Do you want to know why companies use the VAT number check API? If the answer is yes, keep reading to find out!

In case you didn’t know, an API is a program that enables two software programs to communicate with one another. As a result, it allows users to access and utilize data that is stored on a different server. Businesses frequently use APIs to exchange data with other companies; or to automate manual processes.

The VAT number check API is a tool that allows businesses to quickly verify whether a company’s VAT number is valid or not. This is useful because it allows them to identify businesses that are not complying with the VAT laws in their country. For example, if a business has a VAT number that is not registered in the government’s database; then they will know that this business is not complying with the VAT laws.

Why Do Companies Use The VAT Number Check API?

There are many reasons why companies use the VAT number check API. First of all, it allows them to ensure that all their transactions are legitimate and compliant with tax laws. This is important because it helps them avoid penalties and audits from tax authorities; as well as fraud and theft from customers who may try to steal money from them.

Another reason why companies use the VAT number check API is because it allows them to collect information about businesses they are conducting transactions with. This can be useful for marketing purposes; as well as for due diligence purposes in case they need to file a lawsuit against the other party.

Overall, companies use the VAT number check API because it helps them stay compliant with tax laws, and also helps them conduct their business in a safe and secure manner.

How Can You Use This API?

If you’re wondering how you can use this VAT number check API, then don’t worry! It’s very easy to use With this tool at your disposal, you’ll be able to quickly determine whether or not a company is legitimate.

You can also use this VAT number check API to learn more about other businesses by checking their VAT numbers. For example, you can use this information to find out more about their business model, location, and more!

Which API Should You Use?

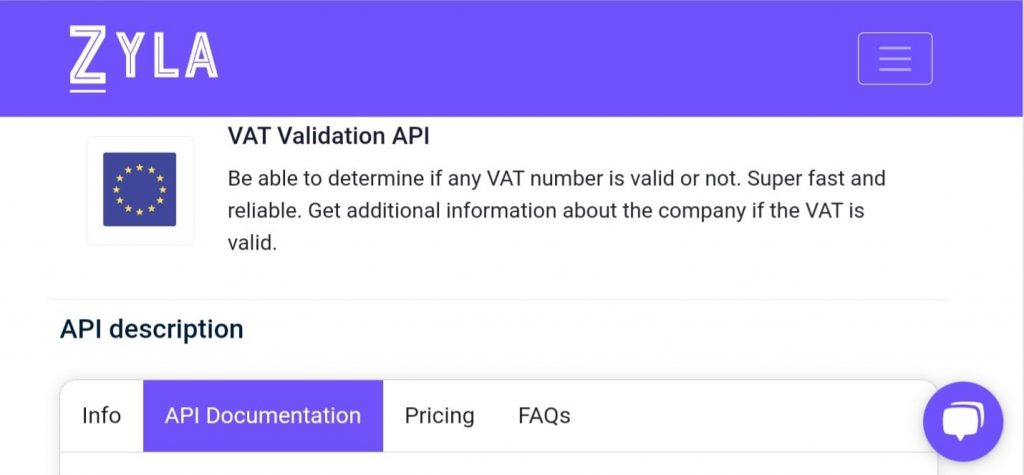

If you want to get started using this VAT number check API, then we recommend using the VAT Validation API fr om Zyla API Hub. This tool is quick and easy to use; and will allow you to quickly determine whether or not a company’s VAT number is valid.

In addition, by using the VAT Validation API, you will also be able to obtain additional information about the company in question such as their location, phone number, and even the name of their owner.

How To Use This?

It’s very simple; just follow these steps:

1- Go to VAT Validation API and simply click on the button “Try Free for 7- Days” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- With your API key, you can already integrate the API in the language you need. In the mentioned URL, you can find a lot of Code Snippets, that can facilitate your integration.

You must select the “VALIDATE” endpoint type, and you can analyze the following responses:

API Responses:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Why not give VAT Validation API a shot right now? Let’s get started!