There are more and more companies and APIs that provide Optical Character Recognition (OCR) services for credit cards and various other documents. Using a Credit Card OCR API can offer several benefits for businesses and applications that deal with credit card information and related documents.

Credit card APIs, often provided by payment processors and financial institutions, offer various use cases for businesses and developers. These APIs enable the integration of credit card processing functionality into applications and services, allowing for secure and convenient payment transactions.

With the ever growing popularity of credit card payments, companies need easy-to-use applications than can render solutions with efficiency, accuracy and functionality. Developers customize software to satisfy their clients needs on the basis of Credit Card OCR API, one of the strongest applications on the market.

There´s a suite of tools by the same provider that in the exchange of data complement the service and optimize the features for the best solutions.

Most Common Use Cases Of The API

Integrating a credit card API into an e-commerce website or mobile app allows customers to make online payments for products and services using their credit cards. This is one of the most prevalent use cases for credit card APIs.

Accordingly credit card APIs are commonly used by subscription-based businesses to automate recurring billing. This includes services like streaming platforms, SaaS companies, and subscription boxes.

Moreover, businesses that operate physical retail stores or restaurants can use credit card APIs to process card payments through their POS systems, making the checkout process seamless and secure.

Besides, mobile wallet apps and peer-to-peer payment services often use credit card APIs to enable users to link their credit cards and make payments to friends or merchants through their smartphones. Furthermore, mobile app developers can integrate credit card APIs to enable in-app purchases, allowing users to buy virtual goods, premium features, or subscriptions without leaving the app.

Why Is OCR API So Popular Among Companies?

Online marketplaces and platforms that connect buyers and sellers can use credit card APIs to facilitate secure payments and manage transactions between parties. At the same time, personal finance apps and budgeting tools can use credit card APIs to help users track their expenses and manage their credit card accounts more effectively.

Notice that onprofits and charities can use credit card APIs to accept online donations, making it easier for supporters to contribute to their causes. Also travel agencies, hotel booking platforms, and airline websites often integrate credit card APIs to handle payments for reservations and bookings.

On top of that, online lending platforms can use credit card APIs to process loan disbursements and repayments securely.

Likewise, credit card APIs often include features for fraud detection, allowing businesses to monitor and flag suspicious transactions in real-time. In addition, loyalty and rewards programs can use credit card APIs to track and reward customer spending, helping businesses retain and incentivize repeat customers.

Besides credit card APIs can be used to verify the authenticity of a user’s credit card during account creation or payment setup, reducing the risk of fraud.

Additionally, businesses that deal with international customers can use credit card APIs to convert currencies during transactions, providing customers with transparent pricing.

Over and above that, some financial services and credit monitoring apps use credit card APIs to help users keep track of their credit scores and financial health.

Benefits To Using A Credit Card API

A Credit Card OCR API can offer several benefits for businesses and applications that deal with credit card information and related documents. Here are some of the advantages:

Basically OCR technology allows to quickly and accurately extract text and data from credit cards. This can save time and reduce errors compared to manual data entry. Moreover, by automating data entry and reducing errors, businesses can save on labor costs and avoid potential financial losses due to data entry mistakes.

Likewise, Credit Card OCR APIs enable automation of data entry processes. This is especially useful for applications that require processing a large volume of credit card information, such as e-commerce websites, payment gateways, and financial services.

Additionally, integrating OCR into your application can enhance the user experience. Users don’t need to manually input credit card details, making transactions quicker and more convenient. Likewise, it can significantly reduce the risk of human errors associated with manual data entry. This can help prevent costly mistakes and ensure accuracy in financial transactions. In turn, this will improve the company´s reputation.

Companies Get The Most Of Credit Card OCR API

OCR APIs can provide verification checks on the extracted data, helping to ensure that the credit card information is valid and formatted correctly. Thus OCR can be integrated with security measures to help detect fraudulent activities. For example, it can be used to verify that the information on the credit card matches the data entered by the user.

Certainly many businesses and industries have regulatory requirements for handling and processing credit card information. OCR can assist in complying with these regulations by ensuring accurate data handling and storage.

We underline the fact that the OCR solutions guarantee integration into systems, applications and websites. This boosts feasibility and capabilities to the existing software.

Into the bargain, OCR services are often scalable, allowing any application to handle varying workloads and grow with your business needs.

Accessibility, analytics and reporting and versatility are largely guaranteed as the applications are powered with AI and ML algorithms that add efficiency.

This credit card OCR API supports multiple languages and character sets, making them suitable for businesses operating in diverse regions.

If you`re interested in the issue, you can also read https://www.thestartupfounder.com/protect-your-customers-from-fraud-with-credit-card-ocr-api/

How To Start Using The API

If you already count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

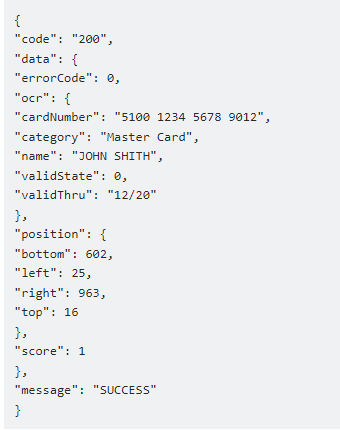

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“ https://www.memberscommunitycu.org/wp-content/uploads/2018/06/Mastercard-01.png” in the endpoint, the response will look like this: