it’s not about advertising a certain product; it’s about illuminating a way. The VAT Validation API, which is available on Zyla API Hub, has capabilities that appeal to both developers and companies. For starters, it provides real-time VAT number validation, allowing you to confirm the legitimacy of VAT numbers given by EU member states. Second, RESTful endpoint integration streamlines the development process, saving time and effort. It also gives detailed VAT rate data, which ensures correct computations and reduces mistakes.

However, the neutrality promise remains firm. Similarly, there are various VAT-related APIs on the market, each catering to a different set of requirements. API A, for example, provides advanced reporting capabilities, whereas API B specializes in cross-border VAT computation. The trick is to select the one that best meets the needs of your project.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To gain access to VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Transitioning To Action: How To Begin

- Register here: Begin by signing up for an account on the Zyla API Hub. The VAT Validation API and related resources are now available.

- The following is the API documentation: Examine the whole Zyla API Hub API documentation. More details about integration rules, endpoints, and parameters may be found here.

- Create a one-of-a-kind API key that will serve as your authentication credential while doing API queries.

- To connect the API to your systems, apply the integration principles. To guarantee a smooth integration process, use example code snippets and tutorials.

- Testing and deployment: To ensure seamless functioning, extensive testing should be undertaken before installation in a production setting.

Related Post: The Game-Changing VAT Number API: Tax Solutions Unleashed