International transactions are an important component of doing business across boundaries in today’s globalized economy. However, maintaining the correctness and security of these transactions is a difficult task. SWIFT, IBAN, and Routing Bank Checker API are groundbreaking trio.

Financial details APIs may also help businesses improve their operations by giving them access to data that can help them make better decisions and manage their finances. APIs can be used by banks, for example, to deliver real-time information about their client’s accounts and transactions, boosting transparency and customer service.

Overall, banking information APIs are a fantastic resource for businesses and individuals looking for financial data access and use. These APIs may help organizations enhance their operations, give better customer service, and stay ahead of the competition by delivering real-time information and greater functionality.

This journalistic article will look into these technologies’ disruptive influence, shining light on how they simplify and streamline international transactions, improving efficiency, dependability, and compliance.

Reasons To Use An API For International Transactions

APIs facilitate automatic communication and data sharing across systems, resulting in increased efficiency. APIs may smoothly transport information such as payment details, client data, and transaction status between multiple systems and parties engaged in international transactions, such as banks, payment processors, and service providers. This automation decreases mistakes and eliminates human data entry, resulting in increased efficiency and faster transaction processing times.

APIs enable real-time updates and alerts, offering rapid feedback on transaction progress, such as approvals, rejections, and problems. This real-time insight enables organizations to track transactions, reconcile finances, and resolve concerns as they develop. It improves transparency and consumer satisfaction by keeping all parties involved up to date on the status of transactions.

Security and Compliance: Because international transactions contain sensitive financial information, high security, and compliance requirements must be followed. APIs provide a safe conduit for data transmission, frequently utilizing encryption and authentication procedures. They also make regulatory compliance easier by seamlessly incorporating features like anti-money laundering (AML) checks, Know Your Customer (KYC) verifications, and fraud prevention measures into the transaction flow.

APIs are meant to be scalable and flexible in order to support variable transaction volumes. They are capable of handling high-volume transactions while maintaining performance. APIs also provide flexibility in terms of system integration, allowing organizations to utilize their existing infrastructure while adding international transaction capabilities. This adaptability helps organizations broaden their reach and serve clients internationally without requiring major system changes or disruptions.

Third-Party connection: APIs allow for a smooth connection with third-party services that support foreign transactions, such as currency conversion, tax computation, address validation, and shipping logistics. Businesses may increase their product, improve client experience, and expedite the entire transaction process by accessing these services via APIs.

Developer-Friendly and Innovative: APIs are created with developers in mind, with extensive documentation, sample code, and developer tools. This developer-friendly approach fosters innovation by allowing organizations to design bespoke solutions, interface with their chosen platforms, and provide value-added services to their consumers.

Which Routing Bank Checker API Is The Best On The Market?

We can confidently declare that, after extensively investigating several market alternatives, we have chosen one that, due to its functionality and ease of use, is one of the best current options.

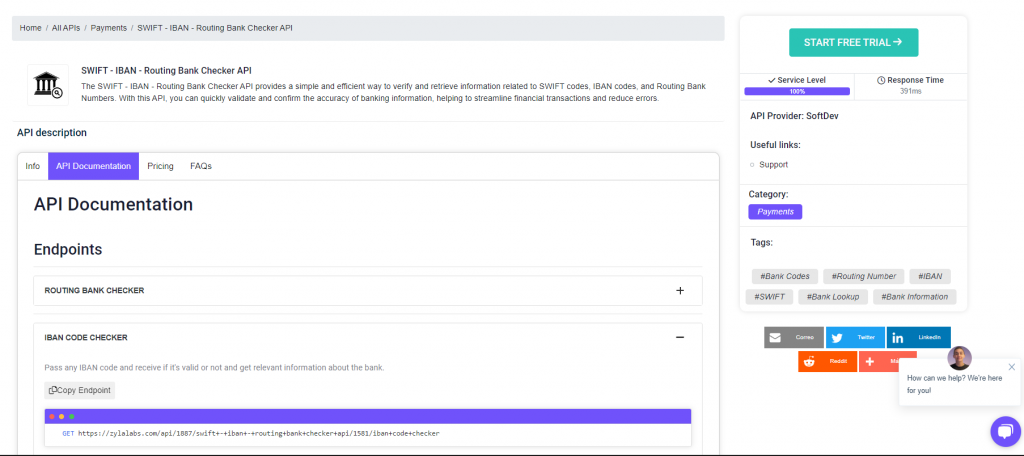

As previously stated, the Zylalabs SWIFT – IBAN – Routing Bank Checker API was chosen since it has served us well and is simple to use even if you are unfamiliar with it.

Look for a bank’s details using a routing number, IBAN code, or SWIFT code. Select if you want to use ACH or wire transfer banking information. It accepts either XML or JSON replies.

If you input the IBAN code “PT50000101231234567890192” into the endpoint “IBAN CODE CHECKER,” for example, you will get the following response:

{

"status": 200,

"success": true,

"message": "PT50000101231234567890192 is a valid IBAN",

"data": {

"iban": "PT50000101231234567890192",

"country": "Portugal [PT]",

"sepa_country": "Yes",

"checksum": "50",

"bban": "000101231234567890192",

"bank_code": "0001",

"branch_code": "0123",

"account_number": "12345678901",

"check_digit": "92",

"bank_details": {

"swift_code": "BGALPTTGXXX",

"bank_name": "BANCO DE PORTUGAL",

"branch": "SISTEMAS DE PAGAMENTOS",

"address": "AV. ALMIRANTE REIS, 71 EDIFICIO PORTUGAL",

"city": "LISBON",

"zip": "1150-012"

}

}

}How Can I Get The SWIFT-IBAN-Routing Bank Checker API?

- To begin, navigate to SWIFT-IBAN-Routing Bank Checker API and press the “START FREE TRIAL” button.

- You’ll be able to use the API after joining Zyla API Hub!

- Utilize the desired API endpoint.

- When you’ve arrived at your endpoint, perform the API request by clicking the “test endpoint” button and keeping an eye on the results on your screen.