In the dynamic world of credit ratings. Accuracy, efficiency, and access to reliable data are crucial factors that influence the decision-making process. To meet these demands, credit rating agencies are increasingly turning to innovative solutions such as International Transaction API. This powerful tool enables credit rating agencies to access comprehensive and up-to-date bank information. Enhancing their ability to assess creditworthiness and make informed decisions. Here we’ll explore why a Bank Information API is a valuable asset for credit rating agencies. Furthermore, providing them with a competitive edge in the industry.

Access To Accurate Bank Data

A Bank Information API offers credit rating agencies a wealth of accurate and verified bank data. With access to crucial identifiers such as Bank Codes, Routing Numbers, IBAN, and SWIFT codes. Agencies can confidently validate the authenticity of bank accounts and ensure the accuracy of financial information. This access to reliable data significantly improves the accuracy and reliability of credit assessments. Furthermore, enabling agencies to provide more precise credit ratings to their clients.

Streamlined Credit Assessment Process

Traditionally, credit rating agencies relied on manual processes to gather bank information, which could be time-consuming and prone to errors. However, with an International Transaction API, agencies can automate and streamline their credit assessment process. By integrating the API into their systems, agencies can efficiently retrieve and verify bank data, eliminating the need for manual data collection and reducing the risk of human errors. This streamlining of processes allows credit rating agencies to deliver faster and more accurate credit ratings to their clients.

Enhanced Risk Management:

Effective risk management is paramount for credit rating agencies. A Bank Information API equips agencies with the tools to assess and mitigate risks associated with credit ratings. Accessing detailed bank information, including SWIFT codes, IBAN codes, and Routing number ensure the credibility of the transactions. This information helps them evaluate credit risks more effectively and make well-informed credit rating decisions, minimizing the potential for financial losses.

Comprehensive Industry Coverage:

A valuable feature of International Transaction API is its extensive coverage of banks and financial institutions worldwide. Whether dealing with local or international credit assessments, credit rating agencies can rely on the API to provide comprehensive data on a global scale. This wide coverage ensures that agencies can evaluate creditworthiness across various jurisdictions and industries, enhancing the breadth and depth of their credit assessments. It enables agencies to make accurate comparisons and identify trends in credit performance, further strengthening the credibility of their credit ratings.

Regulatory Compliance And Data Security:

Credit rating agencies operate in a highly regulated environment, requiring them to comply with strict data protection and privacy standards. A Bank Information API ensures adherence to these regulations by providing secure and encrypted data transmission channels. This safeguarding of sensitive financial information instills confidence in both credit rating agencies and their clients, ensuring the highest level of data security and privacy.

Credit Rating Agencies: Harnessing the Power of Bank Information API

In an increasingly complex and data-driven landscape, credit rating agencies need advanced tools to stay ahead. A Bank Information API proves to be a valuable asset for credit rating agencies. Offering access to accurate bank data, streamlining credit assessments, enhancing risk management, providing comprehensive industry coverage, and ensuring regulatory compliance. By harnessing the power of a Bank Information API, credit rating agencies can deliver more reliable credit ratings. Foster trust with their clients and establish themselves as leaders in the ever-evolving field of credit assessment.

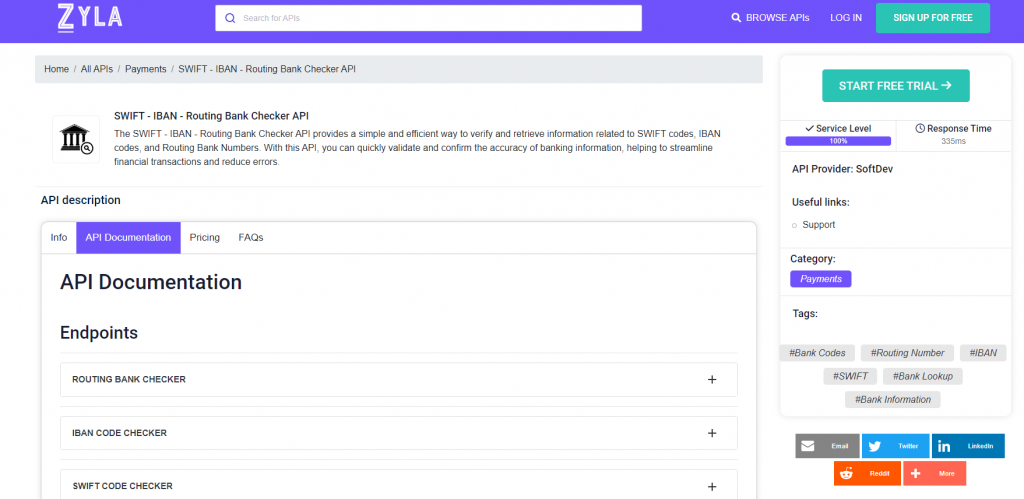

Getting Started with the SWIFT – IBAN – Routing Bank Checker API:

To explore the capabilities of the SWIFT – IBAN – Routing Bank Checker API, simply visit www.zylalabs.com and follow these steps:

Go to the Categories menu and select the Payments option. This will take you to the page featuring the Best Payment APIs, where you can find the SWIFT – IBAN – Routing Bank Checker API.

Click on the API to access its dedicated page. Here, you will find detailed information and documentation about the API, including a comprehensive list of available endpoints.

To get started, take advantage of the free 7-day trial offered by the API. This trial allows you to experience the full functionality of the API and explore its features and capabilities.

During the registration process for the free trial, you will have the opportunity to select a suitable plan based on your monthly call requirements. Choose the plan that best fits your project needs.

Once you have completed the registration and selected your plan. You are ready to start using the SWIFT – IBAN – Routing Bank Checker API. Follow these steps to begin:

Once you have selected the desired endpoint, you can make API requests by pressing the “Run” button. This will trigger the API call, and you will receive the corresponding response.

Example

Routing Number (INPUT) – 121000248

Below is the API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}