Accuracy and compliance are critical in today’s fast-expanding digital economy when organizations operate across borders and transactions occur at the speed of light. The tax system is no exception. With complex taxation and regulatory systems, the demand for accurate and efficient solutions has never been greater. This is where VAT Validator APIs come into play. In this article, we’ll look at VAT Validator APIs, their importance, and a game-changing solution that streamlines VAT validation while assuring error-free transactions.

The Need For VAT Validator APIs In The Age Of Digital Transformation

Businesses are utilizing technology to simplify processes, eliminate mistakes, and improve customer experiences in an era defined by digital transformation. Cross-border transactions have become the norm as the global economy increases, particularly inside the European Union (EU). However, with this growth comes the complexity of multiple VAT legislation and compliance requirements across various EU member states.

Manually navigating these complex tax landscapes can be error-prone and time-consuming, resulting in financial imbalances and compliance difficulties. Developers and organizations demand a dependable solution that fits smoothly into their systems, validating VAT numbers in real-time and assuring proper transactions.

The Obstacle: Getting Through The VAT Verification Maze

Consider the following scenario: a company needs to confirm a trading partner’s VAT number before closing a contract. Without a solid solution, this procedure might necessitate manual searches through government databases, which leaves the possibility for human mistakes and wastes critical time. VAT laws misinterpretation or the use of improper VAT numbers can result in refused transactions, penalties, and reputational harm.

The VAT Validator API Is Introduced As A Solution

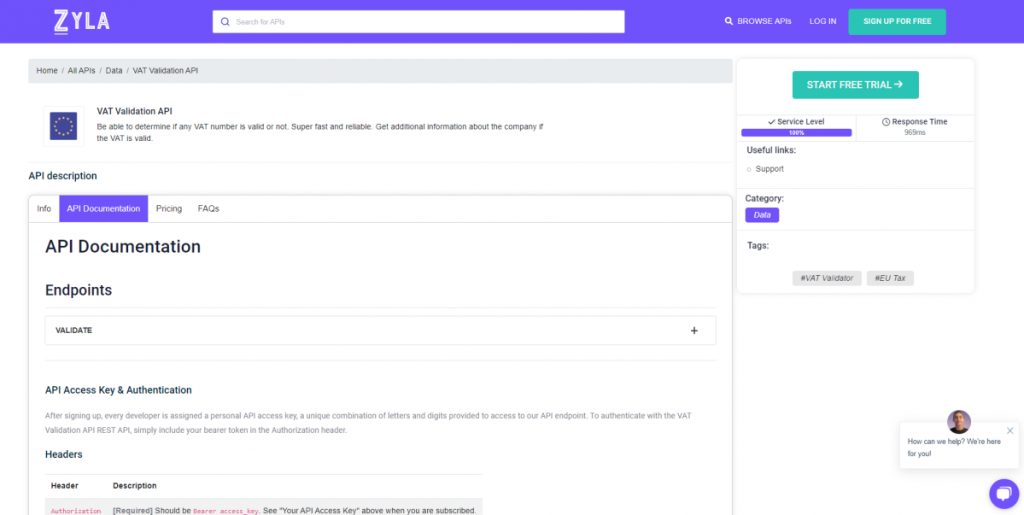

The VAT Validator API, a sophisticated tool developed to meet the issues of VAT validation, is at the forefront of innovation. One such option is available through the Zyla API Hub, and it provides developers and organizations with access to a full VAT validation mechanism.

VAT Validator API Unveiling: Features And Benefits

The VAT Validator API, which is accessible via the Zyla API Hub, enables developers and organizations to include an automated and dependable VAT validation mechanism in their workflows. Among the primary characteristics and benefits are:

- Real-Time Validation: Validate VAT numbers in real-time, removing the danger of incorrect transactions and related fines.

- EU VAT Compliance: Maintain EU VAT compliance by properly checking VAT numbers across member states and enabling smooth cross-border activities.

- Ease of Integration: Thanks to extensive documentation and a developer-friendly architecture, you can easily connect the API to your current systems and applications.

- Increased Efficiency: By automating the VAT validation process, you may save time and money, enabling your staff to focus on key business tasks.

- Error Reduction: Reduce the chance of mistakes arising from human data entry or validation, preserving the integrity of your transactions.

- Savings: Avoid financial losses as a result of transaction mistakes or fines, which contributes to increased financial stability.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Getting Started: Leveraging The VAT Validator API’s Power

It’s only a few steps away from revolutionizing your VAT validation process:

- Sign up here: Begin by creating an account on the Zyla API Hub. The VAT Validation API and associated resources are now live.

- The API documentation is as follows: Examine the Zyla API Hub API docs in its entirety. More information regarding integration rules, endpoints, and parameters is available here.

- Create a unique API key that will be used as your authentication credential while doing API queries.

- Use the integration principles to link the API to your systems. Use sample code snippets and tutorials to ensure a seamless integration process.

- Testing and implementation: Extensive testing should be performed prior to installation in a production situation to guarantee smooth operation.

Related Post: VAT Made Simple: Demystifying With A Lookup API