Are you keeping an eye on the market and considering making your first investment? In this essay, we leave you with three APIs that will assist you!

On the stock exchange, buyers and sellers can negotiate prices and make transactions. The stock market is made up of exchanges such as the New York Stock Exchange and the Nasdaq. An initial public offering, or IPO, is when a corporation sells stock on a stock exchange.

This is when market data is displayed. Market data is used by traders to estimate the worth of various assets and to influence their strategy for entering and exiting trades. Market data is utilized to acquire as much information about the asset as possible in order to measure market risk and the impact of live news releases.

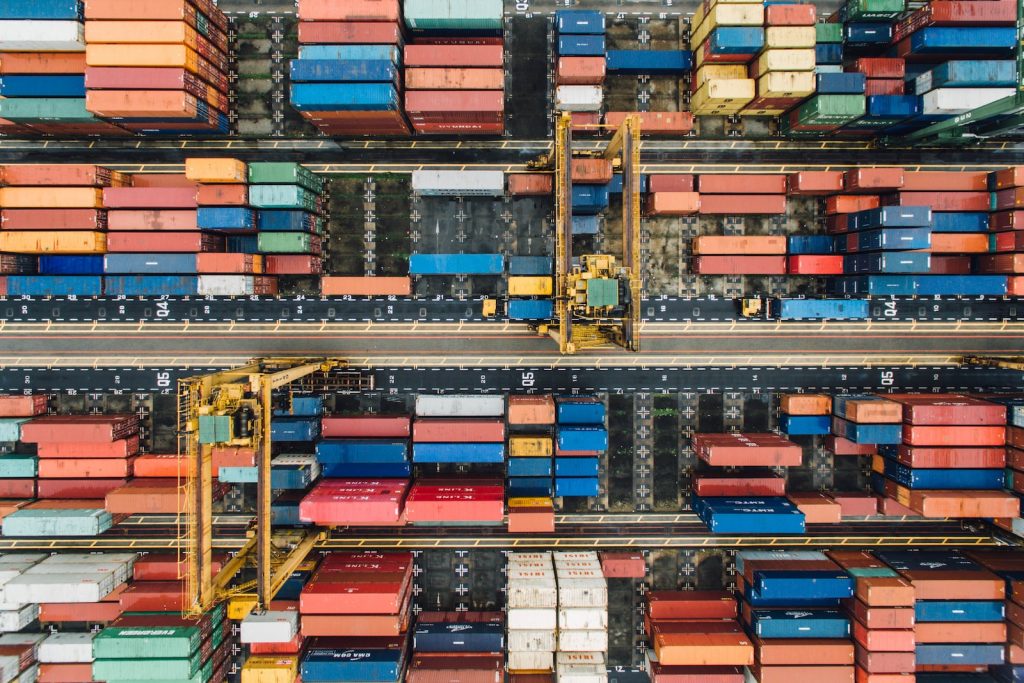

Commodities, as “real assets,” react differently to changing economic fundamentals than “financial assets.” These are some of the few asset classes that benefit from rising inflation, for example. When demand for commodities rises, so do the prices of items and, as a result, raw materials.

Because the global stock market is influenced by a variety of factors, some commodities may underperform. Furthermore, depending on the commodity and its performance, political and economic factors can endanger investors.

In such a complex environment, a bank wishing to decrease annual expenses by up to 10% by optimizing its financial data vendor expenditure must proactively identify and resolve these difficulties, employing an approach that combines technical and administrative expertise.

Some APIs are available to extract valuable information in order to track rates and prices for a number of commodities.

Commodities API

Commodities-API on the other hand, is almost always the superior alternative. This is a website where you can keep track on the prices of various items. Finally, you’ll be able to accurately estimate rates and convert them to your preferred currency.

This online API delivers accurate rate data for a variety of commodities in a variety of currencies. Commodities-API began as a simple, minimalist Open-Source API for recent and historical commodity prices for financial organizations.

The API can offer real-time commodity data with a precision of two decimal points and a rate of up to every 60 seconds. Commodities-API is built on a strong back-end architecture that provides response times of less than 50 milliseconds for defined API calls. Delivering commodities exchange rates, changing single currencies, and returning Time-Series and Fluctuation data are only a few of the processes.

Commoprices

CommoPrices provides reliable, up-to-date, and unbiased data. They provide a wide range of commodities and raw materials.

Why use CommoPrices?

It is difficult for buyers to keep track of the prices of commodities that are becoming increasingly volatile.

Too much data, too many sources, and scarcely useable data

When it comes to commodity price tracking, most buyers simply create benchmarks for suppliers.

CommoPrices is the ideal instrument for understanding markets in a straightforward and objective manner.

Cmdty

Get the commodity prices you want, when you want them, and have them delivered today. These commodity data APIs are fast, versatile, and on-demand.

The Cmdty API is used to request fundamentals, commodities statistics, and economic data. Users can request information by data series, with most series providing historical data back to their origin. cmdty is the leading source of aggregated commodity statistics, all in one simple API.