If you have a big business and need to import some goods to produce your products from other European Union countries, you have to pay attention to its VAT number. What is it? How does it work? How can you get it? We will answer all these questions in this article and also we will provide you with the best tool to verify it as a bonus!

What Is A VAT Number?

VAT stands for Value-Added Tax and it is the unique number that identifies a business in national and international commerce operations. It is also known as a VAT registration number and works as a B2B ID. It is commonly used to determine the customer’s tax status and to assist in determining the location of taxation. Due to its importance, it is also mentioned in bills.

The official taxation website of the EU said that most companies and people engaging in economic activity requires it. There are three possible situations:

1) when they supply taxable goods or services

2) when they make an intra-EU acquisition of goods

3) when they receive or provide services for which they or their clients must pay VAT.

Also, every country in the EU has its national VAT number. This means that if your business exports goods or services in multiple EU countries, you will have to provide a VAT number for each one. And the same happens if you need to import: you will have to check the VAT to know that the company is legal and trusted. Besides, every identification number must begin with the country code and then a block of digits or characters. These requirements are only provided by tax administration offices because they have the authority of the EU Commission.

How Can You Verify VAT Numbers?

Using a VAT number validation API. This is an online application that automatically checks your VAT number. In this way, you can ensure that you always have complete, correct, and up-to-date information for your customers. The instant verification detects missing or incorrect numbers at a glance and removes them from your system if necessary. You will improve the accuracy of your customers’ VAT numbers and always have a complete picture.

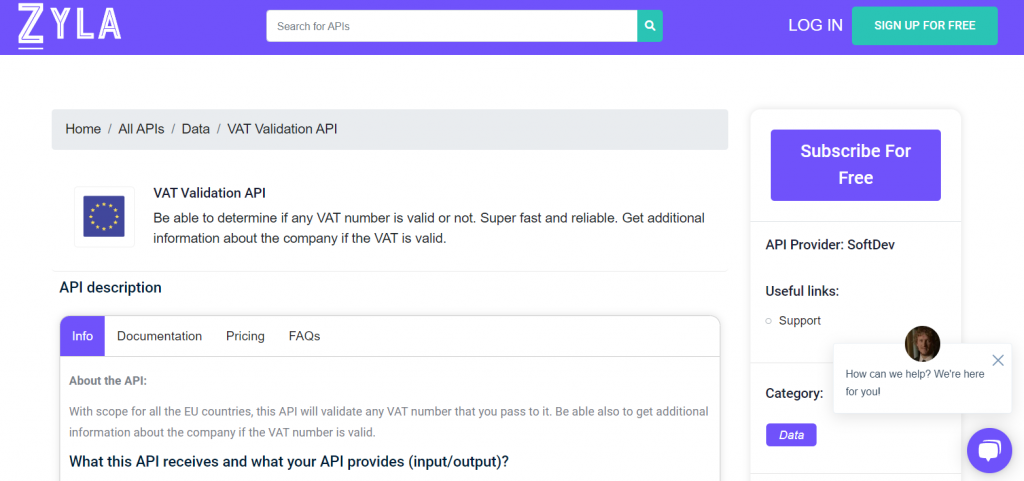

And VAT Validation API is the best option to determine whether or not a VAT number is valid. It’s super quick and easy to use! This application programming interface has coverage for all EU countries. If the value-added tax is valid, you can also obtain additional information about the company. Among the data, you may get the business name -in case you don’t have it- the city, the address, the code, and so on.

First of all, you must register in ZylaAPIHub and subscribe to the VAT Validation API. Then, you insert the VAT number with the country code in the provided box. If it is valid, you will get a “true” response and a series of data like the company’s name or address. But if it is invalid, the platform will return you a “false” response. Start checking your VAT numbers with this API!