Do you want to know how companies can benefit oil is? Do you want to get market information about it? Read this post and get to choose from these three API for commodity data options!

Market players frequently fail to capitalize on crude oil variations, either because they are unfamiliar with the special characteristics of these markets or because they are oblivious of the hidden hazards that might eat into earnings. Furthermore, not all energy-focused financial instruments are created equal, with a selection of these assets having a higher probability of producing favorable returns.

Crude oil swings through supply and demand views, which are influenced by global output as well as global economic prosperity. Oversupply and declining demand prompt traders to sell crude oil markets, whilst rising demand and dropping or flat output prompt traders to bid crude oil higher.

Crude Oil Types

Oil investors are often concerned with the quality of the oil they are investing in as well as the area from where it is sourced. Because of the geographical nature of the regions, crude oil develops differently. Geopolitics, natural disasters, and organizational forces all influence oil prices, which in turn effect production, supply, and demand.

The density and sulfur content of crude oil are used by the oil industry and authorities to categorize it. Oil can be classified as sweet or sour based on its sulfur level, or as heavy or light based on its density. Oil is categorized into six classes by the industry and investors using these two groups and a third group in between:

- Heavy/Sweet

- Heavy/Sour

- Medium/Sweet

- Medium Sour

- Light/Sweet

- Light/Sour

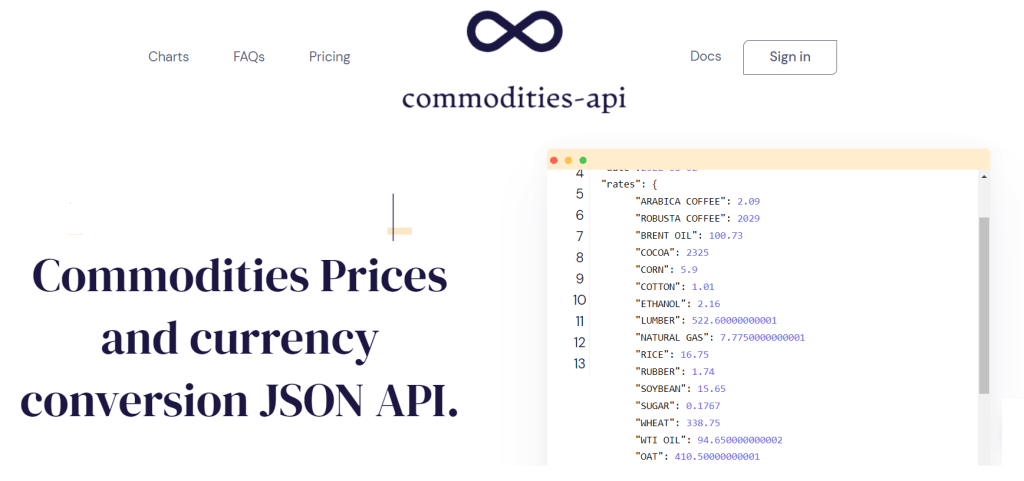

This is because an API, or application programming interface, is a mechanism that allows two different types of programs to interact with one another to access certain data. Although using an API is the easiest way to get a specific piece of data, you must know which web service has the best API. This is because not all Internet-based APIs are trustworthy. As a result, we recommend using Commodities-API, a reputable API with over five years on the market.

Commodities-pricing API‘s data is gathered from more than 15 trustworthy sources, making it the first choice for investors and enterprises looking for commodity spot prices.

How to Acquire Commodities API :

Create a Commodities-API account. It’s quick and free; you can also choose the plan you want to utilize. There are presently three plans available for this API: amateur, basic, and professional. After considering their differences, choose the one that best matches your demands. For example, if you select the first plan, you will receive hourly commodities updates!

After registering, you will be given an API key, which you will need to use each time you make an API call. However, before you use it, you must authenticate it by including your bearing token in the authorization header.

To receive commodity spot prices, simply choose the currency in which you wish to view your pricing and then the commodity symbol you want (in this case, it can be Crude Oil WTI, or Crude Oil Brent). Keep in mind that there are 170 different currencies available!

Finally, execute the API call and await the response.