In today’s fast-paced digital world, accurate and reliable financial information is crucial for businesses and individuals alike. Whether you are a fintech startup, an e-commerce platform, or a financial institution, validating banking details such as SWIFT codes and routing bank numbers is a fundamental step in ensuring seamless transactions and minimizing errors. To facilitate this process, the emergence of bank routing number verification APIs has revolutionized the way financial information is verified, enabling real-time financial insights and bolstering trust and security in the financial ecosystem.

Traditionally, validating banking details involved manual processes that were time-consuming, error-prone, and lacked real-time updates. With the advent of the bank routing number verification APIs, businesses can now access a reliable and efficient solution that automates the validation process, eliminating human error and providing up-to-date information on bank routing numbers and SWIFT codes.

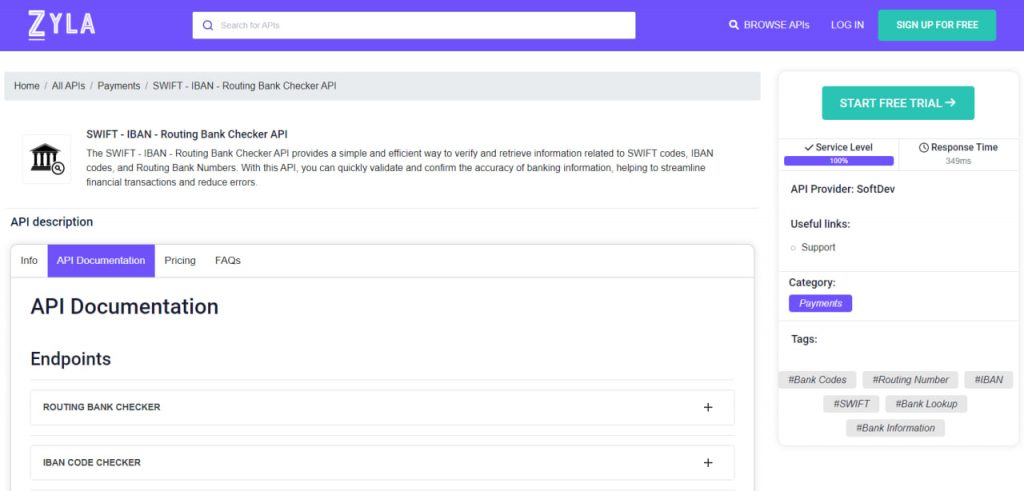

Introducing SWIFT – IBAN – Routing Bank Checker API

As the need for reliable information increases, finding the right API that is up for such a daunting task can be hard. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s a very powerful and flexible option in today’s competitive market.

The key advantage of SWIFT – IBAN – Routing Bank Checker API lies in its ability to connect directly with authoritative databases maintained by financial institutions and regulatory bodies. By leveraging this API, businesses can access a wealth of information about the financial institution associated with a specific routing number. This includes the bank’s name, location, contact details, and other relevant information. SWIFT code verification allows businesses to ensure the accuracy of international transactions and streamline cross-border payments.

Real-time financial insights are critical for businesses operating in dynamic markets. Bank Routing Number Verification APIs like SWIFT – IBAN – Routing Bank Checker API empower businesses with the ability to validate banking details instantly, enabling seamless onboarding processes, reducing the risk of fraudulent transactions, and ensuring compliance with regulatory requirements. By integrating these APIs into their systems, organizations can automate and streamline their workflows, saving time, effort, and resources that can be redirected toward core business activities.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API can be seamlessly integrated into existing systems and applications. It can be used to enrich CRM systems, accounting software, mobile applications, and other financial tools. With it’s flexible integration capabilities, businesses can create a unified view of their customers’ financial landscape, allowing for a more comprehensive analysis of financial data. SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9 digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

Bank routing number verification APIs such as SWIFT – IBAN – Routing Bank Checker API have become indispensable tools for businesses seeking to validate financial information accurately and efficiently. They enable real-time financial insights, enhance security, streamline workflows, and elevate the customer experience. By incorporating SWIFT – IBAN – Routing Bank Checker API into their systems, organizations can leverage the power of automation and technology to unlock new opportunities and build a solid foundation for their financial operations. You can try it out by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.