Are you interested about the reasons for using the credit cards API To get data? Here is the solution to this.

Companies use Credit Card APIs (Application Programming Interfaces) to retrieve and process data related to credit card transactions for various purposes. Here are some reasons why companies utilize credit card APIs:

- Payment Processing: Credit card APIs allow companies to integrate payment processing systems into their applications or websites. By using an API provided by a payment gateway or processor, companies can securely capture credit card information, authorize transactions, and process payments.

- Fraud Detection and Prevention: Credit card APIs often provide access to advanced fraud detection tools and algorithms. Companies can leverage these APIs to analyze transaction data in real-time, identify potential fraudulent activities, and implement measures to prevent fraud. This helps protect both the company and its customers from financial losses.

- Financial Analytics: Credit card APIs often provide access to detailed transaction data, including purchase amounts, dates, merchant categories, and customer information (subject to compliance with data privacy regulations). Companies can leverage this data to gain valuable insights into customer behavior, spending patterns, and market trends. Such insights can be used for targeted marketing campaigns, personalized offers, and overall business strategy improvement.

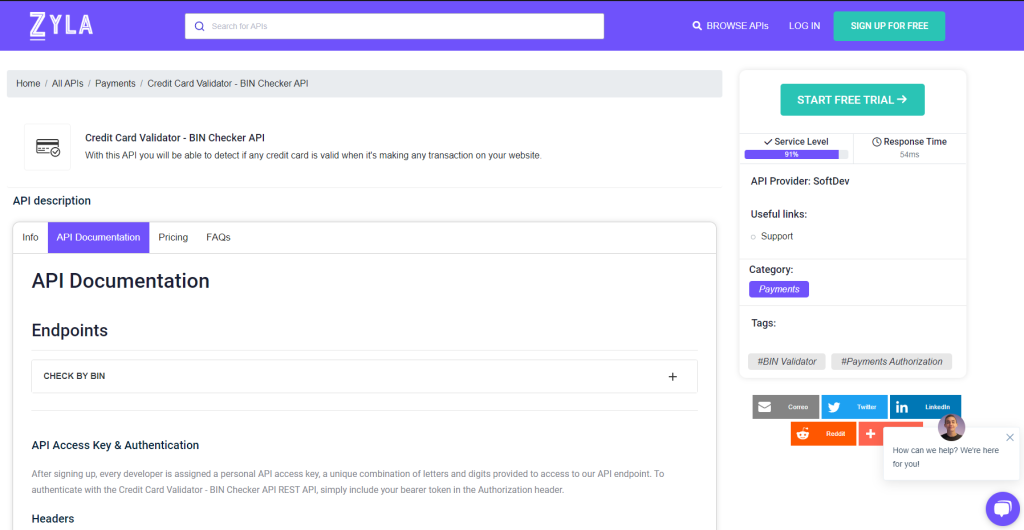

To check credit card payment authorization using an API, you’ll typically need to integrate with a payment gateway service or a third-party payment processor. These services provide APIs that allow you to validate credit card information and process payments securely. We recommend Credit Card Validator- BIN-Checker API.

Which API Is The Best?

This means you won’t have to waste time hunting up BIN numbers or calling banks to learn more about specific accounts. All you need is an API, such as Credit Card Validator – BIN Checker API, and you’ll get all the data you need in seconds.

Because of its simplicity and accuracy, the Credit Card Validator – BIN Checker API is one of the most popular APIs available. You can receive access to all forms of information on bank accounts, including their name and address, as well as their BIN number, by providing some basic information such as the firm’s name and IBAN.

You won’t have to waste time manually searching for this information or asking banks for it. With Credit Card Validator – BIN Checker API, you’ll get all the information you need in seconds!

How Did You Obtain This Data?

1- Navigate to Credit Card Validator – BIN Checker API and select the “Subscribe for free” button to begin utilizing the API.

2- You will be issued your unique API key after registering up in Zyla API Hub. You will be able to use, connect, and administer APIs using this one-of-a-kind combination of numbers and letters!

3- Depending on what you’re looking for, use different API endpoints.

4- You may already integrate the API in the language you require with your API key. There are numerous Code Snippets available at the aforementioned URL to help you with your integration.

Endpoint

- CHECK BY BIN

For instance, if you use the endpoint with the BIN number “448590,” the API will respond with the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}Overall, credit card APIs provide companies with the tools and functionality to securely process payments, detect and prevent fraud, manage subscriptions, gain insights from transaction data, and enhance customer experience.