In today’s globalized financial landscape, compliance with financial regulations is of paramount importance for businesses and financial institutions. The accurate management and validation of banking information, such as SWIFT codes and routing bank numbers, are critical components in ensuring compliance and facilitating secure transactions. The emergence of advanced technologies, including Application Programming Interfaces (APIs), has revolutionized the way financial information is validated and managed. In this article, we will explore how banking Information APIs can assist businesses in effectively navigating financial regulations.

Banking Information APIs provide developers and businesses with a programmable interface to access and validate financial data, such as SWIFT codes and routing bank numbers. These APIs allow seamless integration with existing systems, enabling organizations to automate the verification process and ensure the accuracy and compliance of their financial transactions.

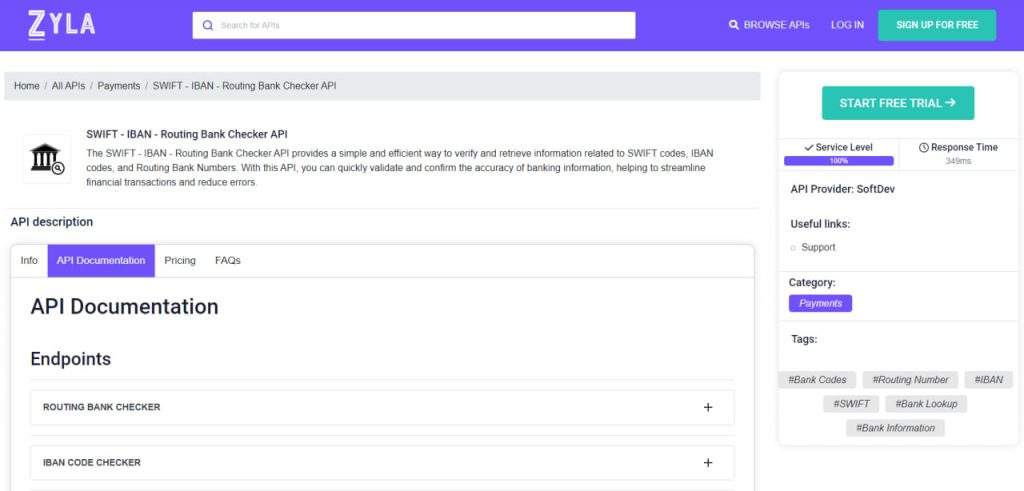

We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s a very solid choice to be compliant with financial regulations and avoid fraud, among other powerful applications.

What Are The Uses Of This API?

SWIFT – IBAN – Routing Bank Checker API brings forth the benefits of validating banking information, which is critical in the world of commerce. This has several uses and benefits, such as:

- SWIFT Code Validation: SWIFT codes, also known as Bank Identifier Codes (BICs), are unique alphanumeric codes that identify specific banks or financial institutions worldwide. Validating SWIFT codes is crucial for international transactions and compliance with regulatory frameworks. SWIFT – IBAN – Routing Bank Checker API offers real-time SWIFT code validation, ensuring that transactions are routed accurately, minimizing errors, and reducing the risk of financial penalties or delays.

- Routing Bank Number Verification: Routing bank numbers, such as ABA routing numbers in the United States, are essential for identifying financial institutions involved in domestic transactions. Validating routing bank numbers helps organizations comply with regulatory requirements and minimize the risk of fraudulent transactions. SWIFT – IBAN – Routing Bank Checker API streamlines this verification process, allowing businesses to authenticate routing numbers in real time, ensuring the accuracy and legitimacy of transactions.

- Anti-Money Laundering (AML) Compliance: AML regulations require financial institutions to implement robust measures to prevent money laundering and the financing of illegal activities. Banking Information APIs such as SWIFT – IBAN – Routing Bank Checker API can aid in AML compliance by cross-referencing customer information, such as names, addresses, and banking details, with global databases. This enables organizations to identify high-risk individuals or entities and take appropriate actions to mitigate potential risks.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API can be seamlessly integrated into existing systems and applications. It can be used to enrich CRM systems, accounting software, mobile applications, and other financial tools. With it’s flexible integration capabilities, businesses can create a unified view of their customers’ financial landscape, allowing for a more comprehensive analysis of financial data.

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9 digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

SWIFT – IBAN – Routing Bank Checker API is a banking information API that provides a formidable toolset for managing financial regulations effectively. By enabling real-time validation of SWIFT codes, routing bank numbers, and other critical banking information, these APIs streamline compliance processes, mitigate financial risks, and enhance operational efficiency. Embracing the capabilities of this API can go a long way in empowering businesses to navigate the complex landscape of financial regulations confidently while providing a secure and seamless experience to their customers. You can try it out by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.